Mexico’s midstream operator CENAGAS looking to invest more than $7.5 billion by 2020

Mexico’s deregulation of its oil and gas sector has many excited about the possibilities of new business coming down the pipes.

A great deal of attention has been paid to exploration opportunities in the country, and Tuesday speakers from Mexico’s midstream operator CENAGAS and mid- and downstream regulator CRE gave their outlook for transportation in the country moving through the end of the decade.

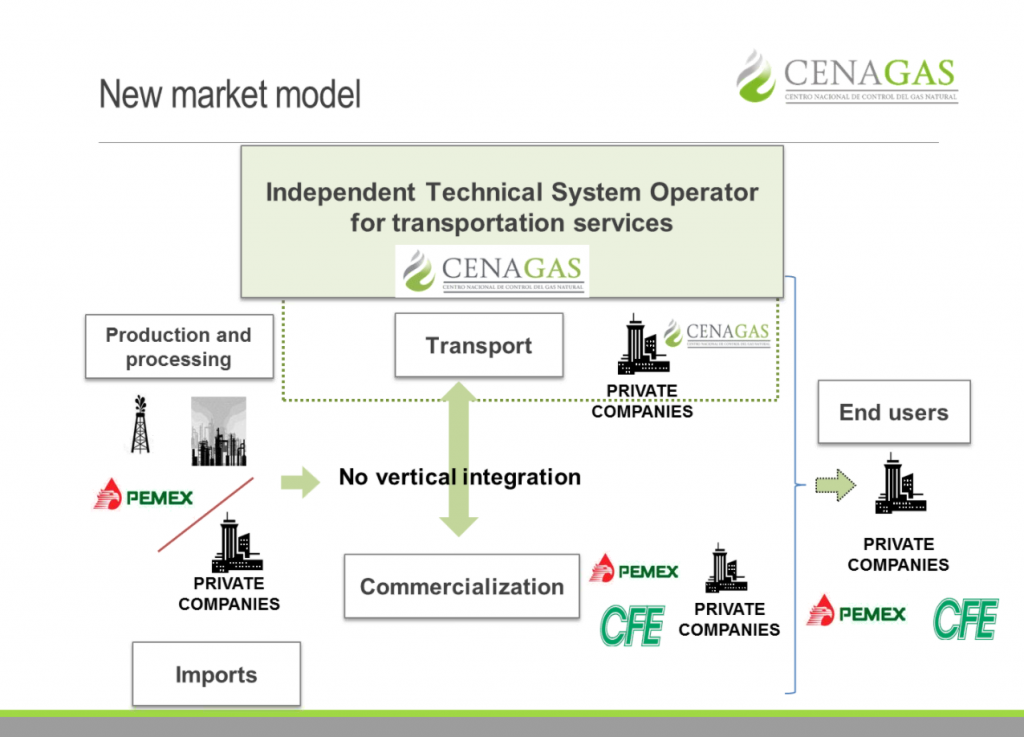

Starting off a Natural Gas Intelligence webcast covering Mexico’s natural gas market, CENAGAS Director General David Madero said his agency has two goals: gas security and efficiency. CENAGAS is taking over the transportation and technical operatorship of PEMEX’s midstream assets as the country begins to liberalize its oil and gas industry.

Between now and 2020, CENAGAS expects to invest more than $7.5 billion on strategic projects which will include rehabilitation and maintenance of the national pipeline infrastructure and modernization of the control, supervision and monitoring systems used by CENAGAS.

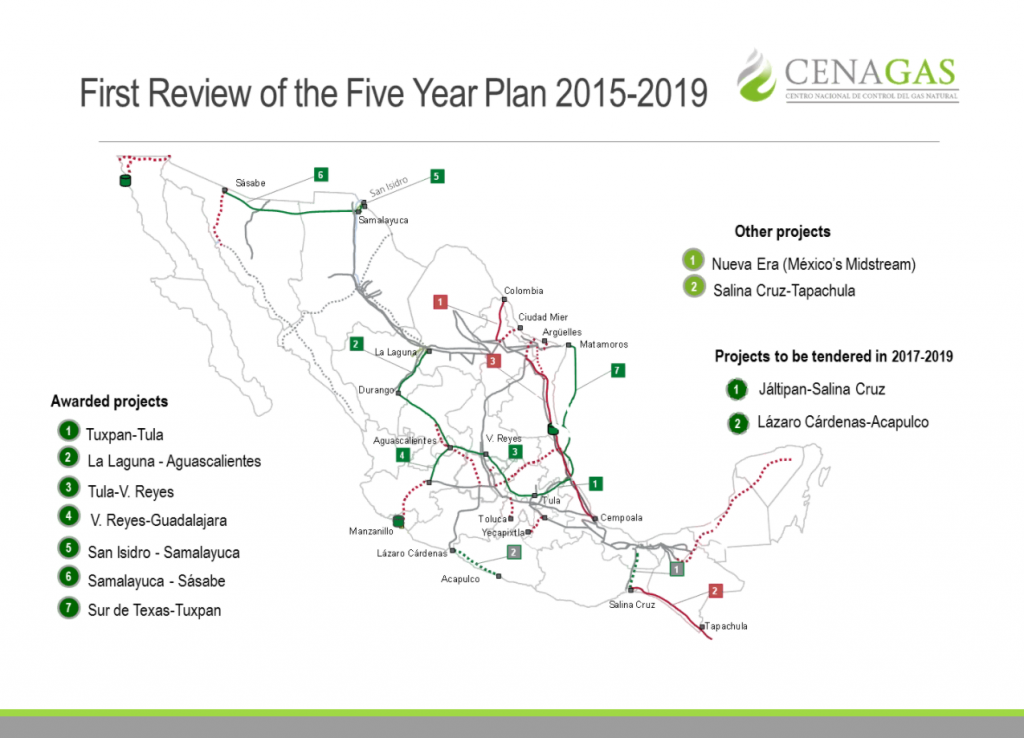

Madero also laid out Mexico’s five-year plan for pipeline expansions, which included a number of projects which have already been tendered, and two more that CENAGAS plans to tender between 2017 and 2019.

CRE plans to make the natural gas market more transparent

Following Madero during the webcast, CRE’s Head of Regulatory Unit Meney De La Peza said that Mexico’s midstream regulator had five goals for the energy reform:

- Enhance natural gas availability throughout the country

- Separate pipeline transportation from natural gas commercialization

- Establish open access and pipeline capacity reserve conditions

- Issue asymmetric regulation for participants with high market concentration (this is targeted primarily at PEMEX)

- Publish volumes, prices, discounts, locations and trade information for retailing and commercialization of natural gas

So far, the midstream regulation has included determining the capacity that PEMEX and other state producers need on pipeline to maintain “transformation and generation activities” as well as approve an open season proposal from CENAGAS. Moving forward, CRE will continue to regulate mid- and downstream activities, and hopes to start a system next year that will list the average gas price from each of Mexico’s 14 regions, making trading more transparent, De La Peza said.

Understanding the local situation is key to mitigating risk

The final participant on today’s webcast, Control Risks’ Mexico Senior Partner Nick Panes, added a risk management perspective to future oil and gas operations in the country. While Mexico certainly has unique challenges, Panes stressed it was important to have them in the correct perspective. Corruption, he said, is certainly a problem, but one that is being blown out of proportion to some extent. The real issue facing companies looking to enter Mexico will be social risks, he said.

“Issues over land acquisitions, leases, rights of way, and protests by communities and environmental groups are credible threats for infrastructure projects,” said Panes. “This can be mitigated successfully through active engagement with relevant communities and stakeholders.”

Engaging local parties has been a major focus for companies looking to join Mexico’s E&P sector as well. Companies like International Frontier Resources (ticker: IFR) have decided to partner with local companies like Grupo Idesa to help successfully enter the country.

“Grupo Idesa has facilities, ports, trucks, infrastructure, and they have people that understand the unions, the community and local issues,” IFR President Steve Hanson told Oil & Gas 360®. “If you go down there and you’re perceived as a foreign company trying to take advantage of the situation, you’re going to run into trouble.”