The Permian ranks among the top-20 oil producing countries on a stand-alone basis

The Permian Basin continues to deliver amid declining activity, with production levels expected to rise past 2,000 MBOPD in the Energy Information Administration’s (EIA) September issue of the Drilling Productivity Report.

The Permian has, for the most part, been the only major oil and gas play to consistently increase production levels on a month over month basis in the EIA’s report. Its projected oil volumes of 2,019 MBOPD in October 2015 are a year-over-year increase of 16%, even though its rig count has dropped by more than 50% in the same time frame. Overall, the EIA projects Permian volumes to rise by 23 MBOPD on a month-over-month basis in October, while collective volumes from the Bakken, Eagle Ford and Niobrara are expected to decline by 102 MBOPD.

By next month, the Permian is forecasted to account for nearly 39% of oil production from the seven major plays in the United States. Its projected output for October 2015 would place 15th globally in comparison to 2014 production numbers, outpacing countries like Norway, Angola and Algeria.

The Industry Buzz Word: Efficiency

As producers have rebalanced their drilling programs and adjusted rates of return, the Permian continues to stand out as one of the highest return plays in the world. Energen Corporation (ticker: EGN) increased its Lower Spraberry type curves by 15% in a May operations update and believes 55% returns are possible at $55/barrel in its best areas. Pioneer Natural Resources (ticker: PXD) offered similar sentiments, saying its Spraberry/Wolfcamp wells could return anywhere from 45% to 60% at the same oil prices.

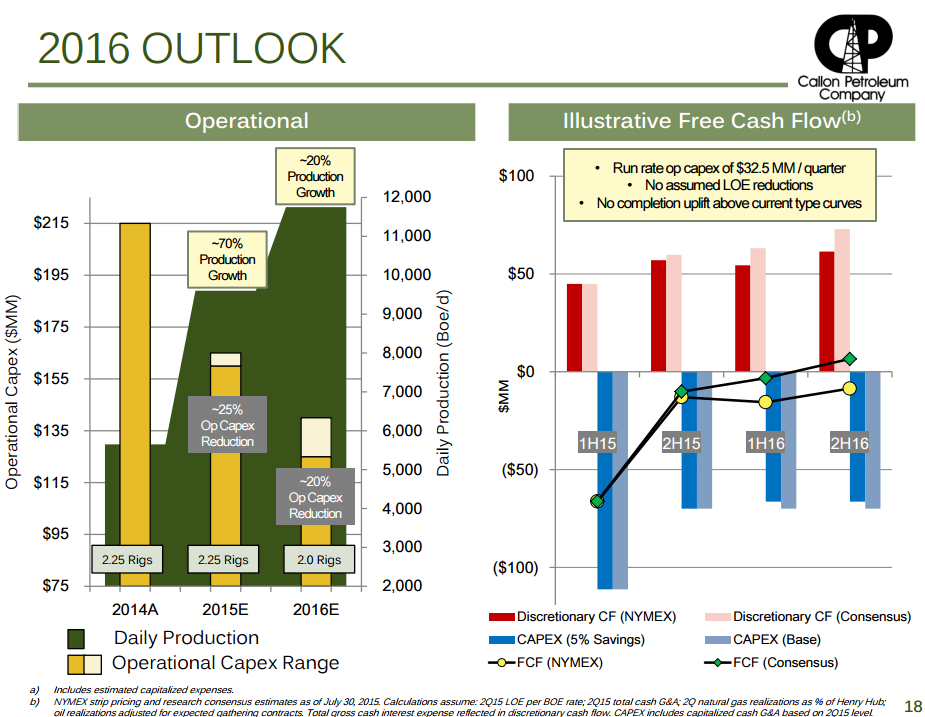

WPX Energy (ticker: WPX) thought so highly of the Permian it shelled out $2.75 billion to acquire a private company in July, adding 92,000 net acres with 12 stacked reservoirs to its portfolio. Callon Petroleum (ticker: CPE), albeit a smaller company, is also realizing the benefits of the Permian. The small-cap E&P expects volumes to climb by 70% in 2015 while reducing its capital expenditures by 25%. Further year-over-year advancements are projected in 2016, with volumes to jump another 20% while requiring 20% less expenditures.