E&P companies are turning to self-sourcing sand to keep costs down

The world of driving down well costs never sleeps. Oil and gas companies are increasingly looking to “do it themselves” instead of paying out cash for services needed to complete wells.

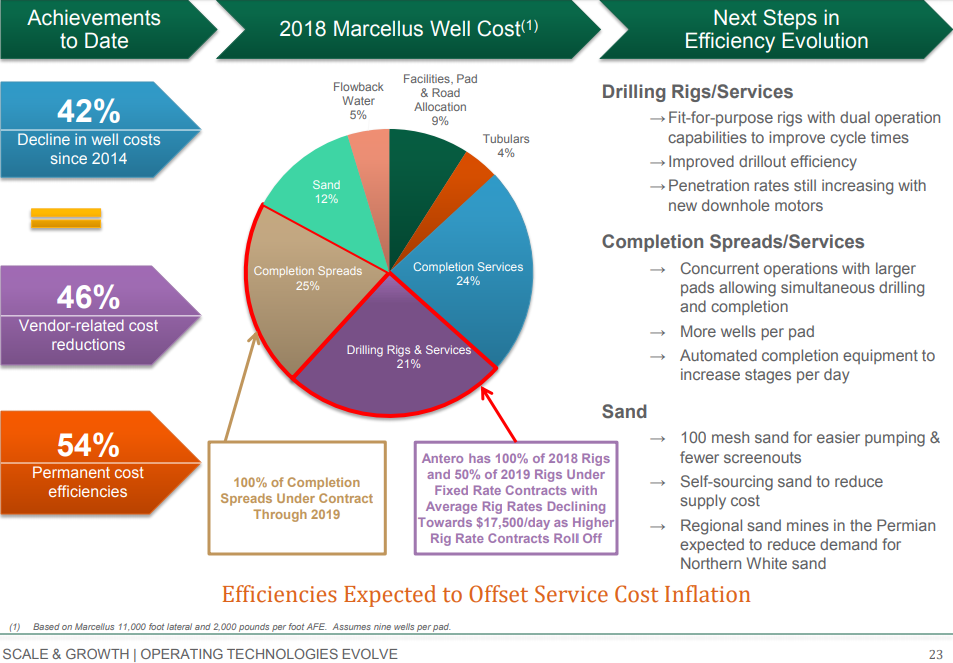

Proppant is one of the most important components of a modern completions job, and its price reflects this. In the Marcellus sand alone accounts for 12% of the cost of an average well. If a company can adjust how it acquires sand, it can address a major driver of well costs.

This has become much more important over the past year, as the shale business surged back into high gear.

Sand prices soared with the rapid rise of the Permian, as mines found it difficult to keep up with demand.

50 million pounds of sand in one well, entire unit trains of sand head south

During the past two or three years, horizontal wells have gotten much longer, jammed with many more frac stages. Sand volumes per well have grown beyond what anyone thought would fit downhole just a few years back.

In 2016, Chesapeake Energy said one of its monster fracs had set a record. Chesapeake called it “Prop-A-Geddon” after the company had pumped 50,185,300 pounds of sand down into a well during the completion, more than 3,000 pounds per foot.

Also in 2016, Halliburton, U.S. Silica and Burlington Northern set a record for the largest amount of sand moved from the mine to the oilfield in a unit train. The unit train, which originated at U.S. Silica’s largest plant in Ottawa, Ill., took five days to build and was loaded with 30/50 and 40/70 U.S. Silica White® frac sand. It was received at the Halliburton Elmendorf South Texas Sand Plant, which can handle two 115 car unit trains simultaneously and can hold 40,000 tons in its eight silos.

Three E&Ps, three of their own sand sources

Antero Resource (ticker: AR) announced it will be getting into the sand business today at the Howard Weil Energy Conference. The company reported that sand is the only major oilfield product that has seen a major price increase. In response, Antero is looking into ways to self-source the proppant, which should reduce the supply cost. Antero is also planning on using 100 mesh sand, which should allow easier pumping and fewer screenouts.

Antero is not the only major E&P to look to self-sourcing sand to lower costs.

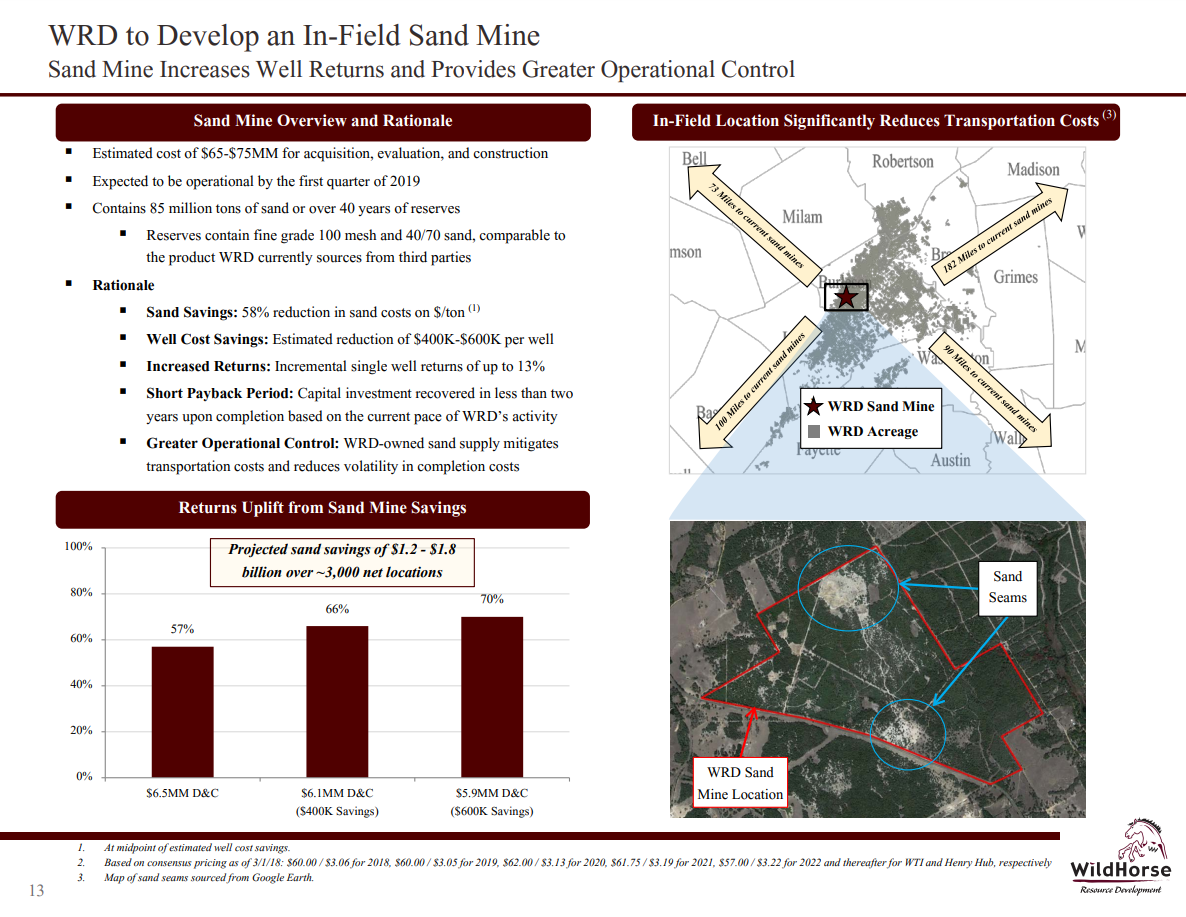

WildHorse Resources (ticker: WRD) announced it will develop an in-field sand mine in its Q4 conference call this month. The company will mine sand from a location in the middle of its acreage, instead of getting sand shipped from mines dozens of miles away. The company estimates this will result in a 58% drop in sand costs, saving about $500,000 per well.

Pioneer Natural Resources (ticker: PXD) has pursued self-sourcing sand for years, and acquired Carmeuse Industrial Sands in 2012. The company reports its vertical integration efforts have provided lower-cost sand for its operations in the Permian, which will be important as Pioneer recently announced its plans to divest all non-Permian assets.

Self-sourcing can make a big difference in the long run

While self-sourcing sand may seem like a minor operational effort, the effects can have a significant impact if they are used throughout the development of an asset. WildHorse, for example estimates that using its new sand mine in all its drilling locations would produce savings of $1.5 billion.

Even if companies do not choose to self-source sand, they are likely to see sand costs fall in coming years. Proppant companies like Hi-Crush Partners are opening sand mines in or near the Permian, which will relieve the current pressure on the sand market. Even companies like Antero, which will almost certainly never buy sand from Permian mines, will see sand costs drop as the competition for Northern White sand from Wisconsin will decrease.