Magellan Midstream reports second quarter results

Oklahoma-based Magellan Midstream (ticker: MMP) reported its second quarter financial results, showing 21% in year-over-year income growth. In Q2, MMP reported $177.4 million in net income, an increase of $31.1 million from $146.3 million in the same period last year.

Distributable cash flow (DCF) for the company also increased by 14% to $222.8 million from $195.8 million in the second quarter of 2014. The increased DCF will mean more cash on hand to pay distributions, a topic of great concern among MLPs as some of the largest talk about cutting distributions given the current commodity prices.

“Magellan continues to generate strong financial results in the midst of the current challenges facing the energy industry. We achieved second-quarter results that were substantially higher than the year-ago period, providing us confidence to increase our annual distributable cash flow guidance again for 2015,” said Michael Mears, CEO of Magellan Midstream.

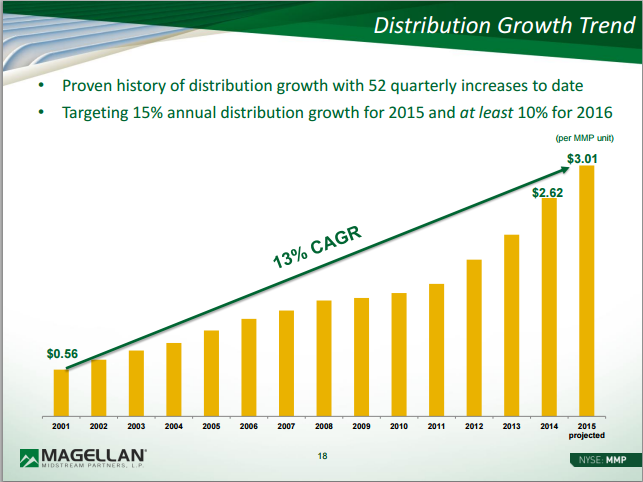

Magellan is targeting 15% annual distribution growth for 2015 and at least 10% for 2016, according to a company presentation.

C-Corp Structure

During the company’s second quarter conference call, Mears attributed some of the company’s competitive edge to its structure. “We’re about as close to a C-corp in governance structure as you can get in the MLP space,” he said. “We don’t have a [general partner], we don’t have any [incentive distribution rights].”

Magellan is made up of three units: Refined Products, Marine Storage and Crude Oil. The Refined Products unit is the company’s largest, accounting for 68% of the company’s operating margin in 2014, while Marine Storage made up 9% and Crude Oil made up the remaining 23%.

Performance by Unit

In its second-quarter release, Magellan reported that the operating margin from the Refined Products unit was $148.2 million, a decrease of $14.5 million, primarily due to the timing of the market-to-market adjustments for NYMEX positions. The unit also reported an increase of $3.2 million to operating expenses due to higher asset integrity spending, additional environmental accruals and additional property taxes that were mainly offset by more favorable product overages.

During the conference call, Mears said the real value from the Refined Products unit came from its stability. “This business is very stable. It is growing in income, primarily due to the tariff index increases that we’re allowed to take each year. And on that matter, this year we’re raising our tariff to 4.6% on July 1.”

Marine Storage operating margin was $30.2 million, up $2.8 million from Q2’14. Revenue increased $3.0 million due to improved utilization and higher average storage rates at the marine terminals, Magellan said in its press release. During the conference call, Mears said the marine unit of the company was Magellan’s foremost growth target.

Magellan’s Crude Oil unit reported an operating margin of $106.9 million, an increase of $33.4 million. Transportation and terminals revenue increased $16.2 million primarily due to contributions from the 40-mile Houston crude oil pipeline that Magellan acquired from Occidental Petroleum (ticker: OXY) in November of last year.

The crude unit consists of about 1,600 miles of crude oil pipelines and 21 MMBO of crude oil storage. Magellan is one of the largest storage providers in Cushing, Oklahoma as well.

Continuing to grow through the end of the year

In its quarterly report, the company said that it plans to increase its expansion capital spending by $200 million to $1.4 billion, with $850 million in 2015 and $550 million next year. The projects included in the company’s capital expansion program are a 40% interest in the Saddlehorn Pipeline Company (which is constructing a 600-mile pipeline to deliver various grades of crude oil from the DJ Basin to Cushing), a 50/50 joint venture with Seabrook Logistics to construct 700 MBO of crude oil storage and infrastructure with deepwater access in the Houston Gulf area, and the purchase of approximately 100 acres of Ship Channel property in Corpus Christi for future development.

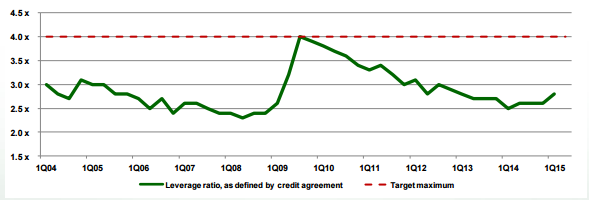

Management said it will be raising its 2015 DCF guidance by $10 million to $880 million, resulting in 1.3 times the amount needed to pay expected cash distributions for the year. Including actual results so far this year, net income is expected to be $3.15 per unit for 2015. In its June investor presentation, the company said it did not expect any equity issuances in the future, and planned to keep its long-term leverage ratio below 4x.

Magellan compares favorably to other MLPs in the EnerCom MLP Weekly scorecard, with a debt-to-market cap ratio of 20% compared to a median of 65% among the 60 midstream MLPs included in the scorecard. The company’s Return On Invested Capital is 21.7% compared to a group median of 9.5% and free cash flow per unit (FCF/Unit) of $2.91 compared to the group median of just $0.70/unit.