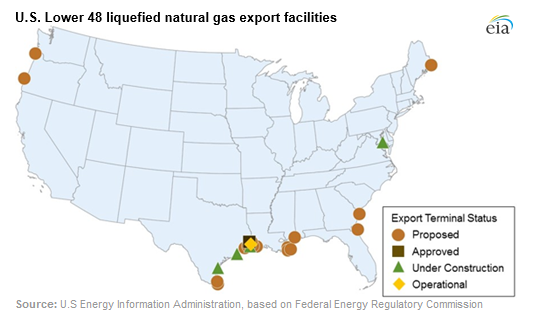

The lifting of the ban on the export of liquefied natural gas (LNG) in the United States has led to a flurry of activity in the Gulf Coast region, and several other coastal areas, as companies plan export terminals for the growth of LNG shipments abroad.

The first U.S. export set sail from Sabine Pass on February 24, 2016, and marks a transition of influence on the global trade balance. It also places the U.S. front and center as a premier natural gas producer and coming global supplier.

The exporting of natural gas requires not only liquefaction, but a new set of infrastructure capable of handling the load. The largest region of natural gas production in the U.S. is the Marcellus shale in the Northeast. The primary region of exportation has become the Gulf Coast.

Export Terminals

Cheniere’s Sabine Pass terminal began operation in February 2016 with different liquefaction units, with a total permitted capacity of 4.16 Bcf/d.

According to EIA data updated today, four other LNG export terminals are currently under construction:

- Dominion Energy’s Cove Point LNG facility in Cove Point, Maryland, is scheduled to bring one train totaling 0.82 Bcf/d online near the end of 2017.

- Corpus Christi LNG, another Cheniere project, is under construction in Corpus Christi, Texas. The terminal is scheduled to begin service in 2018, with total permitted capacity at 2.14 Bcf/d.

- Sempra Energy’s Cameron LNG terminal, located in Hackberry, Louisiana, is under construction and is scheduled to bring three trains online in 2018. A total of 1.7 Bcf/d has been permitted.

- Freeport LNG‘s terminal planned for Freeport, Texas, has three trains under construction totaling 1.8 Bcf/d. The first two are scheduled to begin service in 2019, and the third in 2020.

The growth of export terminals is an indication that there is a rather heavy flow of natural gas expected to the area and companies are ramping up capacity to be able to accommodate the flow. Unlike exploration and production companies that rely on production, terminals and other infrastructure are reliant on capacity contracts. The Federal Energy Regulatory Commission (FERC), in a December 2003 report on New England’s natural gas infrastructure, noted:

“The adequacy of the natural gas infrastructure is based on its ability to fulfill its contractual commitments. Natural gas may be contracted on a firm or interruptible basis. Interruptible contracts are typically less expensive because capacity is only paid for if used, and the supplier or transporter may interrupt service. The natural gas infrastructure is considered adequate if firm commitments are met and terms of the interruptible contract are satisfied.”

Natural gas infrastructure companies do not design or build projects based on the assumption that there will be a future market for transportation. Investment must be supported by revenue certainty through firm service agreements. As a result the timing cure is based solely on the understanding and expectation of future product flow by natural gas producers. With the lengthy curve associated with regulatory approval, construction, testing, and so on, the producers must look several years ahead to assess what they believe their needs may be.

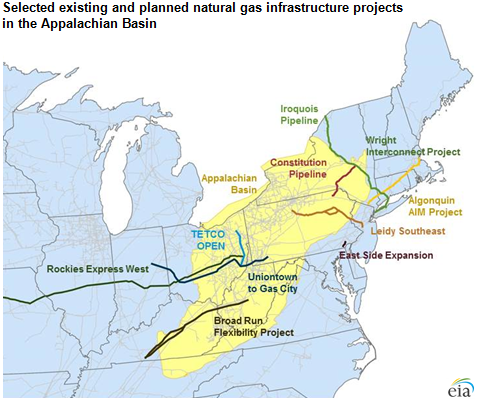

New Pipeline Projects on the Horizon

The need for increased infrastructure from the Marcellus to the Gulf Coast is also a mandate of LNG exports, and many companies are working towards providing it. The ebb and flow of natural gas production has followed the increases in pipeline capacity as its primary source of transporting product from the Marcellus. Natural gas production was able to increase in December and January of 2016 as demand increased and producers had more access to takeaway capacity.

In the past couple months, there have been several new pipeline projects to come online in an effort move natural gas either to the Mid-Atlantic markets (New York, New Jersey, and Pennsylvania) or to feed the gas into existing infrastructure that delivers natural gas further across the country, specifically the U.S. Gulf Coast where LNG plants are planned and currently under construction.

Key projects that came online in late 2015 or early 2016 include, from EIA:

- The Rockies Express Pipeline (REX) reversal project had added westbound capacity to flow natural gas to the Midwest in 2014. In late 2015, Texas Eastern Transmission Company’s (Tetco) OPEN project added 550 million cubic feet per day (MMcf/d) of pipeline takeaway capacity out of Ohio.

- Columbia Gas Pipeline’s East Side Expansion, a 310 MMcf/d project that flows natural gas produced in Pennsylvania to Mid-Atlantic markets.

- Tennessee Gas Pipeline’s Broad Run Flexibility Project, a 590 MMcf/d project originating in West Virginia that moves natural gas to the Gulf Coast states.

- Tetco’s Uniontown-to-Gas City project flows up to 425 MMcf/d of natural gas produced in the Marcellus region to Indiana.

- Williams Transcontinental Pipeline’s Leidy Southeast project provides additional capacity to take Marcellus natural gas to Transco’s mainline, which extends from Texas to New York. From there, the natural gas serves Mid-Atlantic market areas as well as the Gulf Coast.

There are several other projects that are planned and will add natural gas transmission capacity later in 2016: The Algonquin Incremental Markets expansion project will add 342 MMcf/d of capacity to Algonquin Gas Transmission’s pipeline in the highly constrained New England region. The Constitution Pipeline will have the capacity to transport up to 650 MMcf/d of natural gas from the Appalachian Basin to the Iroquois Gas Transmission and Tennessee Gas Pipeline systems in New York, which will provide access to markets in the Northeast and New England. The Wright Interconnect Project expands Iroquois’s facilities and supports the Constitution Pipeline where the Iroquois and Constitution pipelines interconnect in Wright, New York.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.