Highest oil breakeven is in Williston Basin; for gas it’s the Fayetteville

Lowest oil breakeven is the Midland Basin; lowest for gas is the southwest Marcellus

A report from KLR Group today has pegged the breakeven costs for various oil and gas plays around the United States. The report looked at capital performance of E&P companies, and found that the highest breakeven for oil among the basins in the U.S. is NYMEX $67 per barrel for oil, while the highest breakeven for gas is NYMEX $3.70 per Mcfe.

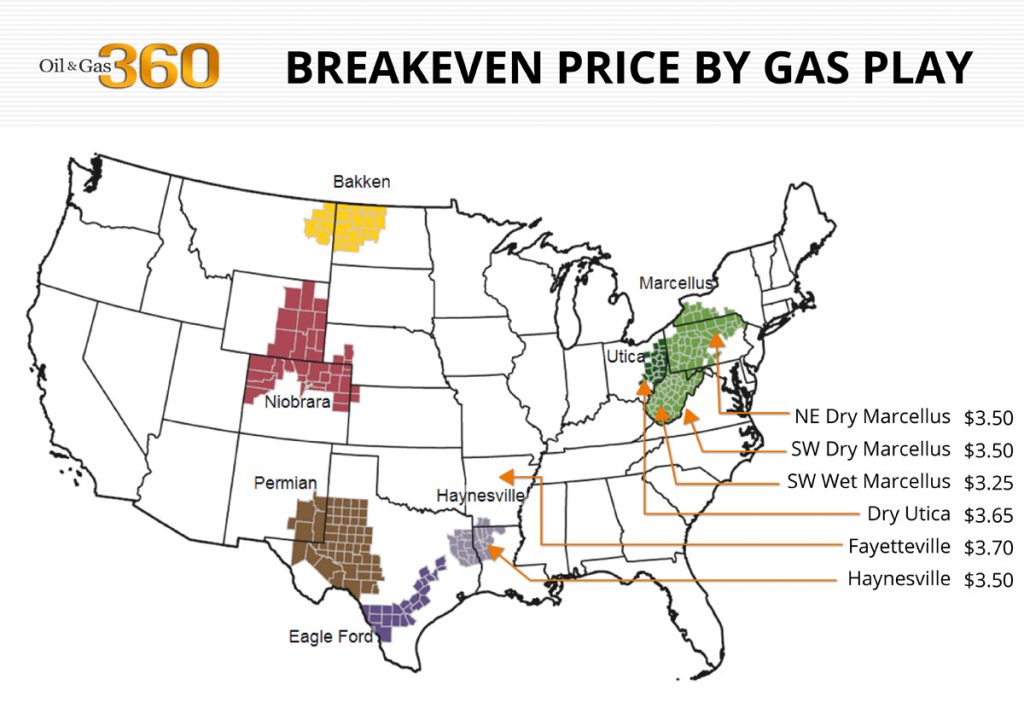

The report found low end for U.S. supply is in the Midland Basin (about $51 per barrel) while the most expensive production is in the Williston Basin Bakken/TFS (about $67 per barrel). On the gas side, supply is bracketed by the southwest Marcellus (about $3.25 per Mcfe) and the Fayetteville (about $3.70 per Mcfe).

KLR’s research found that oil-dominated E&Ps (those whose production was at least 60% oil) had a median capital intensity of about $30 per BOE and operating overhead of about $14 per BOE, equating to a cash cost structure of about $44 per BOE. Given an approximately $11 per BOE median liquids (oil/natural gas liquids) price discount to NYMEX, said KLR, the current NYMEX-normalized oil-dominated E&P cost structure is about $55 per BOE.

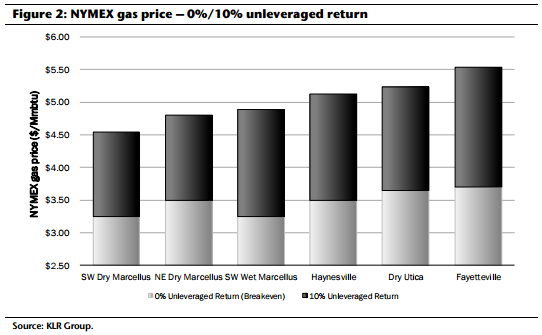

The capital intensity for the median gas-dominated (less than 20% of the company’s production coming from oil) E&P is about $1.85 per Mcfe, while operating and overhead expenses is about $1.25 per Mcfe, equating to a cash cost structure of around $3.10 per Mcfe. Given a $0.40 median gas price discount to NYMEX, the current NYMEX-normalized gas-dominated E&P cost structure is about $3.50 per Mcfe, KLR said.

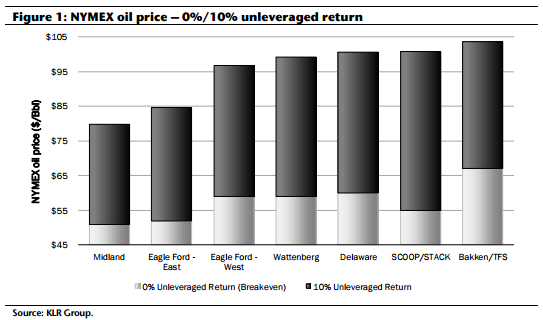

In order to generate 10% unleveraged rates of return, U.S. basins need $104 oil and $5.50 gas

Oil’s steady climb back from the low-30s has given some hope that prices may again reach the breakeven prices mentioned in the KLR report, but there will be much further to go before producers realize 10% rates of return on their production, the energy analyst group said.

In the Midland Basin/Eagle Ford East, where the breakeven is the lowest in the U.S., it would still require a NYMEX oil price of $80-$85 to generate a 10% unleveraged return, said KLR. The low capital intensity, and higher oil composition and oil price realization drive the region’s strong metrics.

The SCOOP/STACK has the second-highest price requirement for a 10% return despite its relatively low breakeven due to its low oil composition, the report said. Despite capital intensity of about $22 per BOE, NYMEX oil prices would still need to reach about $101 per BOE before operators in the region saw a 10% return.

Despite having the highest oil composition in the group, the Bakken/TFS requires the highest NYMEX oil price (about $104 per BOE) to generate a 10% return. Elevated capital intensity and lower oil price realization were the drivers behind this, said the report.

For natural gas, the dry Marcellus would require a NYMEX gas price of at least $4.55 to generate a 10% unleveraged return, said KLR. The region’s low capital intensity is partly offset by a lower gas price realization.

The Fayetteville requires a NYMEX-normalized natural gas price of about $5.50 per Mcfe to generate a 10% return, making it the most expensive natural gas play among those examined by KLR. The Fayetteville was the only basin in last week’s Baker Hughes rig count to show zero activity as low prices continue to make the region uneconomical for new production.