Lonestar Resources, Ltd. (OTCQX: LNREF, ASX: LNR) is an independent oil and gas company focused on the popular Eagle Ford Shale in Texas. On June 2, 2014, the company announced that in addition to its established ASX listing, they had begun trading on the U.S. based OTCQX. This listing enables Lonestar to provide new and existing US investors with immediate access to trading their ordinary shares in U.S. dollars.

The company began to aggressively build in January 2012 and has doubled its acreage on a compounded year-over-year basis. Lonestar Resources went public on the Australian Stock Exchange following its merger with Amadeus Energy in January 2013.

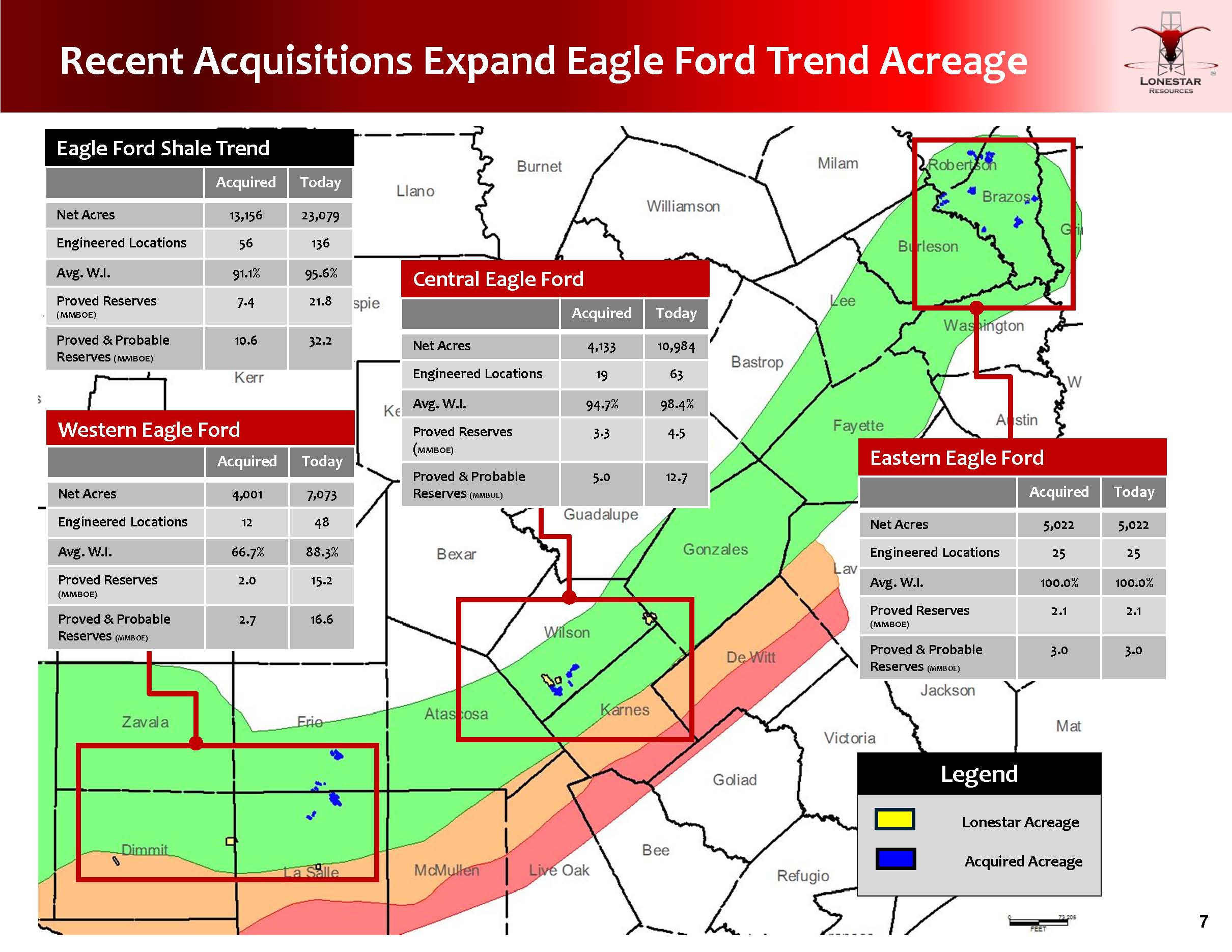

LNREF now holds roughly 23,000 net acres in the Eagle Ford with more than 25 MMBOE of proved reserves (approximately $575 million in PV-10 value). The company aims to control 100% of its properties and has strategically increased its stake through acquisitions and boosting working interest in existing wells. Full working interest allows the company to decide on its own drilling schedule, and currently all operations consist of pad drilling in an effort to reduce costs.

Eagle Ford Progression

Lonestar hit the ground running following its merger completion in January 2013. The company held 13.5 MMBOE of proved reserves ($239.8 million in PV-10) in its first-ever reserves report and Frank Bracken III, Managing Director and Chief Executive Officer of Lonestar, pledged for the company to improve on its goal. “Lonestar intends to continue its core business strategy of acquiring and developing additional leasehold in the Eagle Ford Shale play in South Texas,” said Bracken in the news release. “We remain confident that Lonestar will deliver on its promise to deliver increases in net acreage, proved reserves and asset value.”

Further progression was made the following month by acquiring 1,107 net acres for $58.4 million. The purchase boosted its Eagle Ford footprint by 23% and increased its PV-10 value by 45%. The company instated a goal to garner more than 20,000 net acres within two to three years, but that goal was expedited in February 2014 with the acquisition of 13,156 additional Eagle Ford acres for $71.3 million. The new properties more than doubled its previous standing and increased its PV-10 value by 32%.

Lonestar now holds 135 net locations in the region and is completing wells for $4.9 million to $7.0 million apiece. The low costs have allowed Lonestar to generate $66.43 in cash margin/BOE, according to its March 2014 presentation. An estimated 95% of its budget will be directed towards the Eagle Ford going forward and a two-rig program is planned on being placed into action within the fiscal year.

Lonestar is now seeking to expand its foothold in the Eagle Ford to another prominent formation; the Williston. The company is reviewing roughly 50,000 prospective acres (32,600 net) in the Williston and evaluating the potential of light oil through seismic testing and surveying. The company anticipates bringing in a farm-in partner as early as Q2’14 to accelerate the appraisal process. In its inaugural conference call with analysts and investors, Bracken said, “Our goal is to keep our net capital outlay as small or at zero in the intermediate term, but in spite of that goal, we are increasingly encouraged by the technical information we are receiving from our consultants.”

Source: LNREF March 2014 Presentation

Q1’14 Results

Production from its new Eagle Ford properties were apparent in its Q1’14 results, announced on May 8, 2014. Quarterly production was reported at 3,800 BOEPD (net of royalties), which is 46% higher than Q1’13 production. Totals from the Eagle Ford alone increased by 171% in the same time period. Its current production levels take into account the divesture of roughly $11.7 million in properties in 2013, including the sale of $10 million in Barnett acreage.

In May, volumes increased to 4,200 BOEPD (11% higher than Q1’14) due to two additional wells coming online. The company anticipates adding three more wells to the fold in Q2’14, and placed well costs for the group at just $30.9 million (roughly $6.2 million per well).

Net income was $5.0 million and the company maintains its 2014 expenditure guidance at $105 million to $125 million. Lonestar has $25 million in cash on hand following the closing of $200 million in senior note placement and anticipates to be drilling out of cash flow from 2015 and beyond. Its oil growth is 85% hedged for 2014, but the company plans on reducing hedge amounts to 53% in 2015 and 37% in 2016 – the years when production is expected to truly ramp up.

Lonestar’s Future

Its upcoming two rig program will allow Lonestar to drill 21 wells per year and provide the company with roughly 6.5 years of inventory. According to LNREF’s Q1’14 release, drilling permits nearby its acreage in Brazos County has increased by 195% since November 2013. One of the wells drilled by a competitor has produced 48,515 BOE in its first four months of production. Lonestar anticipates drilling as many as six wells in Brazos County within the fiscal year.

When asked about the numerous Eagle Ford purchases within the past year, Bracken said: “I globally believe the continued entrant of large participants into the eagle ford is a very significant endorsement of its relative returns. Our strategy is to be an aggregator of smaller interests in three core areas and over time build these positions out to a significant mass and scale. I think 40,000 acres is a number that yields real materiality to the market. This is a reminder it has always been a goal to build a company of consequence. But don’t think the transactions of that size will interfere with our strategy.”

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.