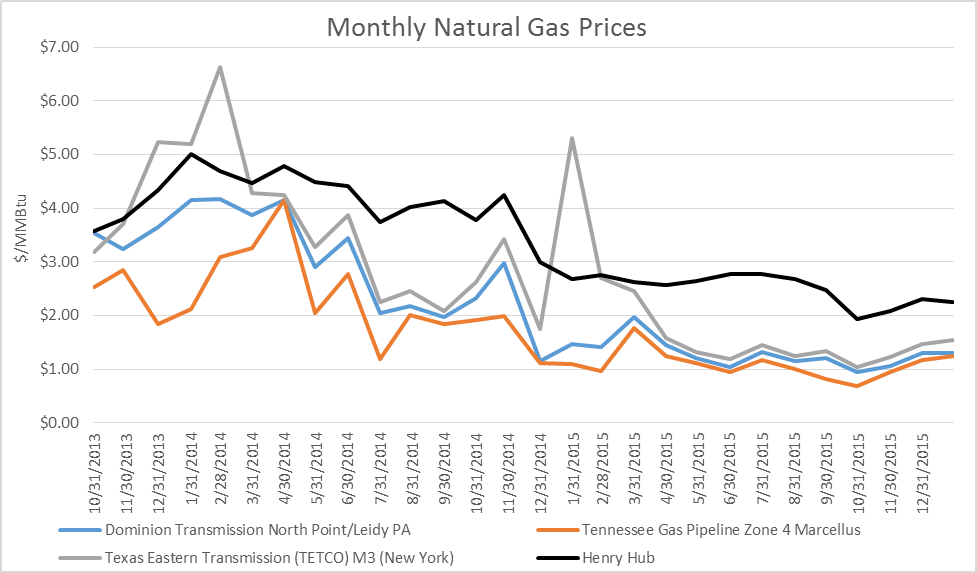

Discount to Henry Hub has Narrowed

The spread between natural gas prices at Henry Hub and pricing in the hubs around the Marcellus has been indicative of the supply glut and the status of infrastructure in the area. Henry Hub in Louisiana acts as the main trading point for natural gas in the U.S., but natural gas from the Utica shale plays in Pennsylvania, West Virginia, and Ohio consistently trade lower than the national benchmark.

Natural gas produced from the Marcellus and Utica is often transported to other areas of the country for consumption. With limited infrastructure to carry out transportation mandates, natural gas supply can quickly build. This can cause prices within the Marcellus region to be discounted. Conversely, the price of natural gas in the North East can increase with an upswing in demand that outpaces the capabilities of the supply routes. During a cold winter when demand for heating in cities like New York and Boston rises, natural gas spot prices can spike dramatically. Currently, there is sufficient natural gas supply in storage to meet these needs. But that supply has not always been as robust.

Source: Bloomberg, compiled by EnerCom Analytics

While the price of natural gas in the North East is still trading well below Henry Hub price, the gap has narrowed in recent months. The price at Dominion Transmissions North Point/Leidy Hub in Pennsylvania was $1.83/MMBtu below the Henry Hub price at December 31, 2014. As of January 29, 2016, it was only $0.95/MMbtu below. Both the TETCO M3 and the Tennessee Gas Pipeline Zone 4 experienced similar results.

The price differentials are a function of the supply and demand curve, but prices are also indicative of the presence or lack of infrastructure necessary to get the product to market. The differentials are decreasing in the area, which would point towards increased infrastructure capabilities coming online.

In January, OAG360® covered the growing infrastructure in the Marcellus: “As more infrastructure is built out in the North East, natural gas spreads continue to narrow. The effects of the infrastructure buildout were muted in November and the beginning of December due to warm weather,” according to the EIA, “but natural gas production increased in December and January as demand increased and producers had more access to takeaway capacity.”

As the infrastructure stemming from the Marcellus becomes more robust, the increased flow of natural gas will lead to lower transportation costs and smaller differentials. Another factor that plays a major part is the weather, and the need for natural gas to heats homes and businesses.

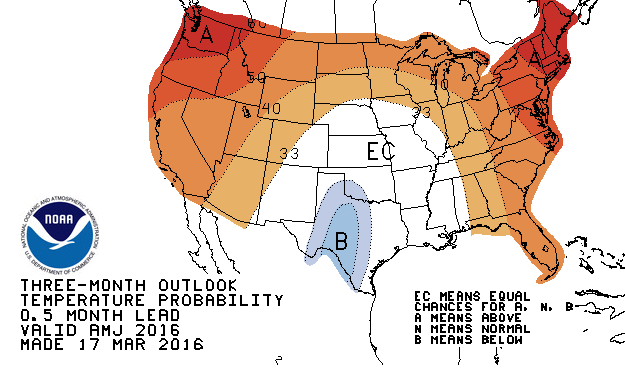

Predicted Weather Patterns and EnerCom Inc.’s Nat Gas Model

While the groundhog prognosticated an early spring on February 2, 2016, Punxsutawney Phil only has a 39% rate of accuracy predicting weather patterns. Another prognosticator of weather with a little better track record is the National Oceanic and Atmospheric Administration (NOAA). They release a three month outlook on temperatures for the continental U.S.

Source: NOAA

The red bands indicate that the temperature will be above the historical average temperature for that region. The white indicates it will be at or around the average temperature, and the blue bands indicate it will be colder than the average.

There is a decent amount of red on this map which would indicate that temperatures in the U.S. will likely be higher than they have historically averaged. This would lead to a drop in heating degree days through the spring and place natural gas into the shoulder months quicker than expected. It could be a fair assertion that summer months will bring warmer temperatures and increased cooling degree days.

A reduced draw from the natural gas storage could lead to a continued build of storage, which would continue to suppress the natural gas price through 2016.

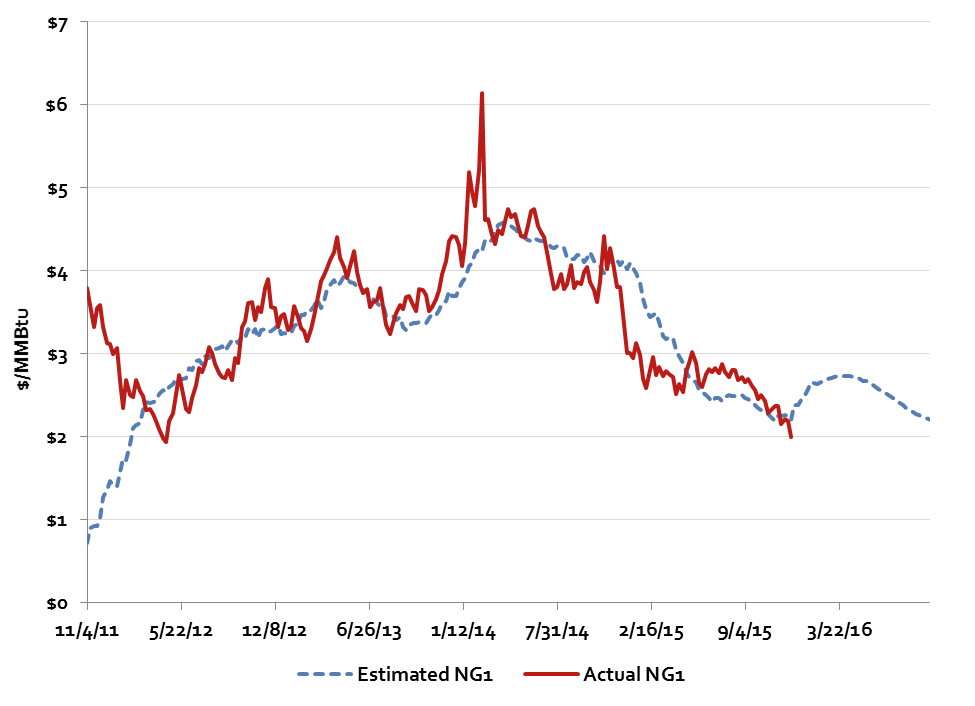

One of the several components for EnerCom’s natural gas model is heating degree days. Add in several other factors and we have come up with a prediction of where the price of natural gas may be headed.

EnerCom’s natural gas model foresees prices staying in a similar range to current prices.

Source: EnerCom Analytics

Enercom’s natural gas forecasting model foresees a bump in natural gas pricing in the near future with a more muted response through the fall of 2016. Pricing will likely stabilize through the course of 2016 as the warmer weather negates some of the heating degree days. And the increased infrastructure in the Marcellus will help the area generate a greater pathway to commercial markets.