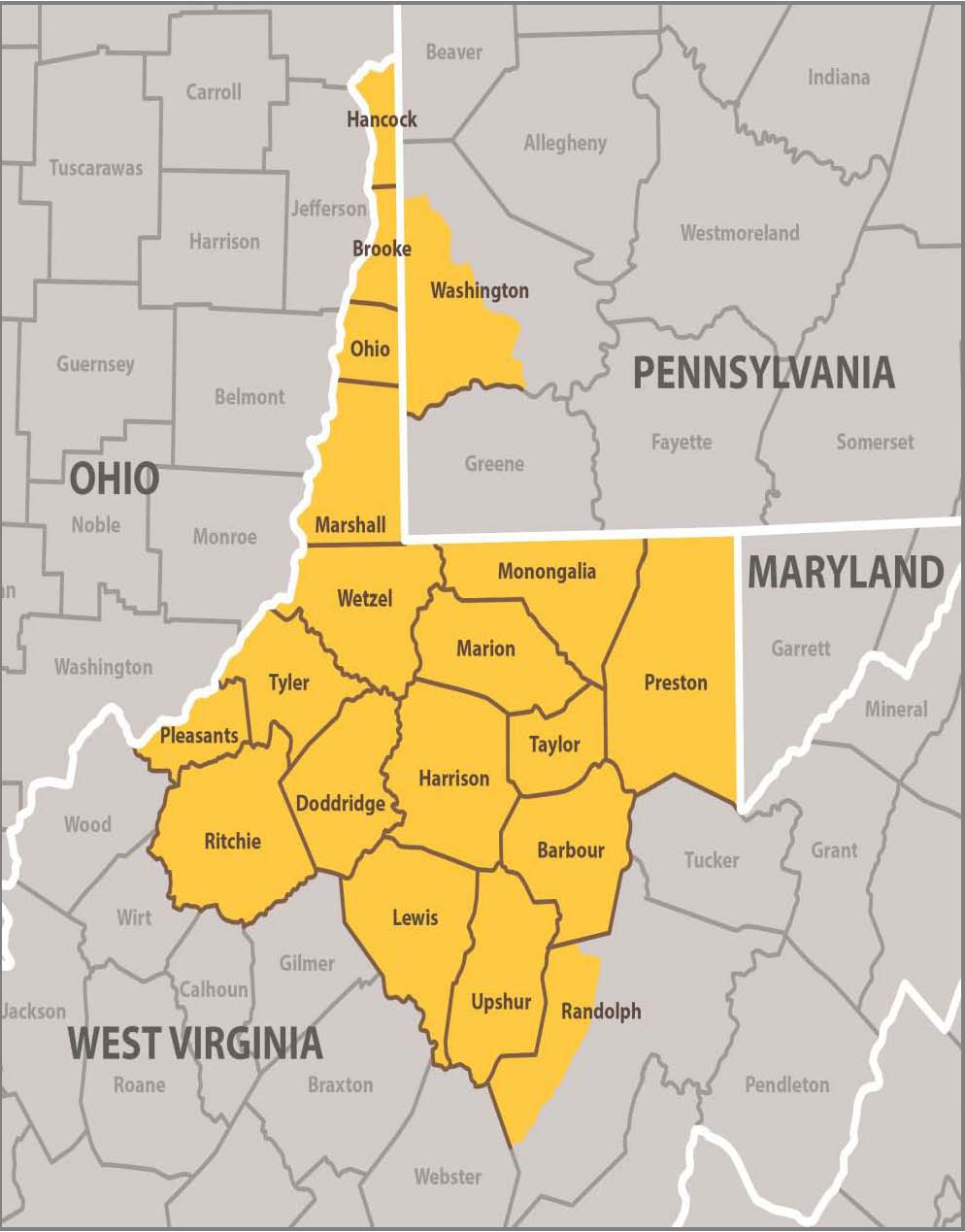

Chesapeake Energy (ticker: CHK), a pioneer in the Marcellus/Utica region, announced the sale of $5.375 billion in regional assets to Southwestern Energy (ticker: SWN) in the early morning hours on October 16, 2014. Per the terms of the deal, Southwestern receives:

- 413,000 net acres located in northern West Virginia and southern Pennsylvania (more than 50% held by production)

- Approximately 1,500 wells, including 435 gross horizontal wells in the Marcellus/Utica with an average working interest of 67.5%

- Average net production of 56 MBOEPD (45% liquids) during September 2014

- Net proved reserves of 221 MMBOE

- Assumption of CHK’s processing and capacity commitments

- An estimated 20 years of drilling inventory through an 11-rig system

Source: CHK 10/14 Presentation

The transaction is expected to close in Q4’14. SWN will finance the transaction through a $5.0 billion commitment from Bank of America and its existing credit facility. The company held roughly $1.8 billion in debt in its Q2’14 earnings release. Prior to the acquisition, its debt-to-market cap ratio was just 15% – far below the 51% median of 86 companies in EnerCom’s E&P Weekly.

Why Chesapeake Wins

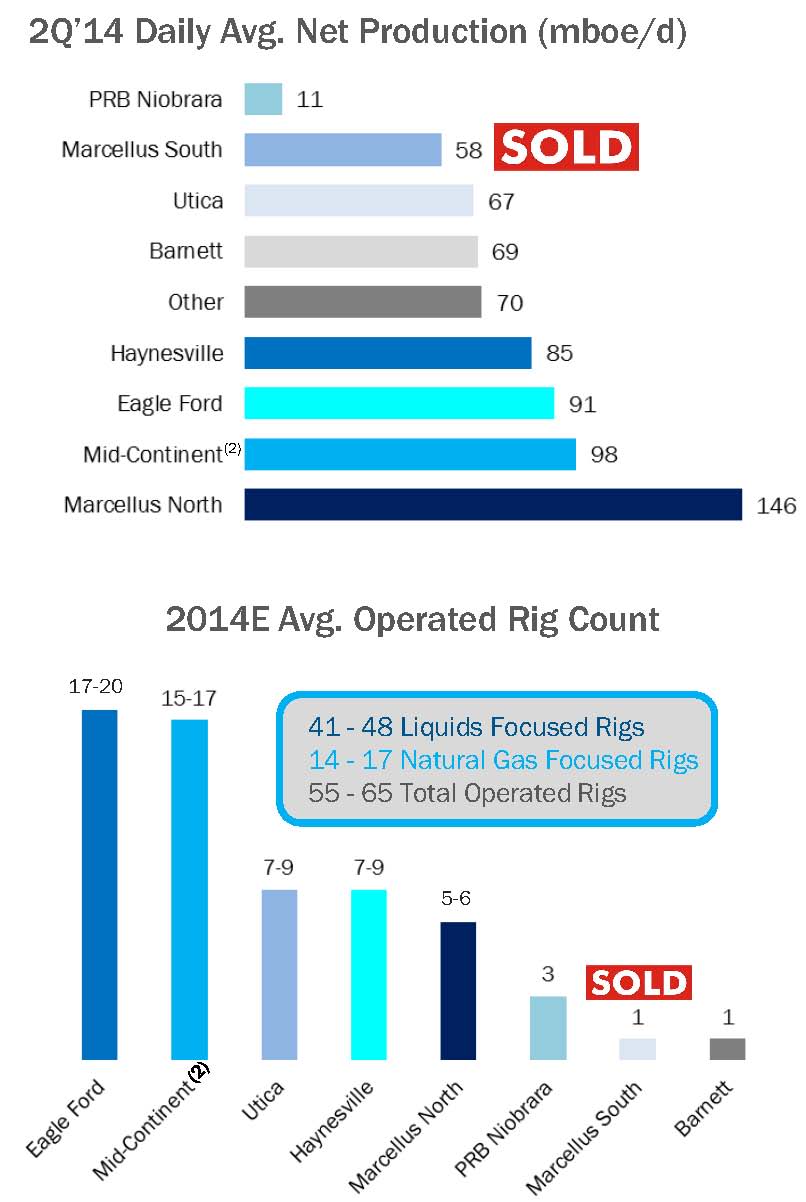

Chesapeake has been in a selling frenzy for the last few years in an attempt to right-size the company, but the latest Marcellus/Utica divesture is the largest in its history. CHK has either sold or spun off $3 billion worth of properties to date in 2014, excluding the latest sale. The company’s focus has shifted primarily to the Mid-Continent and Eagle Ford. The divested southern Marcellus properties, as indicated by the figure to the right, were not a vital beneficiary of CHK’s capital.

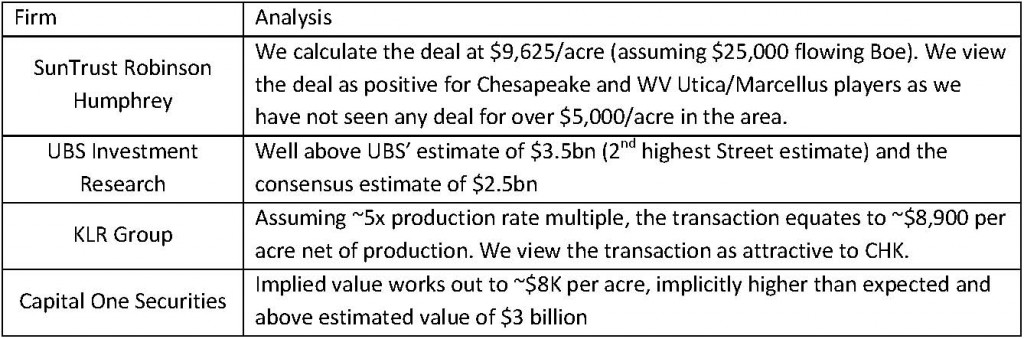

The consensus among sell-side analysts was CHK’s premium price received as part of the deal.

The analysts pointed at using proceeds to pay down debt, which was $11.5 billion as of Q2’14 (91% of market capitalization). UBS said, “We strongly believe allocating the bulk (or all) of the proceeds to debt reduction would be overwhelmingly applauded by investors, particularly in a lower oil price environment.” The firm views the deal as 14% accretive on an enterprise value/EBITDAX ratio, ultimately dropping the multiple to 4.2x from 5.0x prior to the deal.

Chesapeake retains its Marcellus position in northern Pennsylvania and its Utica position in Ohio. Capital One Securities estimates the divested properties account for just 28% and 17% of the company’s Marcellus and Utica production, respectively.

Why Southwestern Wins

Global Hunter Securities held the properties in higher regard than its peers, placing the high-end of acreage value at $8,000/acre excluding existing production. “This is a win/win,” says the GHS note. “CHK needed to de-lever and SWN needed a complimentary asset to the Fayetteville and NE Marcellus… we think this points to an attractive entry price.”

Capital One called the deal a “necessary (but not cheap) addition to the SWN portfolio… The company has the balance sheet to make the deal using debt alone.” EnerCom’s metrics show SWN’s net debt to EBITDA multiple would increase from 0.8x to 2.7x, even though the value of the deal equates to roughly 45% of the company’s current market cap. The current average ratio among 86 companies is 2.5x.

Chesapeake, Pro Forma

In its analyst day in June, CHK said it expected to make $4 billion worth of divestments in 2014, matching its 2013 sales. The company had not made any hints at its landmark divesture announced today.

The Eagle Ford will be a driver moving forward for CHK – the company announced it would commit 35% of its capital and run 15 to 20 rigs in the region at its analyst day. Updated guidance in terms of expenditures has not been announced, but Chesapeake management reiterated guidance growth of 7% to 10% in the company’s existing properties.

Source: SWN Acquisition Press Release

Southwestern, Pro Forma

Southwestern is already the fourth-largest natural gas producer in the lower 48 states, and management said the future for gas is “robust” in a conference call following the release (download transcript). SWN management described its new properties as its “third premier acreage position,” joining the Fayetteville and the northeastern Pennsylvania Marcellus. The company expects the reserve mix to be equally distributed among the three by year-end 2017, as opposed to the current mix of 67% for the Fayetteville and 33% for the NE Marcellus.

SWN will embark on its Marcellus/Utica properties with four to six rigs in 2015, ramping up to 11 rigs by 2017. “When you stress-test the acquisition at $3.50 flat forever, we still deliver good returns,” said Steve Mueller, Chairman and Chief Executive Officer of Southwestern Energy in the call.

Management was limited in the majority of comments on the call due to the recent timing of the acquisition, but did mention it does not expect to spin off its midstream assets to finance the deal. Mueller says the acquisition will only be accretive to the company’s current growth rate of 15%.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.