Merger would create $1 billion Mid-Con company

Midstates Petroleum (ticker: MPO) proposed a merger with SandRidge Energy (ticker: SD), only a few weeks after the SandRidge-Bonanza Creek (ticker: BCEI) merger was scrapped.

This potential merger would see SandRidge holders receive 1.068 shares of Midstates Petroleum per SandRidge share, based on yesterday’s closing prices. This would mean the transaction does not give SandRidge any premium, but simply exchanges shares at market value.

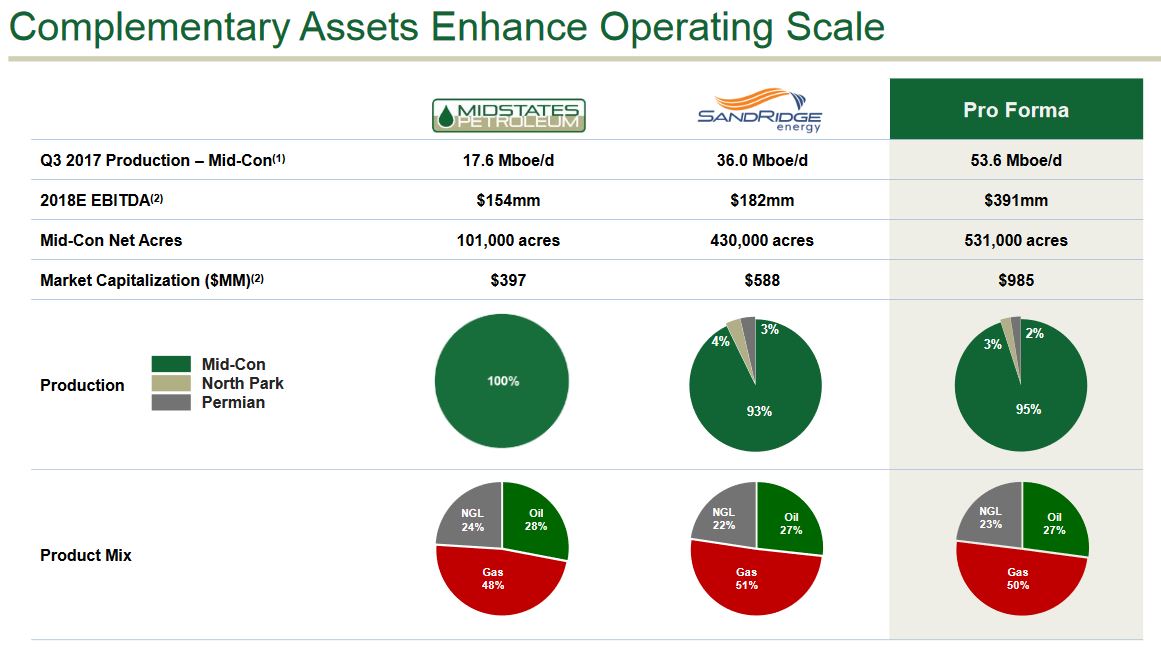

If the merger is completed, Midstates holders would retain a 40% stake in the company, while SandRidge owners would hold 60%. Midstates’ CEO David Sambrooks would lead the combined company, and remaining positions would be filled on a “best of the best” basis. The combined company would have a market cap of $1 billion, based on the current valuations of each individual company. Midstates estimates that the merger could close in late Q2.

Currently only a proposal, has not been approved by SandRidge board

Unlike many merger announcements, this combination has not been approved by the boards of both companies, but is instead a proposal by Midstates. While the Bonanza Creek-SandRidge merger was cancelled after objections from major shareholders, this combination may have better prospects.

The two companies have much more complimentary assets, making projections of synergies more plausible. Both companies have extensive positions in the Mid-Continent, with holdings in the Mississippi Lime and northwest STACK. The pro forma company would hold 456,000 net Miss Lime acres and 75,000 NW STACK acres. Midstates holds only Mid-Con assets, while Bonanza Creek is primarily a DJ basin-focused company. Midstates estimates that the merger would lead to $70 million in synergies, with further possible upside from applying improved completions designs across the combined acreage holdings.

Major shareholder overlap and approval

More importantly, though, this combination has the support of major shareholders. The opposition of Carl Icahn and other large SandRidge shareholders doomed the SandRidge-Bonanza Creek merger, so such support is very significant. There is actually 40% overlap in shareholders of Midstates and SandRidge, meaning key shareholder support can go a long way. Fir Tree and Avenue Capital hold a combined 40% of Midstates, and support the merger. Fir Tree is also a major shareholder of SandRidge, and was one of the groups that opposed the previous merger.

According to Reuters, the overlap in large shareholders may mean Midstates’ management will dominate the new company. Midstates’ CEO will be in charge, which may please Icahn and Fir Tree.