Growing production and higher EBITDAX despite low commodity prices

Commodity prices have put tremendous strain on the entire oil and gas industries, with companies cutting capital expenditures by 35% on average,  based on analysis done by EnerCom Inc. Despite the large capital reductions, some producers are still finding a way to grow business. Fort Worth-based Lonestar Resources (ticker: LNR) proved during its Q1’15 quarter call that its Eagle Ford assets continue to be profitable, and that the company can continue expanding its footprint, all while remaining economical.

based on analysis done by EnerCom Inc. Despite the large capital reductions, some producers are still finding a way to grow business. Fort Worth-based Lonestar Resources (ticker: LNR) proved during its Q1’15 quarter call that its Eagle Ford assets continue to be profitable, and that the company can continue expanding its footprint, all while remaining economical.

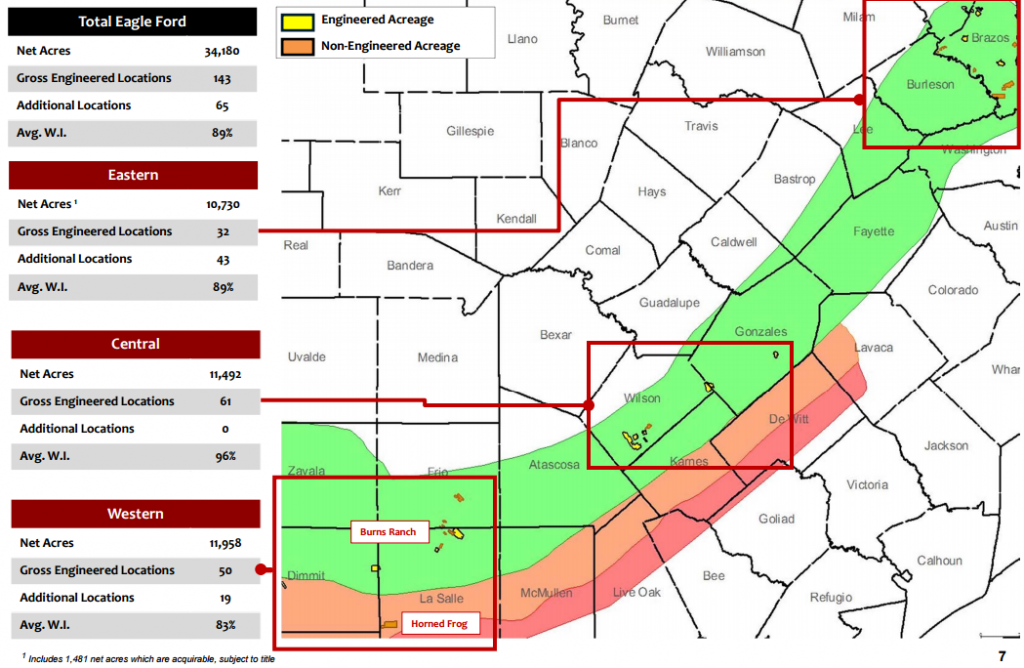

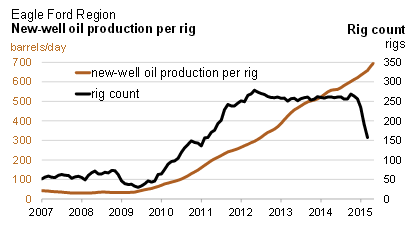

LNR’s focus is in the crude oil window of the Eagle Ford Shale, where the company anticipates spending 95% of its capital over the next several years. The company’s leasehold currently encompasses 34,180 net acres in the Eagle Ford. The Eagle Ford Shale has been an increasingly productive region, with operators reporting an 11% increase in well test rates in the last four quarters.

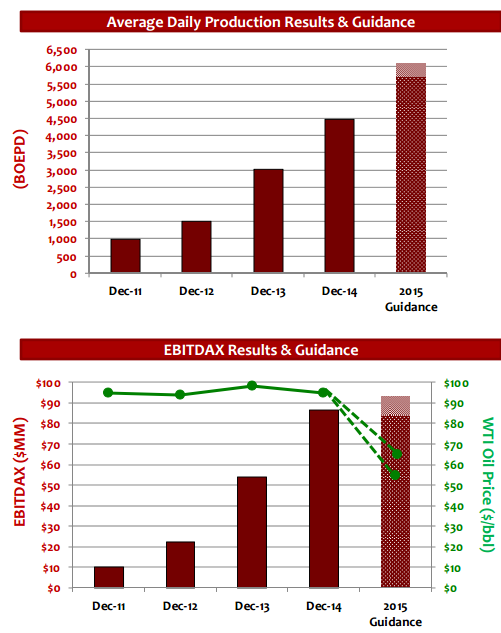

In the company’s Q1’15 report, Lonestar registered a 46% year-over-year increase in net oil and gas production to 5,547 BOEPD (83% liquids) from 3,800 BOEPD in Q1’14. LNR’s Eagle Ford assets recorded a 55% increase in production, contributing 4,827 BOEPD to the company’s Q1 production. The company plans on bringing online 11 wells total in Q2’15 and Q3’15, and guidance for the fiscal year expects to see volumes in excess of 6,000 BOEPD.

Lonestar Resources reported EBITDAX of $21.7 million, 14% higher than the $19.1 million the company reported in Q1’14. During the company’s conference call, Douglas Banister, CFO of Lonestar, said production was the key driver for revenue growth with hedges offsetting downward pressure from lower commodity prices. The company reported net revenue of $29.1 million, up 14% from $25.6 million in Q1’14.

Lonestar Resources growing footprint in South Texas

After the company’s conference call, Frank Bracken, CEO of Lonestar Resources, spoke with Oil & Gas 360® about how LNR is continuing to grow. The company announced that it has finalized agreements to acquire approximately 6,122 gross (4,047 net) mineral acres in La Salle County, Texas. Lonestar’s independent engineering consultants estimate that proved net reserves associated with the properties are 2.7 MMBO of liquids and 11.0 Bcf of natural gas, or 4.5 MMBOE of total reserves. The leasehold adds 32 gross (20 net) horizontal drilling locations to Lonestar’s Eagle Ford drilling inventory. Bracken told OAG360 that the key aspect of this deal is that it does not change the company’s budget. “We’re out of pocket nothing on this deal,” said Bracken.

Lonestar Resources already owned working interest in the leasehold and paid $2.1 million for the remaining interest in the northern side of La Salle, adding 1,720 gross (1,225 net) acres to its Greater Burns Ranch leasehold. The company’s independent engineering consultant estimates that proved and probable net reserves associated with the northern section is 1.6 MMBOE.

The second portion of the acquisition, the Horned Frog lease, was executed as a farm-in agreement in which the company acquired working interest in 4,402 gross (2,822 net) acres in west central La Salle County. Bracken said the company was able to make this acquisition because of its flexible financial position. “There is not another operator who could have made that deal happen. We know what’s in the ground and we’re confident that we will see good returns from Horned Frog.” The agreement calls for Lonestar to drill two wells in 2015 to keep the leasehold. Proved and probable net reserves are estimated at 9.2 MMBOE.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.