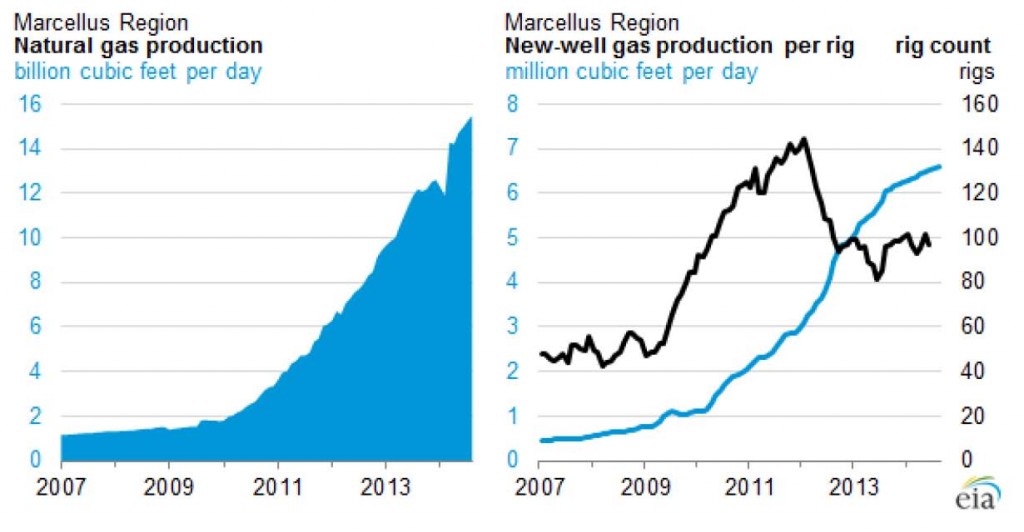

Experts were predicting half way through 2013 that what was unthinkable just a year before might actually happen in 2013: the Marcellus gas production might reach 10 Bcf/day.

The shale deposit that now accounts for almost 40% of U.S. shale gas production blew past that milestone and it has now achieved another milestone: natural gas production in the Marcellus region surpassed 15 billion cubic feet per day (Bcf/d) through July, according to the EIA’s newest Drilling Productivity Report. The Marcellus shale production climbed to today’s level from 2 Bcf/d in 2010.

The EIA says six shale plays accounted for 95% of domestic oil production growth and all domestic natural gas production growth during 2011-13.

The EIA reported for July that the rig count in the Marcellus Region has remained steady at around 100 rigs for the past 10 months. “Given the continued improvement in drilling productivity, which EIA measures as new-well production per rig, EIA expects natural gas production in the Marcellus Region to continue to grow. With 100 rigs in operation and with each rig supporting more than 6 million cubic feet per day in new-well production each month, new Marcellus Region wells coming online in August are expected to deliver over 600 million cubic feet per day (MMcf/d) of additional production. This production from new wells is more than enough to offset the anticipated drop in production that results from existing well decline rates, increasing the production rate by 247 MMcf/d,” the EIA said.

Marcellus Pioneer Not Slowing Down

One company that has led the development of the Marcellus Shale is Range Resources (ticker: RRC). Range’s aggressive development timeline in the Marcellus illustrates how it and fellow independent oil and gas companies created the U.S. Shale Boom:

2004: Range initiates Marcellus development, drilling the Renz #1 in Washington County, PA.

2006-2007: Within 18 months, Range entered five shale plays, growing shale gas production from zero to 60 Mmcfe/day. Net acreage prospective for shale gas development grew from 180,000 to 650,000 net acres.

2008: The Company’s net acreage in the Marcellus Shale grew to more than 900,000+ acres. The Company brought in Mark West Energy Partners, L.P., to construct processing and gathering facilities and exited the year with net production from the Marcellus of 30 Mmcfe/day.

2009: Range drilled 55 horizontal shale wells in the Marcellus shale driving net production past the 100 Mmcfe/day milestone before year-end. Range drilled its first two horizontal wells in the northeastern core of the Marcellus both with seven-day production rates above 13 Mmcfe/day. Bill Zagorski, VP of Geology is recognized as the “Father of the Marcellus” by the Pittsburgh Association of Petroleum Geologists.

2010: Range completed its first Upper Devonian and Utica test wells with favorable results. In the Marcellus shale, the company drilled more than 100 horizontal wells and exited the year with net production in excess of 200 Mmcfe/day.

2011: Range sold its North Texas Barnett Shale acreage and production for approximately $900 million and funded increased activity in the Marcellus. The Company exited the year with net production of over 400 Mmcfe/day from the Marcellus.

2013: Range’s corporate net production volumes surpassed 1 Bcfe per day; Marcellus gross production reaches 1 Bcfe per day.

2014: Range’s total proved reserves reached 8.2 Tcfe, as well as resource potential reaching 64 – 85 Tcfe. In the Marcellus, Range reports 41 – 51 Tcfe resource potential with its approximately 1 million net acres.

SOURCE: Range Resources

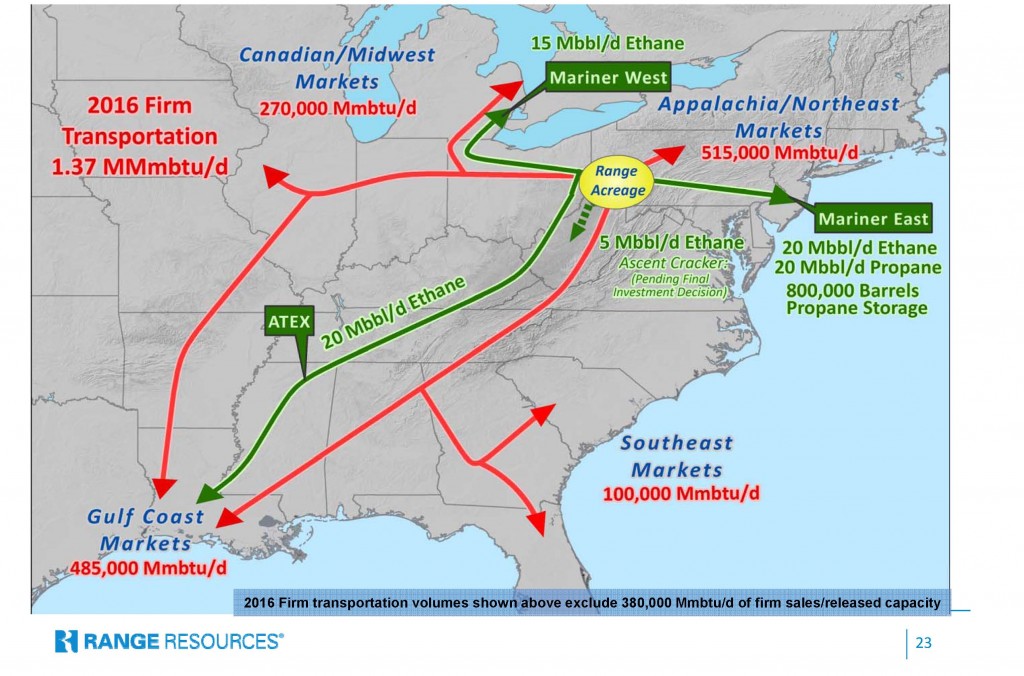

In its Q1’14 earnings release, Range President and CEO Jeff Ventura said Range had the ability to grow its net production to 3 Bcfe/day, or three times its current production. “The wells have been identified, the compression and plants have been scheduled, and the takeaway capacity to multiple markets has been secured.”

Range has earmarked 87% of its $1.52 billion capital budget to continue its Marcellus drilling and development program.

On its Q2’14 earnings call, Jeff Ventura, Range President and CEO, said: “For the second half of 2014, we plan to drill Marcellus wells that are projected to have an average lateral length of 5,413 feet, some with laterals over 10,000 feet. On our first quarter conference call in April, it was great to announce that Range has just drilled what we believe is the highest-rate Marcellus well ever drilled by any company in the southwest portion of the play. That well had an initial 24-hour rate of 38.1 million equivalent per day. This well had its 7,065-foot lateral completed with 36 stages. And it’s located in Washington County, Pennsylvania.”

Source: RRC July 2014 Presentation

“This quarter, I’m excited to announce that we drilled and completed our best well ever on our Northeast acreage position. This well had an initial rate of 28 million per day from a 6,553-foot lateral with 33 stages. It could’ve IP’d for a much higher rate but was constrained by our surface facilities. This well set a new 30-day production record for Range and averaged 25 million per day for this period. This well has been online now for 40 days and is still producing 22 million per day. The cost to drill and complete this well was $5.2 million. We have multiple potential offsets to the well.”

Range says its ethane contracts have cleared a path, allowing overall capacity to reach 3 Bcfe per day net from the Marcellus alone. “We are projecting that we could be able to move 4 to5 Bcf per day of Appalachian gas to where two-thirds of the current United States demand for natural gas exists,” the company said in its 2013 annual report to shareholders. In addition, Range foresees selling its natural gas liquids to export markets in Europe, South America and Asia as export and import facilities come online.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.