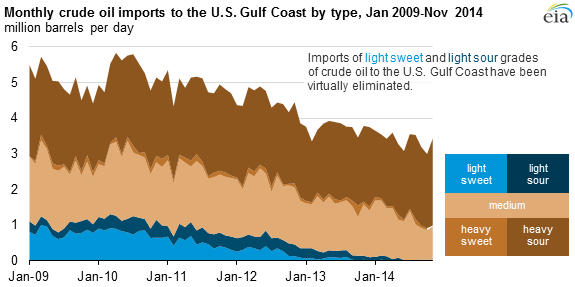

The EIA reports that imports of light-sweet and light-sour grade crude to the Gulf Coast is now almost nonexistent

The Energy Information Administration (EIA) reported today that imports of light-sweet and light-sour crude to the United States Gulf of Mexico have declined to the point of being nearly nonexistent. The administration’s note says the increase in U.S. shale and tight crude oil production has resulted in a drastic decrease in crude oil imports to the Gulf Coast area.

Beginning in 2010, improvements to the crude distribution system and sustained increases in production in the Permian and Eagle Ford basins significantly reduced light crude imports. The Gulf historically imported as much as 1,300 MBOPD of light-sweet crude, more than any other region in the country.

Since September 2012, imports of light-sweet crude oil to the Gulf have regularly been less than 200 MBOPD. Similarly, Gulf imports of light-sour crude have declined and have been less than 200 MBOPD since July 2013. The EIA reports that in November 2014, light-sweet imports to the Gulf were 552 MBOPD and light-sour imports were 125 MBOPD. In September 2014, light-sweet imports to the Gulf were just 7 MBOPD.

Crude oil has previously been imported to the Gulf Coast from several countries, mainly the Americas (Mexico, Venezuela, Colombia and Canada) and the Middle East (Saudi Arabia, Kuwait and Iraq). Imports from other countries to the Gulf have declined significantly in recent years, from an average of 1,700 MBOPD in 2009 to 260 MBOPD in 2014, through October.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.