Maintains 10% CAGR Distribution Through 2020

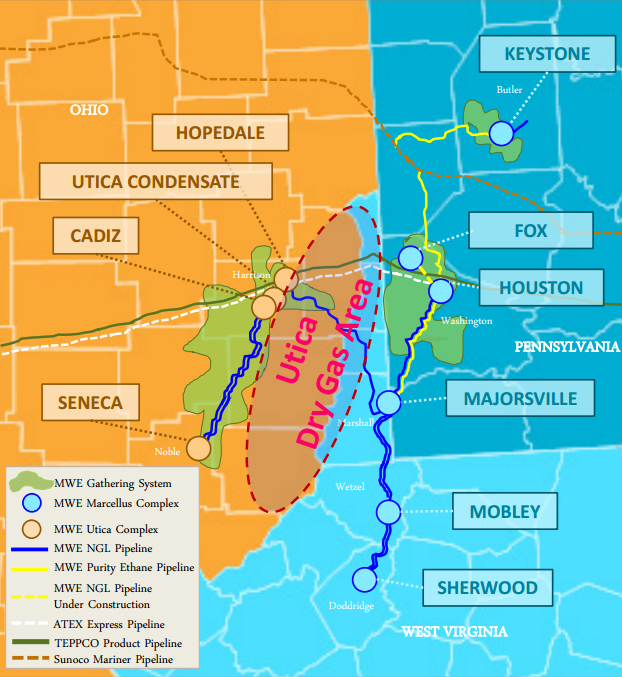

MarkWest Energy Partners (ticker: MWE), one of the largest Master Limited Partnerships (MLP) in the oil and gas industry, outlined its near-term plans in its 2015 Analyst Day on June 3. The Denver-based midstream provider is the second largest gas processor in the United States and has nearly 4,700 miles of pipeline in its portfolio. Its primary focus is in the Marcellus/Utica region, and management expects 75% of its 2015 operating income contribution to be sourced from the Northeast play.

Changing of the Tide

Only months ago, “liquids” seemed to be the industry buzz word due to pricing premiums. In the new commodity environment, companies like MarkWest are realigning their focus to exploit opportunities with dry gas. With the slimmer margins playing a role, MWE plans on building out its position in the dry gas window to take advantage of proximity. “This strategy is primarily geared to stay aligned with the activity levels of the partnership’s producer customers,” said a note from Global Hunter Securities. Gulfport Energy (ticker: GPOR), for example, is the highest acreage holder in the dry gas window and complimented MarkWest on its infrastructure buildout during its Q1’15 conference call.

The midstream provider’s Appalachia footprint is vast; it expects to hold 60% of all fractionalization and processing capacity by 2017. MarkWest believes volumes from the region can more than double by 2025. However, the resource abundance has led to oversupply in the region, and MWE is taking steps to steer natural gas liquids to other markets. Although no projects were announced during the presentation, management pointed out its multiple export outlets can be used to distribute the resources throughout North America and bring a more even spread between supply and demand.

Delaware Basin in the Books

MWE announced plans to install a 200 MMcf/d processing plant in the Delaware Basin on the eve of its analyst day, adding the project is part of a long-term, fee-based agreement with Chevron (ticker: CVX) and Cimarex Energy (ticker: XEC). Global Hunter Securities notes that management “expressed guarded optimism on its ability to further scale-up” its position, and further growth will likely be influenced by its brand name and existing relationships.

Wunderlich Securities says the expansion will be difficult due to the high competition in the region, and its current pipeline network (about 60 MBOPD) is minimal in the grand scheme of things. “Should [MWE] not win additional business, we would expect returns to be modestly lower than the mid-teens returns of larger Marcellus complexes with acreage dedications,” the firm says.

Still in the Growth Stage

MarkWest has increased its distribution on a compounded annual basis by 11% since its Initial Public Offering in May 2002. The growth rate is expected to continue through 2020, and its current yearly distribution is $3.70 per share. Despite the consistent rise, MarkWest has carefully guarded its balance sheet with long-term debt and fee-based structures. Its debt to market cap percentage is 35% – below the median of 54% of the 58 midstream companies covered in EnerCom’s MLP Scorecard. MWE is bolstered with more than $1.1 billion in liquidity on its senior secured credit facility of $1.3 billion.

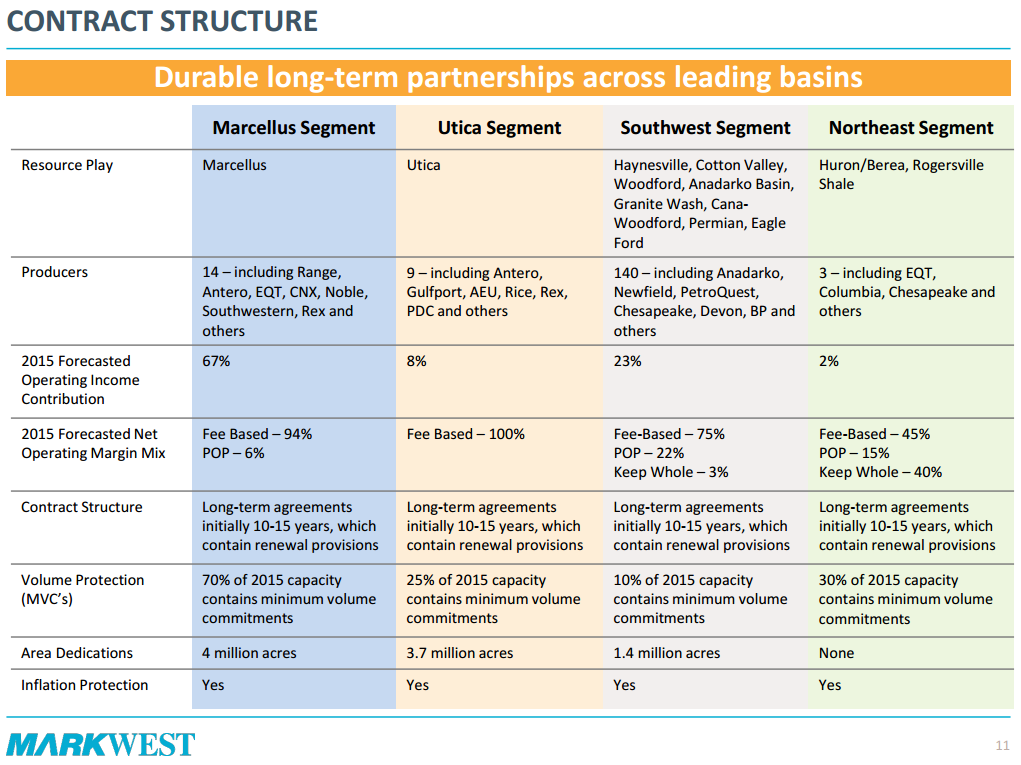

Approximately 90% of its 2015 net operating margin is fee-based, meaning the company is much more exposed to changes in volumes as opposed to changes in commodity prices, even though roughly 53% of its volumes are hedged.

The continued rise of Appalachia production will leave MWE more available to incoming volumes as the company continues its capital investment program, which has totaled more than $25 billion.