Magellan Petroleum Corporation (ticker: MPET) is an independent oil and gas exploration and production company with assets in the United States, Australia, and the United Kingdom. The development of a CO2-enhanced oil recovery program at its Poplar Dome assets in eastern Montana is its primary focus. In Australia, Magellan operates two onshore gas fields in the Amadeus Basin in the Northern Territory, and along with one offshore exploration license, NT/P82, in the Timor Sea.

OAG 360 has covered MPET’s properties in Montana and the United Kingdom is two separate feature articles.

The onshore legacy assets consist of operations in the Palm Valley and Dingo gas fields. The properties are fully contracted and hold an estimated $10.3 million in PV-10 with 1.84 MMBOE in reserves. A total of 53 billion cubic feet (Bcf) of gas are proved and probable.

Magellan’s Australian Operations

MPET reached a contract in 2012 to sell Palm Valley’s natural gas production to Santos Ltd. (ticker: STOSY ) for the next 17 years. The field is serviced by the Amadeus Darwin Gas Pipeline, providing resources for nearby customers and reducing transportation costs. The Palm Valley, since its discovery in 1965, has  produced a total of 158 Bcf of gas dating back to its first production in 1983. MPET’s current stake holds 11 Bcf of proved gas with an additional 13 Bcf of proved and probable resources.

produced a total of 158 Bcf of gas dating back to its first production in 1983. MPET’s current stake holds 11 Bcf of proved gas with an additional 13 Bcf of proved and probable resources.

Magellan holds a retention license in the Dingo field and has begun an application process to acquire a 20-year operating license. An agreement was reached in 2013 with the Power and Water Corporation to sell 30 Bcf of gas during the period, and sales are expected to commence in 2015. In the meantime, MPET plans on obtaining additional permits and licenses to expand its Dingo production. Plans include completing a 30 mile tie-in to existing pipeline infrastructure, as well as completing the design and construction of surface facilities.

MPET’s current license will expire in February 2014 and is subject to renewal for an additional five years. The gas market in the territory has just recently made the Dingo available for production. The field has not been produced since its discovery in 1981, but four appraisal wells drilled prior to 1991 confirmed the field’s resource potential. MPET’s current probable resources are 29 Bcf of gas.

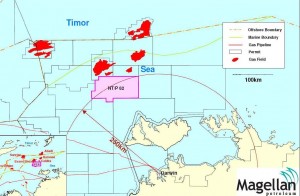

Magellan’s exploration permit NT/P82 asset (100% WI) is located in the Timor Sea offshore Northern Australia. The lease spans approximately 2,500 square miles and is estimated to hold between one and three Tcf of potential gas resources. A 2-D seismic survey has already been completed and a 3-D survey is expected to be finalized by March 2014. The company anticipates receiving full results by winter 2014. Per the terms of the permit, a well must be drilled by May 2015 and the lease is due to expire by May 2016. MPET is currently seeking a farmout company to meet its work commitment, which should become clearer once testing results are finalized. The company plans on engaging in the partnership process in June 2014.

Magellan’s exploration permit NT/P82 asset (100% WI) is located in the Timor Sea offshore Northern Australia. The lease spans approximately 2,500 square miles and is estimated to hold between one and three Tcf of potential gas resources. A 2-D seismic survey has already been completed and a 3-D survey is expected to be finalized by March 2014. The company anticipates receiving full results by winter 2014. Per the terms of the permit, a well must be drilled by May 2015 and the lease is due to expire by May 2016. MPET is currently seeking a farmout company to meet its work commitment, which should become clearer once testing results are finalized. The company plans on engaging in the partnership process in June 2014.

Australia Background

Australia has used liquefied natural gas (LNG) to take advantage of energy-starved regions in Southeast Asia. In fact, Australia was the world’s third largest LNG exporter in 2012. Production has ramped up for natural gas resources in recent years, and production rates increased in four out of five years during 2008 to 2012. In turn, the Australian government projects natural gas to account for 35% of the country’s energy consumption by 2035, up from 25% in 2011. Roughly 990 Bcf of gas was exported in 2012, with Japan receiving roughly 77% of the resource. Two floating LNG terminals are in process of being built and are expected to go into service by 2017 and 2019, respectively.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication.