Enbridge, Williams and Cheniere all simplifying structure

The wave of consolidation in pipeline companies continues, with three companies announcing transactions worth a combined $20 billion.

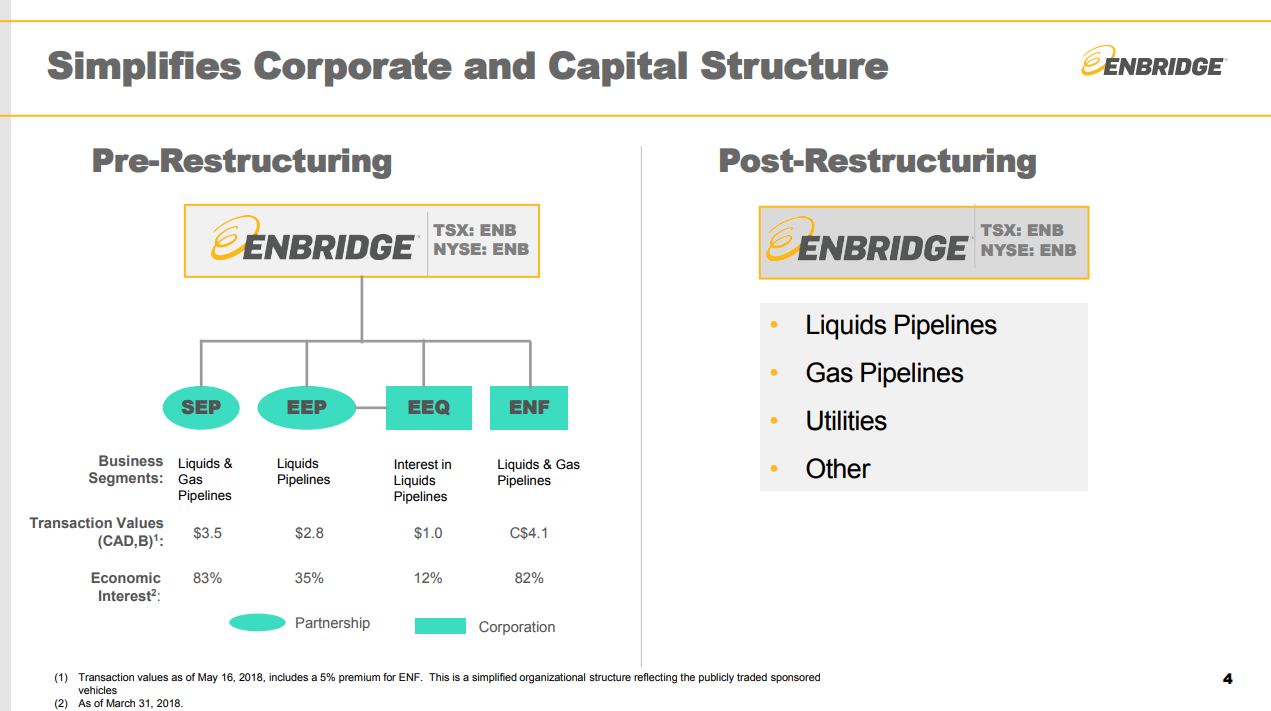

Like many other pipeline firms, Enbridge (ticker: ENB) has a complex corporate structure, with several large subsidiary companies. The company holds at least partial ownership of Spectra Energy Partners (ticker: SEP), Enbridge Energy Partners (ticker: EEP), Enbridge Energy Management (ticker: EEQ) and Enbridge Income Fund Holdings (ticker: ENF). Enbridge intends to simplify this tangle of ownership, acquiring each of these subsidiaries in four separate transactions.

Each of these acquisitions will be all-stock, with SEP, EEP and EEQ acquired at yesterday’s closing price, while ENF will receive a 5% premium to yesterday’s closing price. In total, these will require 272 million shares of Enbridge, or $9 billion in equity.

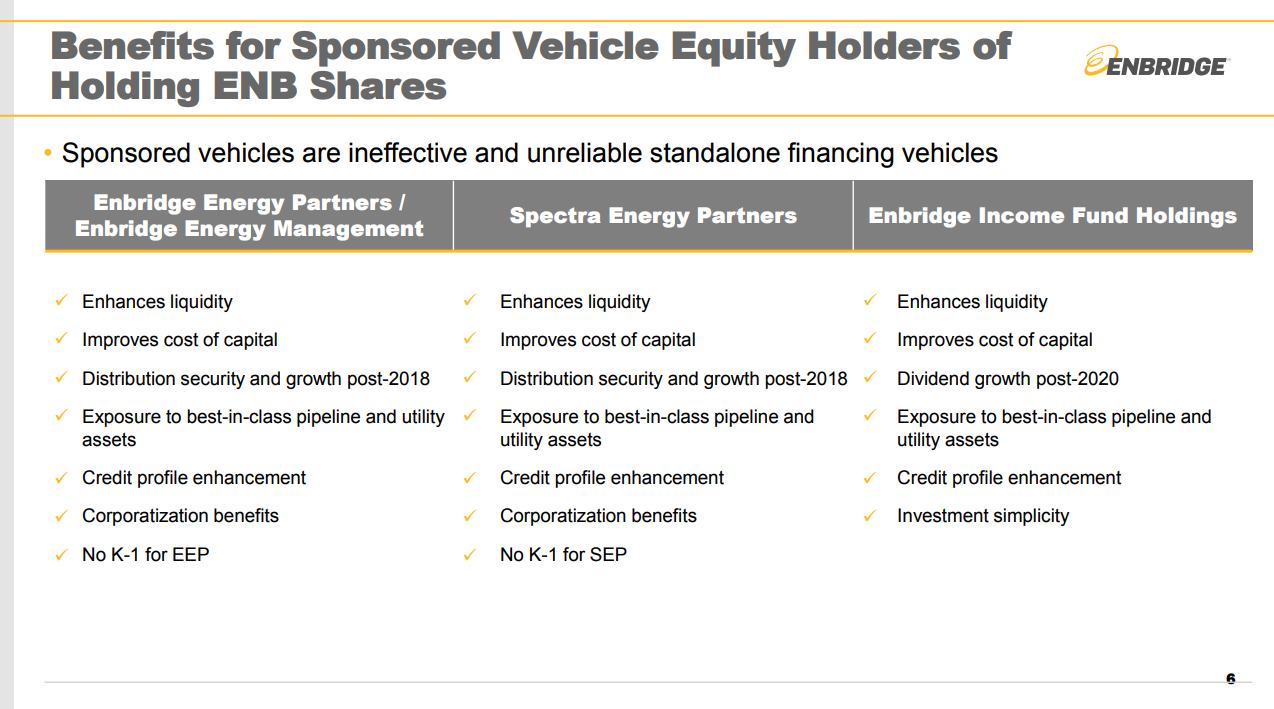

Enbridge reports these subsidiaries are no longer viable as sources of capital due to several factors. The FERC income tax policy change in March, which effectively decreased the rates many MLPs were allowed to charge, makes the partnership structure of SEP and EEP less attractive. The recent tax legislation compounded this problem, lowering the corporate tax rate and making C-corps more attractive. The market has soured on MLPs and pushed for a wave of consolidation among the industry.

The FERC ruling would require EEP and SEP to cease distribution growth, with serious effects as early as 2019, by Enbridge’s estimate. Enbridge also judges ENF to have an uncompetitive cost of capital, which would inhibit any future dividend growth.

Enbridge observed the market’s response to other companies’ efforts to mitigate these problems with the MLP structure, and chose to streamline its structure. The company believes consolidation would increase its transparency and ease of investment, with minimal impact on long-term guidance. Eliminating distributions by the subsidiary companies would also improve Enbridge’s credit profile.

Williams transaction valued at $10.5 billion

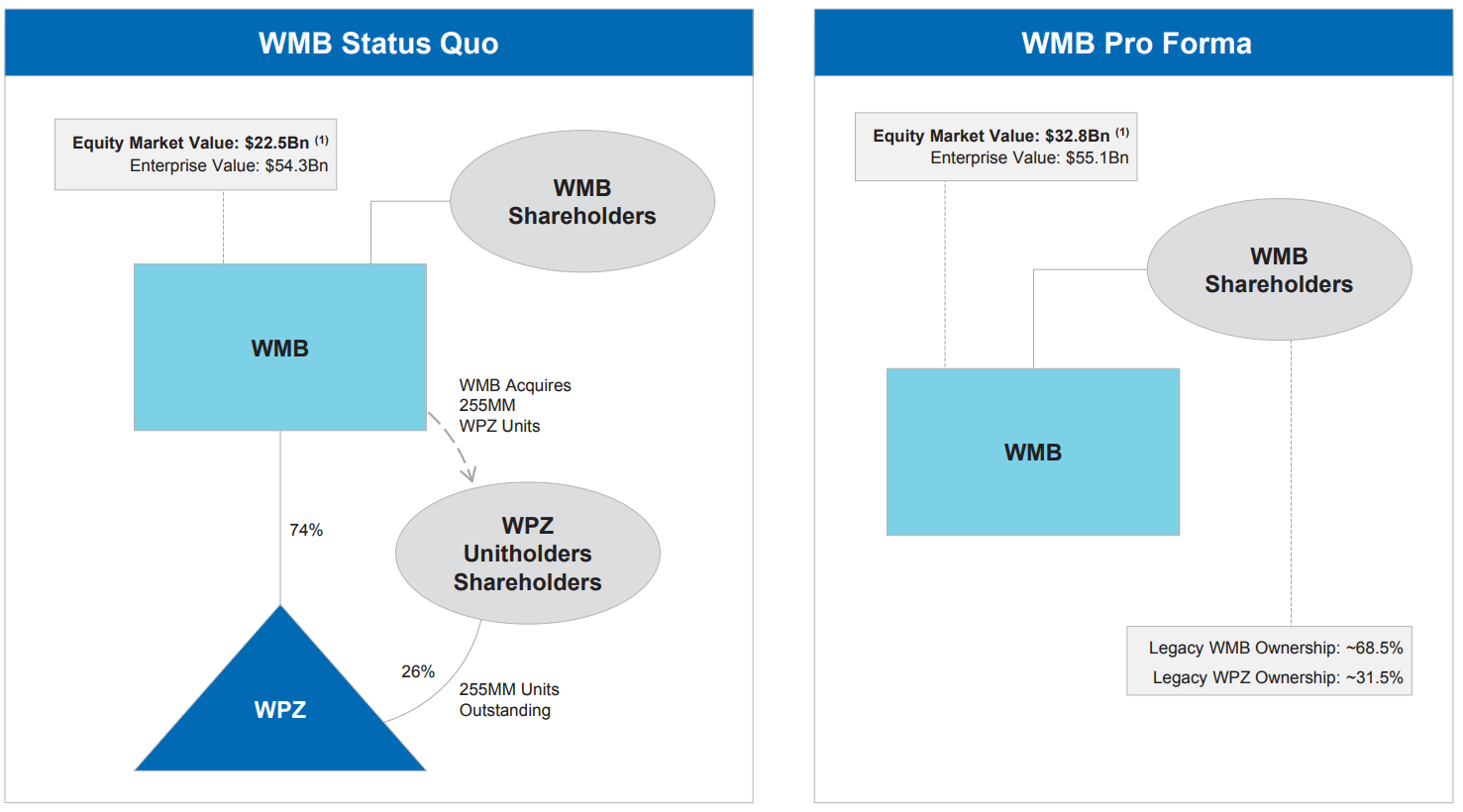

While Enbridge announced the most complex consolidation transaction today, the largest was announced by Williams (WMB).

Williams will acquire all public equity of its subsidiary Williams Partners (ticker: WPZ) in an all-stock transaction valued at $10.5 billion, a premium of 6.4% to yesterday’s closing prices. Williams and WPZ indicated the potential for a consolidation in the immediate aftermath of FERC’s March ruling, and determined that a combination would be the ideal path forward.

Williams expects to see benefits from significant retention of distributable cash flow, along with modest G&A savings. WPZ will, like all of the other MLPs that have become C-corps, will increase its access to capital markets.

Williams President and CEO Alan Armstrong commented “Today’s announcement will maintain the income tax allowance that is included in our regulated pipeline’s cost-of-service rates. This transaction also simplifies our corporate structure, streamlines governance and maintains investment-grade credit ratings. The transaction will allow Williams to directly invest the excess coverage in our expanding portfolio of large-scale, fully-contracted infrastructure projects that will drive significant EBITDA growth without the need to issue equity for the broad base of projects currently included in our guidance.”

Cheniere not eliminating its MLP yet, but simplifying structure

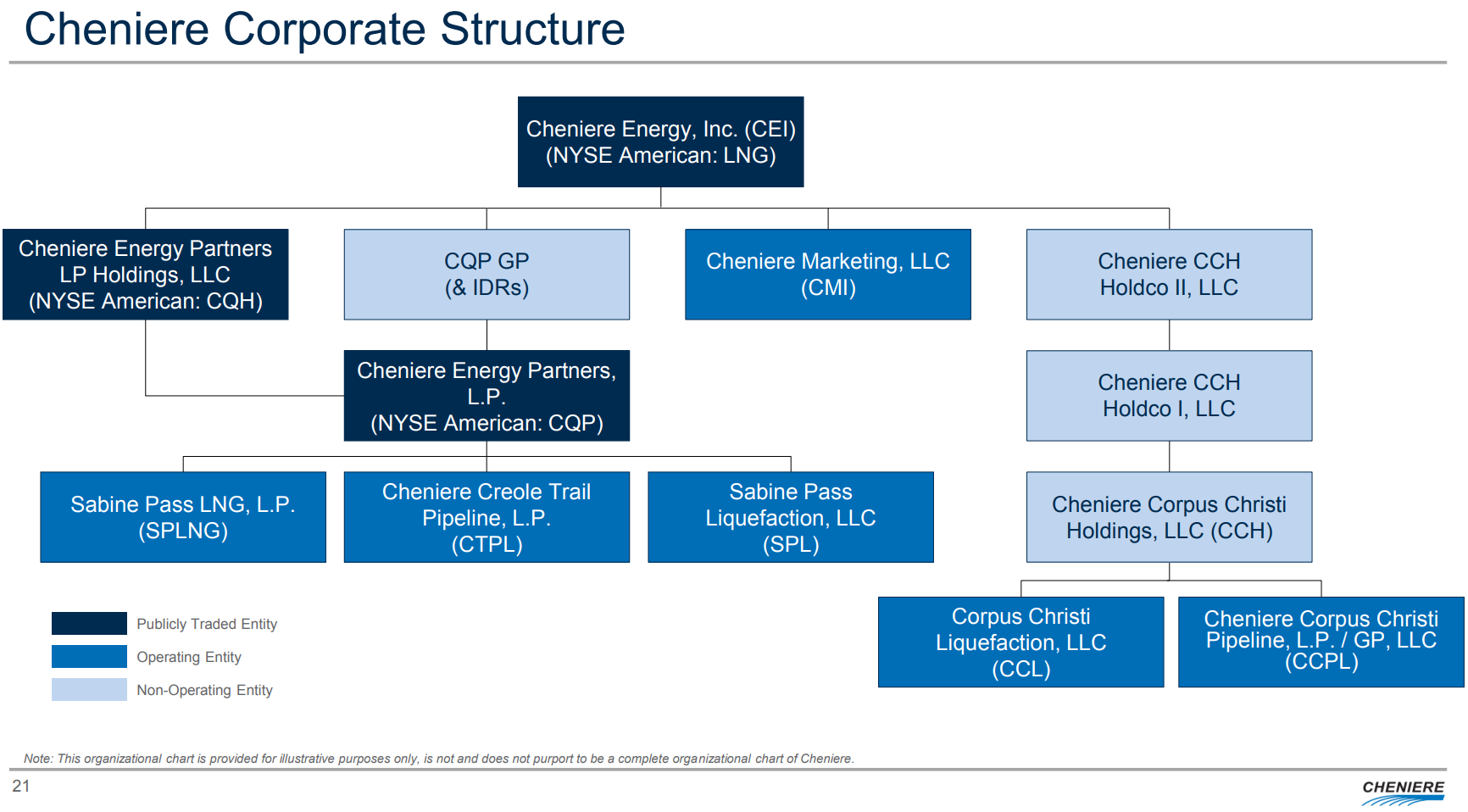

Finally, a merger was announced by a less likely company, one that is not focused on pipelines, Cheniere Energy (ticker: LNG). Cheniere announced an offer to acquire all the publicly held shares of Cheniere Partners Holdings (ticker: CQH) in an all-stock transaction. Cheniere is proposing 0.45 Cheniere shares for each share of CQH, which would value the transaction at $529 million, based on yesterday’s closing price.

Cheniere has a very complex corporate structure, and this transaction is less comprehensive than that of Enbridge or Williams, but it will simplify the landscape. This transaction is somewhat different from those of Enbridge and Williams, as CQH is not an MLP but instead holds a significant stake in Cheniere Energy Partners (ticker: CQP), which is a publicly traded MLP. The transaction would make a future consolidation simpler, however, as Cheniere would not need to simultaneously acquire CQH and CQP if it wished to eliminate the MLP company.

Further moves likely

Several master limited partnerships have already moved away from the structure in 2018, with Tallgrass Energy (ticker: TGEP) acquiring Tallgrass Energy Partners (ticker: TEP) and Viper Energy (ticker: VNOM) transitioning to a C-corp in March.

Further action is likely, as several companies have expressed pessimism regarding the viability of MLP vehicles.

Energy Transfer Equity (ticker: ETE) discussed the possibility in its most recent earnings call, while TransCanada’s (ticker: TRP) TC Pipelines (ticker: TCP) announced the FERC ruling may reduce yearly cash flow by $100 million, and TransCanada does not consider it a viable financing alternative.