Switching fuel is more important than it seems

Upcoming regulations on fuels in the maritime industry will have major effects far beyond shipping companies, with reverberations throughout the oil industry.

The International Maritime Organization has passed new regulations for ships around the world requiring them to use 0.5% sulfur fuel, a major drop from the 3.5% allowed currently.

OPEC presented its analysis of the situation in its World Oil Overview released this week. According to the cartel, ships have three options for complying with the new regulations:

- Switching to a low sulfur fuel

- Installing an emissions scrubber and continuing to use high-sulfur fuel

- Switching to an alternative fuel, primarily LNG

While LNG will likely play a growing role in ship fuels in the future, there is not enough infrastructure currently in place to support a large-scale shift to LNG fuels. Only a handful of shipping companies have announced plans to install scrubbers on their fleets, so the majority of shipping companies will demand a low sulfur fuel.

Companies also cannot hope for a stay in implementation, as an IMO official commented today “I can categorically say there will not be a delay…A delay to the regulation would damage the IMO’s reputation and credibility as a rule-making body for international shipping and would lead to more regional and national action to control air pollution from ships.”

Refineries will run at double time, demand will surge in 2020 – costs are high

Unfortunately, uncertainty in the precise fuel needed and the relatively short period between the regulation announcement and implementation means there has been little effort by refineries to retool to supply the new fuel. According to Wood Mackenzie, for example, adding a residual hydrocracker to strip fuel of sulfur would cost near $1 billion and take up to a decade.

The only way for refiners to supply the surge in demand for low sulfur fuel, then, will be running at higher rates, at least until ships install scrubbers or larger refinery retooling can be accomplished. The continued growth of U.S. shale will likely aid in this, as the low-sulfur oil produced in shale plays is easily refined into the fuel required.

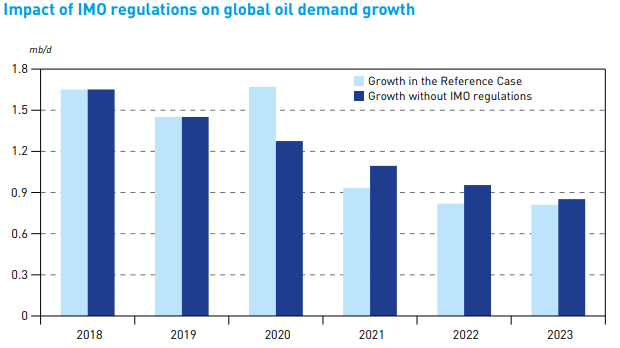

OPEC expects the regulations will cause crude oil demand to surge in 2020, with yearly demand growth of 1.67 MMBOPD instead of 1.27 MMBOPD. This growth surge will be balanced by slower demand growth in the following years.

Effects will ripple across the oil landscape

The extended effects of this change will be considerable. According to Bloomberg, oil prices may rise by $4/bbl in 2020 specifically due to the IMO rules, and many analysts predict an even higher surge. High-sulfur grades of oil, however, are likely to see widening differentials to Brent and WTI, as the regulations mean more sulfur must be stripped out in the refining process. The increased need for low sulfur fuel will also raise prices for other refined products, particularly other fuels like diesel, gasoline and jet fuel.