GeoPark and Gran Tierra both add Ecuador to Latin American portfolios

Two North American oil and gas producers have added Ecuador to their Latin American portfolios, winning acreage blocks that are prospective for hydrocarbon production. GeoPark Limited (stock ticker: GPRK, $GPRK), an independent Latin American oil and gas explorer, operator and consolidator with operations in Colombia, Peru, Argentina, Brazil and Chile, has now added Ecuador to its key target list through the acquisition of the Espejo and Perico blocks. GeoPark said the Espejo and Perico blocks are low-risk exploration blocks located in Sucumbíos Province in the north-eastern part of Ecuador, in the Oriente basin.

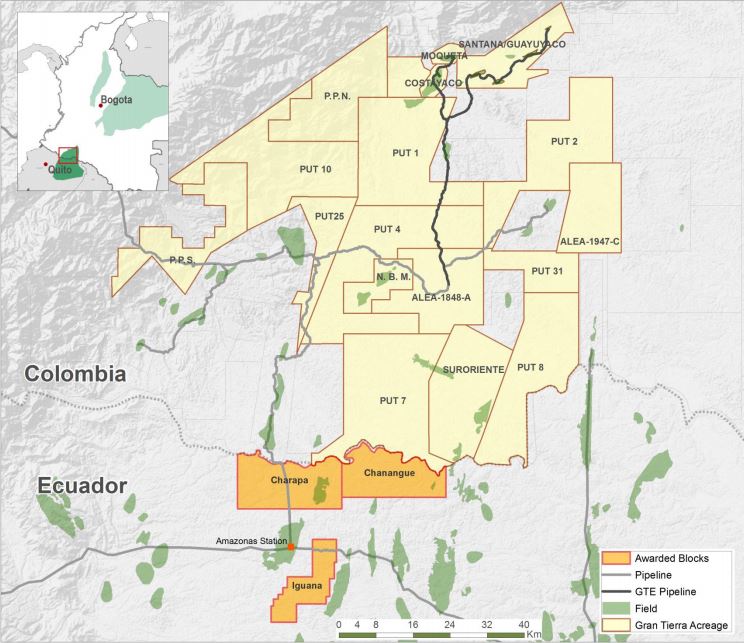

Meanwhile, Canadian producer Gran Tierra Energy Inc. (stock ticker: GTE, $GTE) also announced that it made a new-country entry into Ecuador through the submission of winning bids for a total of three blocks, which were offered by the Ministerio de Energia y Recursos Naturales No Renovables (“MERNR”) in Ronda Intracampos. The three blocks are located in the Oriente Basin and are approximately 140,000 acres in total area, creating a contiguous acreage position extending from Gran Tierra’s existing assets in the Putumayo Basin in Colombia, the company said in a statement. Final award of these blocks is contingent upon regulatory approvals and the execution of the Participation Contracts.

Gran Tierra listed key highlights of landing the winning bid.

Key Highlights

- Makes Gran Tierra a top landholder in the play trend which extends from the Putumayo Basin in Colombia through to the Oriente Basin in Ecuador; the Putumayo and Oriente Basins are the same geological basin, with different names due to the international border between Colombia and Ecuador

- Further strengthens and consolidates Gran Tierra’s position in conventional oil resource fairway; Ecuador’s Napo Formation is equivalent to the Villeta Formation in the Putumayo Basin and has the same multi-zone potential in carbonate and sandstone reservoirs

- Gran Tierra has secured 100% working interest (“WI”) and operatorship in the Charapa Block, Chanangue Block and Iguana Block (collectively, the “Blocks”), which increases Gran Tierra’s gross acreage position in the conventional resource plays in Ecuador and Colombia from 1.2 million to over 1.3 million gross acres.

- Gran Tierra’s winning bids consisted of a work program bid by block, including the drilling of a total of 14 exploration wells over four years across the Blocks, and the Company’s share of revenues which is tied to the Oriente Blend Oil Price and to production volumes; the Contracts are a sliding scale, with the Company take ranging from 87.5% at US$30 per barrel to 40% at US$120 per barrel; there is no consideration payable upon the signing of the Contracts and cash outlays begin with the commencement of the work program

- Gran Tierra expects to commence its Ecuador exploration drilling program in 2020 with no anticipated changes to the previously issued 2019 guidance; this new exploration program is expected to be fully funded through forecasted net cash provided by operating activities

- Through the preliminary award of the Charapa Block, Gran Tierra establishes a proven position in the B-Limestone play trend; the Charapa field has had historic oil production from the B-Limestone over a 17-year period

- Contiguous acreage extending from Colombia’s Putumayo Basin into Ecuador’s Oriente Basin provides Gran Tierra with the ability to potentially construct strategic gathering infrastructure on 100%-operated acreage, which would allow the Company to potentially utilize the existing infrastructure in Ecuador

Gary Guidry, President and Chief Executive Officer of Gran Tierra, said, “We are excited about our new-country entry into Ecuador, an achievement which aligns with Gran Tierra’s strategy – focusing on proven conventional hydrocarbon basins, with access to established infrastructure, in a strong stable economic environment, combined with a highly competitive fiscal regime. The blocks would extend our dominant position in Colombia’s Putumayo Basin into Ecuador’s Oriente Basin, with assets that are highly complementary to our existing land base. Ecuador represents a unique opportunity in terms of scale for Gran Tierra. With our winning bids for the Blocks, we believe we are acquiring significant future potential exploration upside which could enhance our long-term growth strategy and be an excellent fit.”

GeoPark operations map in Latin America. The Ecuador acquisition would be south of Colombia when added to the map.

GeoPark said the Espejo block covers an area of 15,650 acres (63 sq km) and the Perico block covers an area of 17,700 acres (72 sq km). Both blocks are covered with 3D seismic and are adjacent to multiple discoveries, producing fields and existing infrastructure, the company said. From existing 3D seismic and other relevant data, more than five multilayer, ready-to-drill light oil prospects and leads have been identified. Ongoing geoscience evaluation and field operations are expected to start in late 2019 or early 2020. The Oriente basin is currently producing more than 500,000 BOPD, according to the company. It has access to infrastructure, with spare capacity, and a well-developed service industry.

Jim Park, GeoPark CEO, gave the company presentation for GeoPark at EnerCom Dallas 2019. Click the picture to view the archived webcast of the presentation from Feb. 27, 2019.

The blocks were awarded to the GeoPark and Frontera consortium (50% GeoPark, 50% Frontera) in the form of production sharing contracts in the Intracampos Bid Round carried out on March 12, 2019 in Quito, Ecuador. The winning bid consisted of committing a minimum investment program of carrying out 55 sq km of 3D seismic in the Espejo block and drilling four exploration wells in each block, with a total estimated investment commitment of $60 million ($30 million net to GeoPark) over the next four years. GeoPark and Frontera will have a 70-78% contractor share at approximately $60-70 Brent. The final award is contingent upon regulatory approvals and the execution of the contracts, expected for 2Q2019.

James F. Park, CEO of GeoPark, said: “Congratulations to the GeoPark team for again patiently, selectively, and successfully expanding our unique Latin America asset base with the acquisition of these new low-cost, low-risk, high potential blocks attractively positioned in the neighborhood of some prolific oil fields. Our entry into Ecuador gives GeoPark an exciting new platform in the country with the third largest reserves in Latin America and further advances one of our key long-term growth strategies tying together the common petroleum system of southern Colombia, Ecuador and northern Peru.”