New research shows the LNG industry could grow Australia’s GDP by almost 3% from 2013 levels by 2020

A new report titled “Ready or Not? Creating a world-leading oil and gas industry in Australia,” found that the liquefied natural gas (LNG) industry in Australia could become the world’s largest and most technologically advanced, contributing more than AUD$55 billion (USD$44.03 billion) to the country’s GDP in 2020. That represents almost 3% growth from Australia’s 2013 GDP of USD$1.56 trillion.

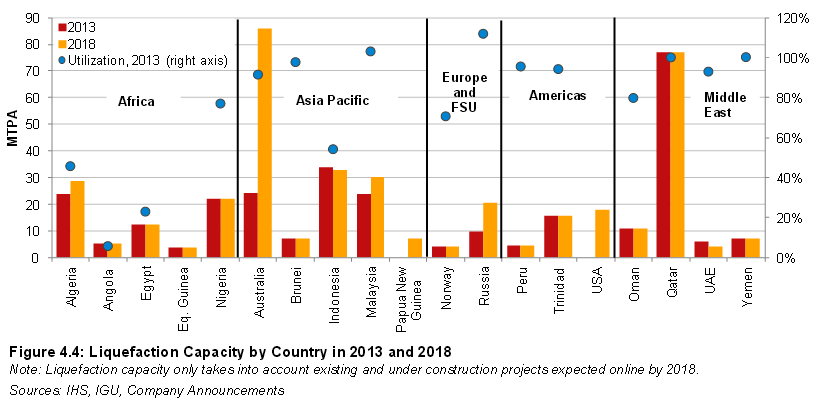

The report, conducted by Accenture, found that over the next five years Australia’s natural gas production will increase by more than 90%, the number of wells in production will increase by 400% and pipeline infrastructure in Australia will increase by 45%. Total cumulative capital investment and operating expense will reach around AUD$360 billion (USD$288.13 billion) by 2020, 40% more than the AUD$250 billion (USD$200.09 billion) invested during the recent capital investment boom, according to a press release from Accenture.

Accenture interviewed LNG operators and the companies that service them in order to assess the country’s readiness to build out its LNG assets. The report concluded that in order for Australia to secure its place as the world’s leading LNG producer and derive the associated benefits, there is a need to improve international competitiveness, remove regulatory constraints and introduce a more flexible labor relations regime.

“If operators, the service sector and government can work together to get the transition right, we estimate the industry could collectively realize an additional AUD$50 – $70 billion of shareholder value over the next 25 years – and this will have a positive impact on the whole economy,” said Bernadette Cullinane, Asia Pacific managing director for Accenture’s energy industry group. “The speed and scope of the transition is unprecedented. The industry must be ready to support and maintain safe, efficient and reliable operations for the next 40 years.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.