April 2015 marks the first time ever that natural gas generated more electricity than coal

The Energy Information Administration’s (EIA) Electric Power Monthly for April 2015, showed natural gas overtaking coal as the primary source of electrical power generation in the United States. April marks the first time ever that natural gas has powered more electrical generation than coal.

According to the EIA, in April, natural gas created 92,516 megawatt hours (Mwh) of electrical power, while coal was responsible for 88,835 Mwh of electricity. Just a month prior, coal generated 9,753 Mwh more than coal, with 108,642 Mwh of power generation, while natural gas was used to create 98,889 Mwh of electricity.

Natural gas has been steadily gaining a larger share of power generation, making up 31% of total generation in April 2015, up from 22% in April 2010. Electrical generation from coal has steadily declined over the same period, falling to 30% from 44% in the same time frame.

Regulations making coal a less attractive source of electricity

Low natural gas prices in conjunction with increasingly stringent emissions regulations are making coal less and less favorable as a source of power generation. The Environmental Protection Agency’s (EPA) Clean Power Plan aims to reduce greenhouse gas emissions by 30% by 2030, and with coal being responsible for 75% of U.S. carbon emissions, it has become the primary target of emission-related regulations.

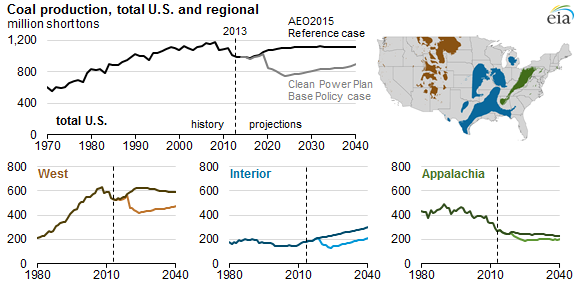

The EIA estimates that the Clean Power Plan could reduce the amount of coal produced in parts of the U.S. by up to 45% by 2024. After 2024, the administrations expects coal production to increase to meet greater electrical demand, but total production levels would still be significantly lower than in the EIA’s reference case, which does not include the EPA regulations.

Fewer plants, fewer rail cars

As natural gas continues to make up a larger part of the power generation picture, coal is being retired at an incredible pace. Alliant Energy (ticker: LNT) recently announced that it will phase out six of its Iowa coal plants, marking the 200th coal plant in the U.S. to close in the last five years. With 523 coal-fired plants in operation in 2010, LNT’s decision means that 38% of the coal plants active in the U.S. five years ago are no longer in operation.

Planned gas expansions could also put more pressure on railroads, both in terms of pricing of the coal business and coal’s part in the overall mix of rail shipments, according to Macquarie Research. The research note marks 2017 as the watershed year for railroads in terms of pricing. “Though we forecast less of a drag for export coal, the continued deterioration in mix leads us to estimate flattish pricing ex fuel for 2H15 and about 0.5% growth in 2016 … We still assume a coal bottom in 2016, but given the highlighted gas capacity additions, our outlook may prove optimistic.”

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.