BHP Billiton wins Trion farmout

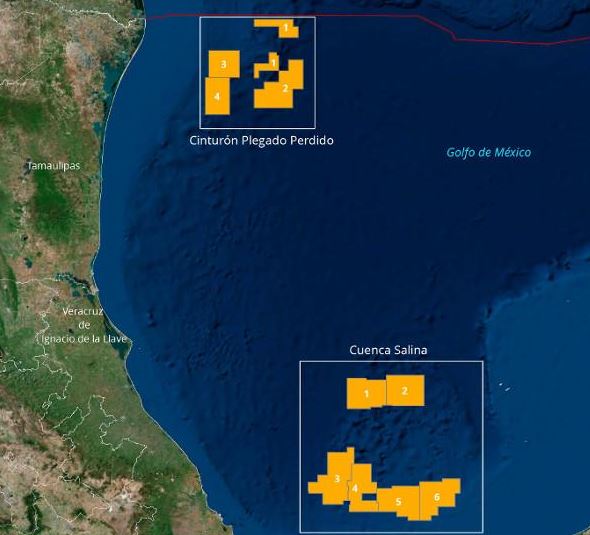

Mexico’s deepwater Gulf of Mexico oil and gas auction, Round 1.4, resulted in eight of the 10 deepwater blocks in the Gulf being awarded to bidders outside of Mexico—a first for a country that has been determined to successfully draw outside companies to help overhaul its energy sector.

Mexico’s National Hydrocarbon’s Commission (CNH) said that BHP Billiton (ticker: BHP) won the bid to develop the Trion deepwater field in Pemex’s, Mexico’s state-owned oil company, first-ever farmout deal.

CNH president Juan Carlos Zepeda said in a press conference that he expects production at Trion to begin around 2023 with exploration going another decade, according to a report in Offshore Engineer.

BHP Billiton outbid BP for the Trion field, which is less than 50 miles (80 km) from the U.S.-Mexico maritime border, according to a report by Reuters. BP was the only other company that participated in bidding for the Trion farmout. BHP offered $624 million to complement its royalty bid, CNH said. Trion is located at a water depth of about 8,000 feet. According to the report, Pemex estimates Trion has 3P reserves of 485 MMBOE that will require investment of approximately $11 billion for exploration and exploitation.

The Pemex farmout deal includes two delineation wells, one exploration well, and a 1250sq km wide-azimuth seismic acquisition. Pemex says that it estimates first production from the field in 2023. By 2025, it expects to reach peak production of 120,000 BOEPD, according to the OE report.

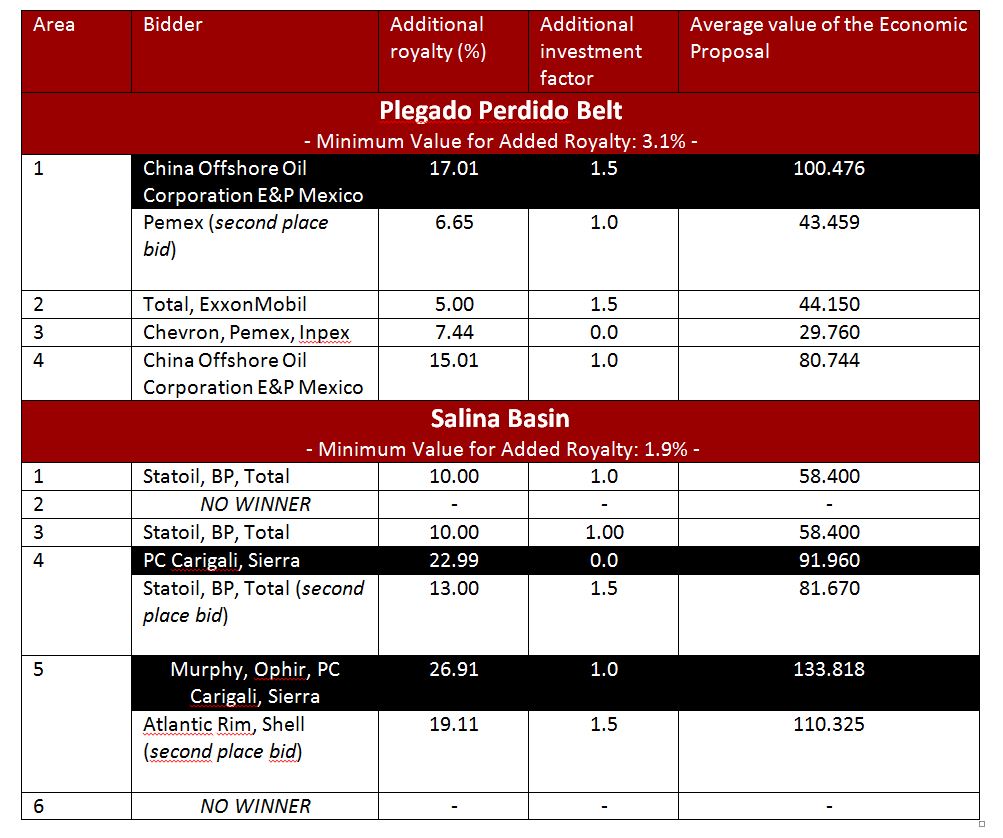

The following chart, provided by Haynes and Boone, details the bidding results and the winning bids by block.

Mexican officials said the eight blocks when added to Trion should lgenerate production of 900 MMBOEPD, the Wall Street Journal reported.

Mexico produced an average of 2.4 MMBOPD during 2014, according to the EIA. Mexico’s total oil production has been declining rapidly. Crude oil production in 2014 was at its lowest level since 1986 and it was down 27% from its peak in 2004.

History of Mexico’s oil sector reforms

The government of Mexico nationalized its oil sector in 1938 and created Pemex to be the state-owned oil company and sole operator in Mexico. Pemex is the largest company in Mexico, according to the EIA report. In December 2013, the Mexican government enacted constitutional reforms ending the Pemex monopoly on the oil and natural gas sector and opening the industry to greater foreign investment. The reforms allow for new exploration and production contract models: licenses, production-sharing, profit-sharing, and service contracts. After a short learning curve, Mexico has achieved a successful round of oil and gas leasing in conjunction with outside companies.

Mexico had to amend its constitution to set the stage for the 2013 reforms. The EIA’s summary of the reforms in Mexico include:

- Create four oil and gas exploration and production contract models, including service contracts, production-sharing, profit-sharing, and licenses.

- Give Pemex first refusal on developing Mexican resources before private companies begin bidding rounds (round zero), in which Pemex can provide financial and technical plans to develop the resources within three years.

- Give regulatory authority over the oil and gas sectors to the Energy Regulatory Commission, the Secretary of Energy, and the National Hydrocarbon Commission, and create the new National Agency of Industrial Safety and Environmental Protection.

- Keep Pemex as state-owned but with more administrative and budgetary autonomy, and allow the company to compete for bids with other firms on new projects.

- Establish the Mexican Petroleum Fund to manage contract payments and oil revenue.

More rounds to come: Mexico’s Sec. of Energy

“Before the president’s term is over, we will have an additional three tenders: one in autumn 2017, another in winter 2018; and a final one before the presidential term ends, which is also in the winter of 2018. For this, we are considering new deepwater block and some shallow water blocks and some land blocks,” Mexican Secretary of Energy Pedro Joaquín Coldwell said.