Lonestar Resources US Inc. (ticker: LONE) reported a net loss attributable to common stockholders of $13.7 million, or $(0.58) per share for Q4 2017. For 2017, the company had a net loss of $42.6 million, or $(1.92) per share. Net oil and gas production in Q4 2017 was 7,272 BOEPD. For 2017, Lonestar produced about 6,495 BOEPD.

Reserves

Proved reserves at yearend 2017 were 73.6 MMBOE with a SEC PV-10 of $538.3 million, composed of 50.7 MMBbls of crude oil, 10.9 MMBbls of NGLs and 73.6 Bcf of natural gas.

2018 plans

Lonestar issued production guidance of 7,550 to 7,650 BOEPD for the first quarter of 2018. Lonestar estimates that March production benefitted partially from the addition of the company’s Horned Frog wells, and estimates that March 2018 production will rise to an average of 8,350 to 8,450 BOEPD and that production will exit the first quarter at rates of 9,500 to 10,000 BOEPD.

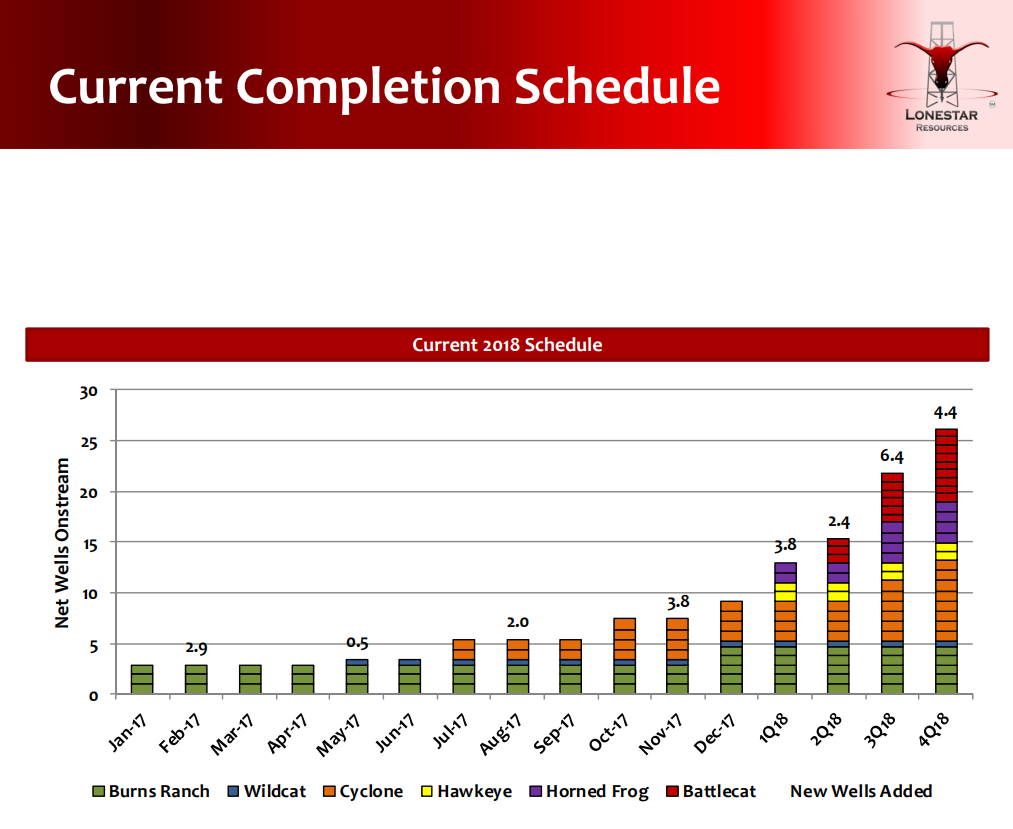

Lonestar said it has commenced a more active drilling and completion program in 2018, and all four wells are producing at rates that exceed internal forecasts. The company has brought online four gross/3.8 net wells. In January, Lonestar’s first two wells on the Hawkeye property in Gonzales County tested at average rates of 1,115 BOEPD.

Lonestar recently placed two wells online at the Horned Frog property in La Salle County, registering average test rates of 1,939 BOEPD. Additionally, Lonestar has drilled its first 3 wells in Karnes County, and the wells are scheduled to commence fracture stimulation with a newly-dedicated frac spread in early April.

CEO Bracken

CEO Frank D. Bracken, III, stated, “Over the past two years, we have dramatically strengthened our balance sheet and have made significant technical advancements to drilling, completing and producing our Eagle Ford Shale wells. As a result, 2018 will be a breakout year for Lonestar. Our 2018 full-year production guidance remains at 10,000 to 10,700 Boe/day, and represents approximately a 65% increase versus 2017. Our Adjusted EBITDAX guidance of $100 to $110 million represents similar growth versus 2017 results.

“The combination of significantly higher cash flows and our currently contemplated capital spending are expected to drive down our debt to EBITDAX ratio to below 3.0x by year-end 2018. Our stronger financial position has allowed us to secure dedicated drilling and pressure pumping services, which in turn will greatly enhance our ability to control the quality and timing of our operations with a goal of delivering production more quickly.

“The impact of our progress is already evident, as our first four wells of 2018 are outperforming our expectations. Additionally, we have drilled our first three wells in Karnes County and have scheduled to begin fracture stimulation operations in early April. We are excited about the success and momentum we are created to date in 2018, with first quarter exit rates approaching 10,000 Boe/day, providing us increased confidence that we will fully deliver on our 2018 guidance,” Bracken concluded.