America’s main energy export destination sees increased growth

The Federal Reserve Bank of Dallas has released its Mexico Economic Update, outlining the current situation of the U.S.’s primary energy export destination.

The Mexican economy showed solid growth in Q1 2017, with GDP rising by a 2.4% annualized rate. This growth was achieved despite higher inflation, interest rates and uncertainty over future trade relations with the U.S. This growth has increased the consensus growth forecast for this year from 1.5% to 1.7%.

The Peso continued to strengthen relative to the dollar, averaging 18.8 Pesos/Dollar in April. This reverses the Peso’s slide, as the currency has been losing strength relative to the dollar since 2014. Inflation was higher than expected, however, at 5.8% in April. This is significantly above the Bank of Mexico’s long term target of 3%. Banco de México Governor Agustín Carstens has stated that the central bank will use interest-rate increases and currency interventions as needed to strengthen the peso and stabilize prices.

U.S. is net exporter of energy to Mexico

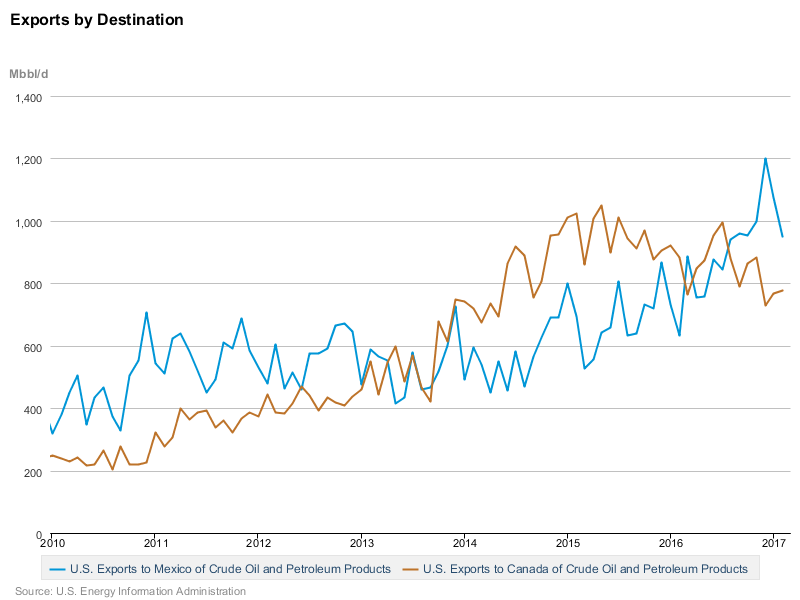

Mexico is now the U.S.’s primary oil and gas export destination, outpacing Canada, according to the EIA. The U.S. has exported a larger amount of crude and petroleum products to Mexico than Canada since August 2016, and averaged a total of 950 MMBOPD in February. Exports to Mexico have been rising gradually over the last few years, and the U.S. has been a net exporter of crude oil and petroleum products to the country since 2015.

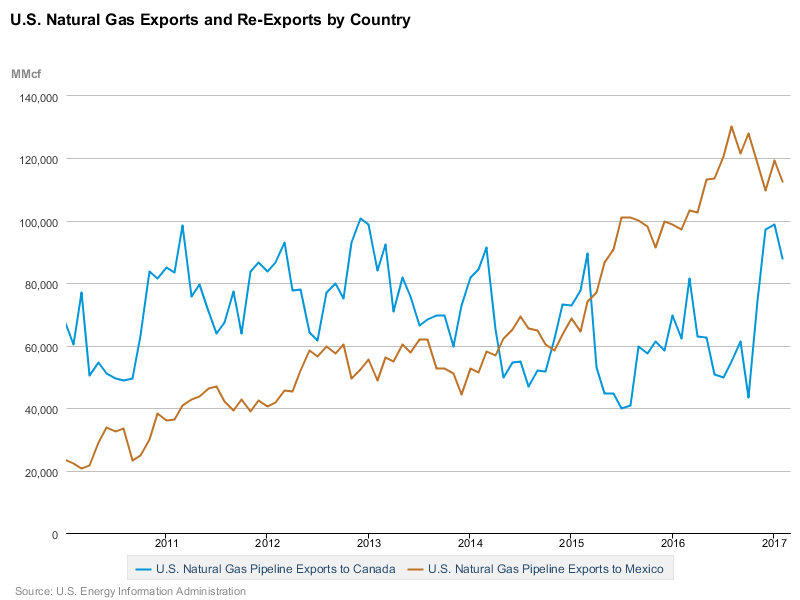

The story is similar with natural gas. In February 2017, the U.S. exported more than 112.6 Bcf of gas to Mexico, compared to 87.9 Bcf to Canada that month. U.S. imports of gas from Mexico are relatively insignificant, totaling only 917 MMcf in 2016.

Refineries targeting Mexican fuel market

Mexico is becoming a major destination of Permian production as numerous companies try to decide what to do with booming production. Raven Petroleum’s planned refinery, for example, will export refined products to Mexico through Laredo.

The country is in the process of deregulating its fuels market, most recently by phasing out mandated gasoline prices. Demand in Mexico is growing by 3% per year, outpacing growth in supply. Gasoline prices rose by 20% in the country in January as the government raised maximum rates. The Mexican supply imbalance has made it an attractive destination for refined products, a situation companies are looking to take advantage of.