Marathon Sells CO2 and Waterflood Assets in West Texas and New Mexico

Marathon Oil Corp (ticker: MRO) announced on Monday that it has signed an agreement to sell certain non-operated CO2 and waterflood Permian assets in West Texas and New Mexico for $235 million, excluding closing adjustments.

The effective date for the transaction is September 1, and the deal is expected to close by year end. Production on the properties for sale averaged 4,000 Boe/d in the first half of 2016. Marathon declined to identify the buyers.

Part of Ongoing Effort to “Simplify and Concentrate Portfolio”

As a result of the price downturn, the company has focused more of its resources on oil fields in Texas, North Dakota, and Oklahoma. “Ongoing portfolio management continues to drive the simplification and concentration of our portfolio to lower risk, higher return U.S. resource plays and support our 2016 objective of balance sheet protection,” said Marathon President and CEO Lee Tillman in April.

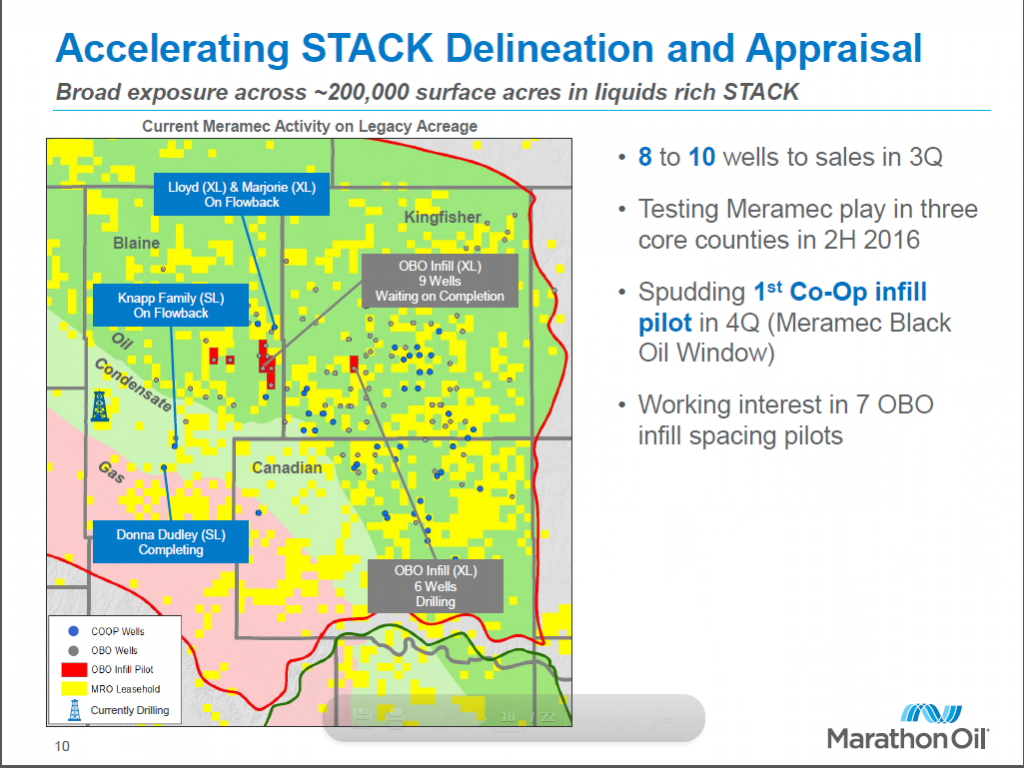

On August 1st, the company completed its June acquisition of EnCap-owned PayRock Energy Holdings, LLC for $888 million. This added 61,000 net surface acres in the oil window of the Anadarko Basin STACK play to the company’s 279,000 acre STACK and SCOOP positions.

With Permian Sale, Company Has Netted Roughly $1.5 Billion in Assets Sales in the Last Twelve Months

Since August 2015, the company has announced or closed non-core asset sales in excess of $1.5 billion with the goal of raising cash and “living within our means.” The company has exceeded this target with the sale of the West Texas and New Mexico assets. This goes along with trends in the industry, as companies use a mix of asset sales and financing to weather oil prices at or below $50.

The largest transaction in the last twelve months was the April divestment of $870 million in Wyoming upstream and midstream operations, which included waterflood developments in the Big Horn and Wind River Basins and a 570-mile pipeline. The company had operated in Wyoming for 100 years. Adding another $80 million were a 10% working interest in the Shenandoah Discovery in the Gulf of Mexico, operated natural gas assets in Colorado’s Piceance Basin, and undeveloped acreage in West Texas.

Last August, the company sold its assets in Wilburton, OK, East Texas, and North Louisiana for $102 million. This was followed in December and February by $205 million from Gulf of Mexico sales of producing properties in the greater Ewing Bank and non-operated producing interests in the Petronius and Neptune fields.

At the end of 2015 Marathon reported net proved reserves of 2.2 billion Boe in North America, Europe, and Africa. North American operations are focused on the Eagle Ford, Bakken, and SCOOP/STACK plays.