MLP Pioneer Cuts Dividend and Capex by more than 50%

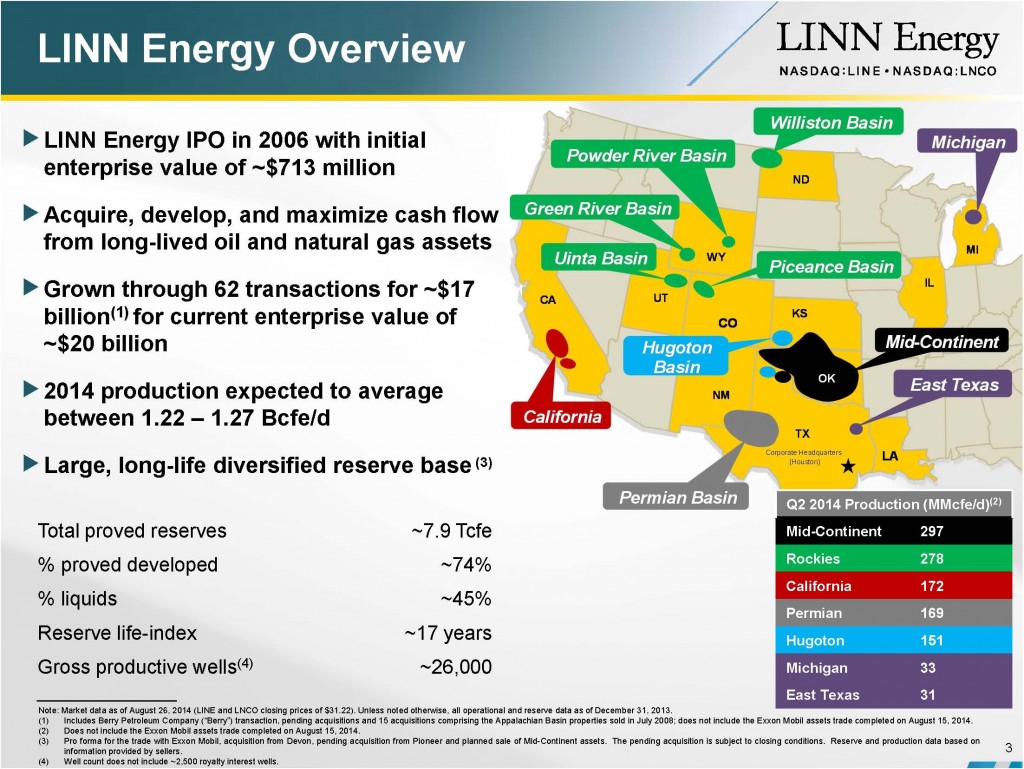

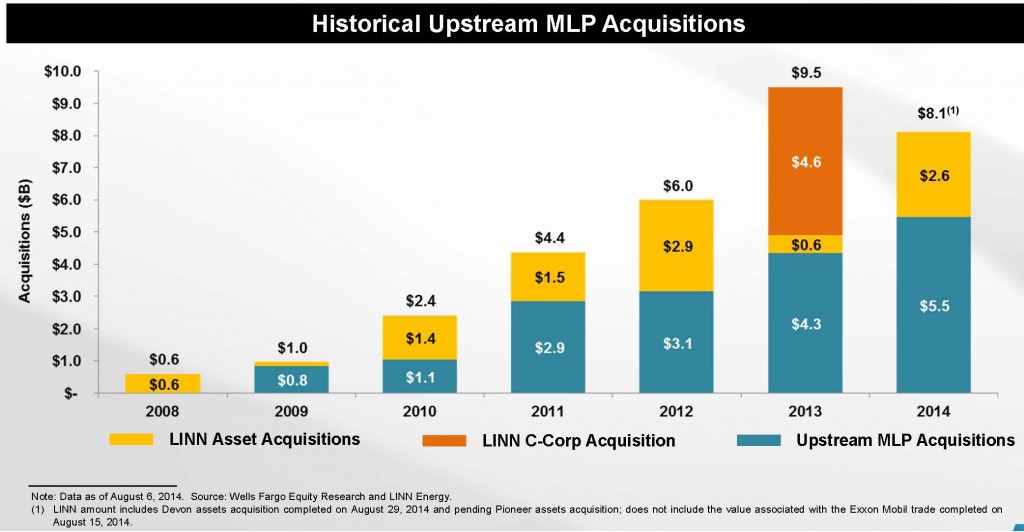

LINN Energy LLC (ticker: LINE), a top-15 independent oil and natural gas development company, has announced reductions of more than 50% in both capital expenditures and dividends in 2015. LINN Energy has an unconventional approach in the oil in gas industry, with LINE executing on oil and gas development while the sole purpose of its subsidiary, LinnCo, LLC (ticker: LNCO), is to own LINN units and raise additional capital. The strategy has assisted LINE’s acquisition strategy, which has amounted to more than $16 billion in acquisitions since 2008. LNCO was created in October 2012 and announced its first dividend just weeks later, prior to the announcement of its Q3’12 results.

LINN’s business plan called for a stable growth structure, with attractive dividends and highly hedged production. Expected natural gas production is approximately 100% hedged through 2017, while its oil hedges account for roughly 70% of 2015 production and roughly 65% of 2016 volumes. According to a company release, LINN’s estimated hedge book value as of year-end 2014 was approximately $2 billion.

Source: LINN 01/15 Presentation

The Formation of DrillCo

In relation to the new commodity market, LINN signed a non-binding letter of intent with privately held GSO Capital Partners LP (the credit platform of The Blackstone Group L.P.) for funding up to $500 million with five-year availability. The companies will operate under the entity of DrillCo, and GSO will provide 100% of the drilling costs and receive 85% working interest until a 15% internal rate of return is achieved. Once the IRR is reached, LINN’s working interest will increase to 95% from 15%.

“DrillCo provides several strategic advantages for LINN,” said Mark Ellis, Chairman, President and Chief Executive Officer of LINN Energy, in a conference call following the announcement. “It allows us to develop assets without increasing capital intensity and add a steady and growing cash flow stream with no capital requirement. It increases our long-term ability to fund oil and natural gas development capital and the distribution with internally generated cash flow. It mitigates drilling risk, potentially broadens our universe of acquisition targets and, finally, upon meeting the return hurdle, it would provide incremental lower decline production growth for LINN.”

Management mentioned potential acquisitions a handful of times in the call, not ruling out the purchase of another C-corporation like its $4.9 billion acquisition of Berry Petroleum in December 2013. “Part of our strategic vision in a challenging commodity price environment is to position ourselves to be a buyer in a very opportune point in the commodity cycle,” said Ellis. Additional partnerships similar to the DrillCo agreement are also a possibility.

Source: LINN 01/15 Presentation

LINN Metrics Overview

LINN Energy is by far the largest E&P company on EnerCom’s MLP Scorecard. Its enterprise value of more than $16 billion is nearly equal to the combined value of the other 11 E&Ps involved in the Scorecard.

When compared to 87 peers on EnerCom’s E&P Database, LINN compares favorably in terms of both production replacement and finding & development costs. Its average three-year F&D costs of $2.74/Mcfe is below the industry median of $3.32/Mcfe and its three-year production replacement of 670% is far above the median of 354%. LINN’s debt to market cap percentage (327%) is the second-highest among its 20 E&P Mid-Cap peers – a result of its sizable acquisitions in recent years. However, the company’s ability to grow both production and reserves at relatively cheap prices bode well for its MLP structure.

Capital and Dividend Adjustments

In response to the dropping oil prices, LINN announced a 2015 budget of $730 million – a drop of 53% compared to the $1.55 billion budget in 2014. The company is also cutting its annualized dividend to $1.25 per unit – 57% below 2014’s distribution of $2.90 per unit. The capital for dividends and operations in the upcoming year are expected to be fully funded from internally generated cash flow.

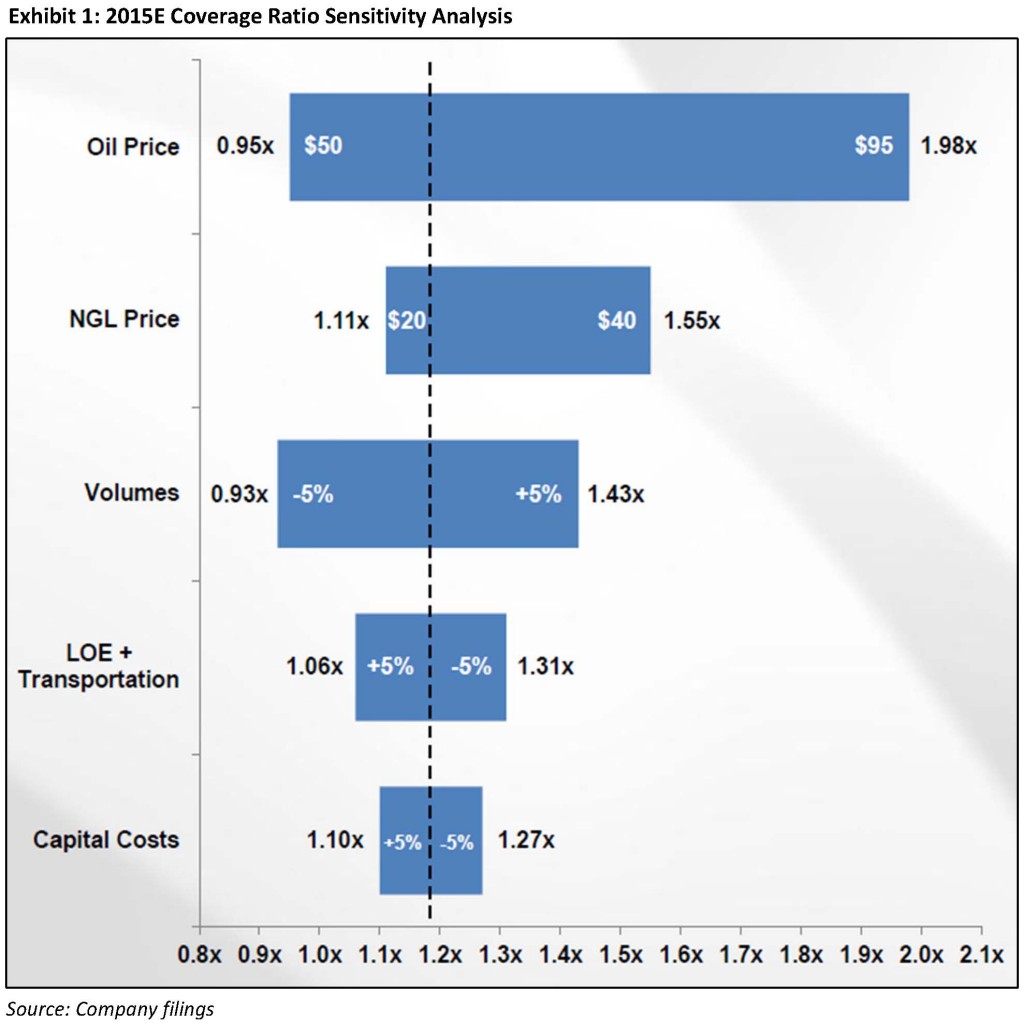

Current liquidity is approximately $2.2 billion. Its borrowing base, including the recent GSO deal, is $4.5 billion. In the call, Ellis said LINN’s projected coverage ratio (the amount of return in relation to expenditures) is 1.18x and does not include the potential upside of higher commodity prices, positive acquisitions or impact from the agreement with GSO. The company provided coverage scenarios, which are outlined in a graphic from MLV Co. on the right.

Operations Update

LINN is projecting 2015 average annual production of 1,110 to 1,235 MMcfe/d (54% natural gas). By comparison, the company projected volumes of 1,070 to 1,140 MMcfe/d in its 2014 guidance release.

LINN said it plans on focusing on “lower risk development and optimization projects” in 2015, which include workover opportunities and expanding operations in California. The Golden State will receive 25% of expenditures in the upcoming year.

Kolja Rockov, Chief Financial Officer, explains: “Lots of intensive drilling and capital intensity really doesn’t belong in the MLP scene, so that’s the strategic direction that we’ve been going in. If you drill a 50% rate of return well with our growth Capex in mind, we’re happy to give away some of it to mitigate that kind of risk and provide a more stable, lower decline, long-term production profile for LINN. And when it flips, obviously, that’s the right kind of production profile.”

Management added no capital is required to extend current leases. LINN is adhering to a general guideline based on returns of at least 15% to 20% for its projects in the current market.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.

Analyst Commentary

R.W. Baird (1.6.15)

We revised our revised our estimates on LINE's 2015 outlook and distribution cut (Bellamy). Last week, Linn Energy (LINE/LNCO) cut its distribution by -57% and reduced its 2015 capital budget by -53% Y/Y, driven by significantly lower crude oil prices. We applaud LINE for being proactive, which we called for in our recent upstream downgrade note (Link). However, despite the distribution cut bringing 2015 coverage to 1.16x in our model, we estimate coverage of 0.90x in 2016

Raymond James (1.6.15)

Distribution Cut Unfortunate, But LINN Stronger Because of It

Recommendation: LINN’s distribution cut announcement, while surprising in the timing and the magnitude, strengthens LINN’s overall financial flexibility and boosts the company’s sustainability through this period of commodity price weakness. LINN is now the only Upstream MLP that is expected to be cash flow neutral. However, given the lower distribution rate, we are lowering our price target from $18 to $14. We reiterate our Outperform rating.