From the Federal Reserve Bank of Dallas

Mexico’s economic output contracted in July as the monthly gross domestic product (GDP) measure declined. Before release of the most recent data, the consensus 2017 GDP growth forecast had been revised higher, to 2.2 percent in August from 2 percent in July.

Other data were mixed as employment growth remained strong and retail sales and exports ticked up, but industrial production fell. Inflation continued rising even as the peso maintained its recovery against the dollar.

Earthquakes in southern and central Mexico in September will likely depress economic activity in the affected regions, which include metropolitan Mexico City, through the rest of the year. However, the effect will be temporary and growth should rebound as reconstruction accelerates.

Economic Activity Index Falls

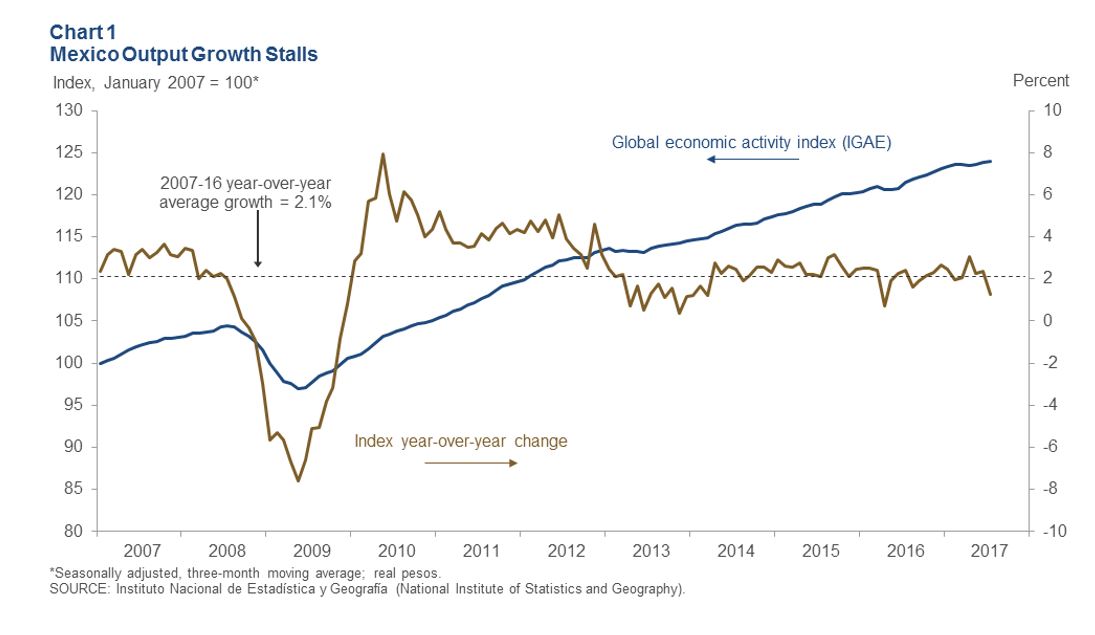

Mexico’s global economic activity index, the proxy for GDP, fell 0.7 percent in July after growing 0.6 percent in June. The three-month moving average was flat at the start of the third quarter (Chart 1). Service-related activities (including trade and transportation) slipped 0.1 percent in July. Goods-producing industries (including manufacturing, construction and utilities) declined 1 percent. Agricultural output dropped 1.6 percent.

Exports Trending Higher

Total goods exports rose 1.6 percent, while manufactured goods exports advanced 1.9 percent in August. Both categories dipped in July. With this data, the latest three-month moving averages show a steady climb (Chart 2). Total exports were up 8.1 percent year to date through August relative to the same period in 2016. Manufacturing exports grew 7.1 percent and oil exports advanced 24.1 percent in the first eight months of 2017 compared with the same year-ago period.

Industrial Production Drops Again, but Manufacturing Ticks Up

Mexico’s industrial production (IP), which includes manufacturing, construction, oil and gas extraction and utilities, fell 1 percent in July. In contrast, manufacturing IP gained 0.3 percent. Both total and manufacturing IP were flat in June.

As a result of continued lackluster readings, both series’ three-month moving averages fell—manufacturing IP less so than total IP (Chart 3). In the U.S., IP dropped 1 percent in August after six consecutive months of growth.