From the Federal Reserve Bank of Dallas

The Federal Reserve Bank of Dallas has published its latest Energy Indicators report with pipeline constraints leading the news. Report follows.

Pipeline limitations are driving down local prices for oil and natural gas, causing drilling activity to flatten and the inventory of uncompleted wells to rise in the Permian Basin. Texas mining employment growth also slowed in July. Meanwhile, refineries are processing record volumes of crude, and surging petrochemical processing is putting downward pressure on the price of key chemical products.

Employment: extraction sector job growth down 47% from prior month

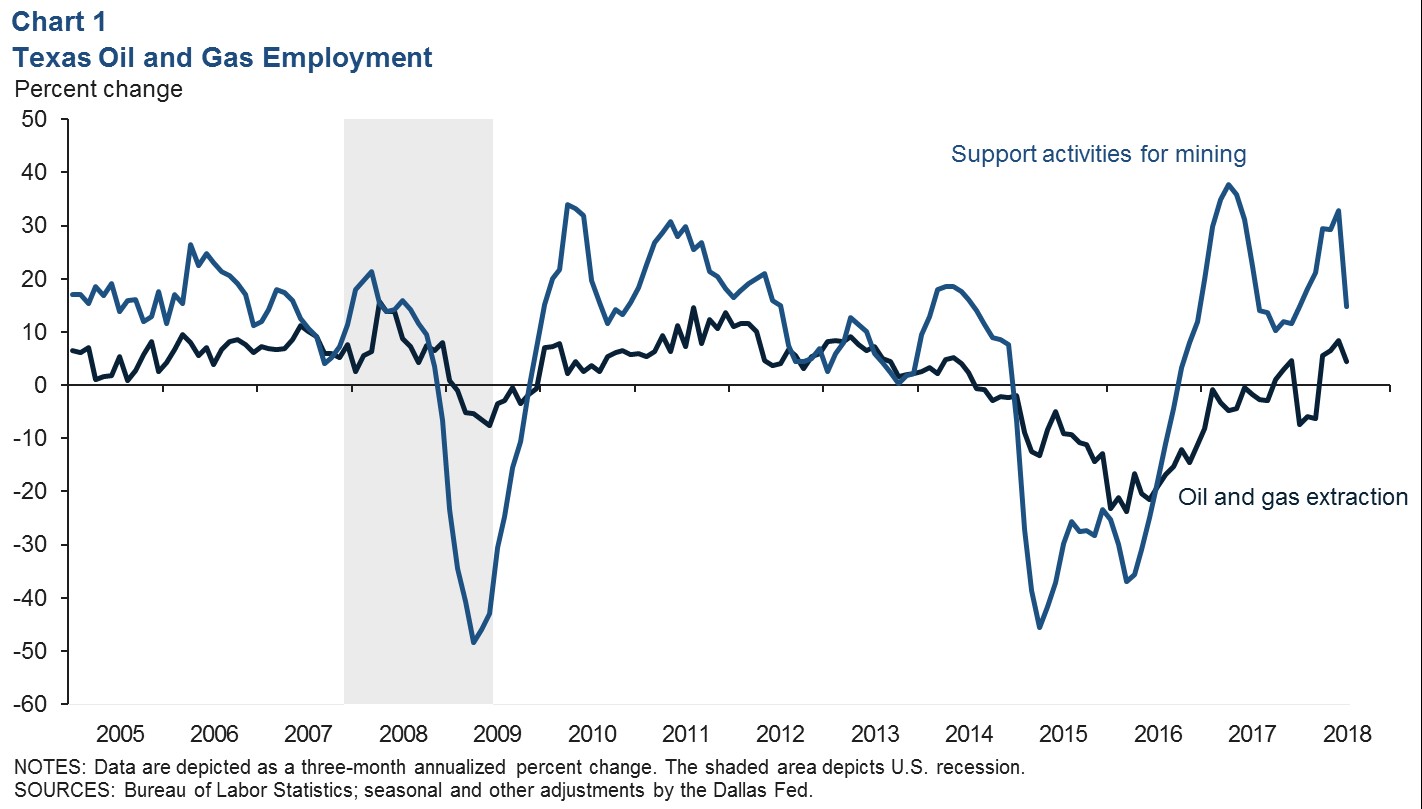

Recent revisions to first-quarter data took a bit of the shine off of stellar energy job growth in Texas. The Texas mining industry added 18,273 jobs from December to June rather than the 22,800 estimated prior to the revision. Looking at the most recent data, mining employment slowed from an explosive second quarter to post still-healthy job growth.

Support activities for mining grew at an annual rate of 14.7 percent in the three months through July (5,400 jobs)—half the pace of recent months.

By that same measure, growth in the extraction sector slipped to 4.4 percent (800), down from 8.3 percent the prior month (Chart 1).

Oil and gas extraction jobs outside of Texas also slowed in recent data. Extraction employment in the rest of the U.S. grew at an annual rate of nearly 4.8 percent (887) over the three months ending in July, down from 8.2 percent in June.

Data for U.S. support activities employment (excluding Texas) are lagged and not yet available for July. Employment in the sector grew an annual 16.4 percent for the three months through June.

Prices

The monthly average price for Brent crude was little changed from July to August at $73 per barrel (Chart 2). Production increases from outside Iran and Venezuela offset the declines in exports and production from these countries, keeping global markets relatively balanced.

Limits on pipe capacity affects Midland differential: averaged $52 in August

Limited pipeline capacity continues to adversely affect local prices in West Texas. West Texas Intermediate (WTI) crude priced in Midland declined to an average of $52 in August. The average monthly spread between Midland and global benchmark Brent widened by about $3.22 to $20.74.

WTI priced in Cushing, Oklahoma, was buoyed in July and August by an outage in Canada that reduced crude flows south.

Natural gas prices at Henry Hub rose to average $2.94 per million British thermal units in August. At the West Texas Waha hub, which is also constrained by pipeline capacity, gas prices declined to $1.88 in August. The spread between the two benchmarks reached a new high this year of $1.

Drilling Activity: Rig Count Flattens

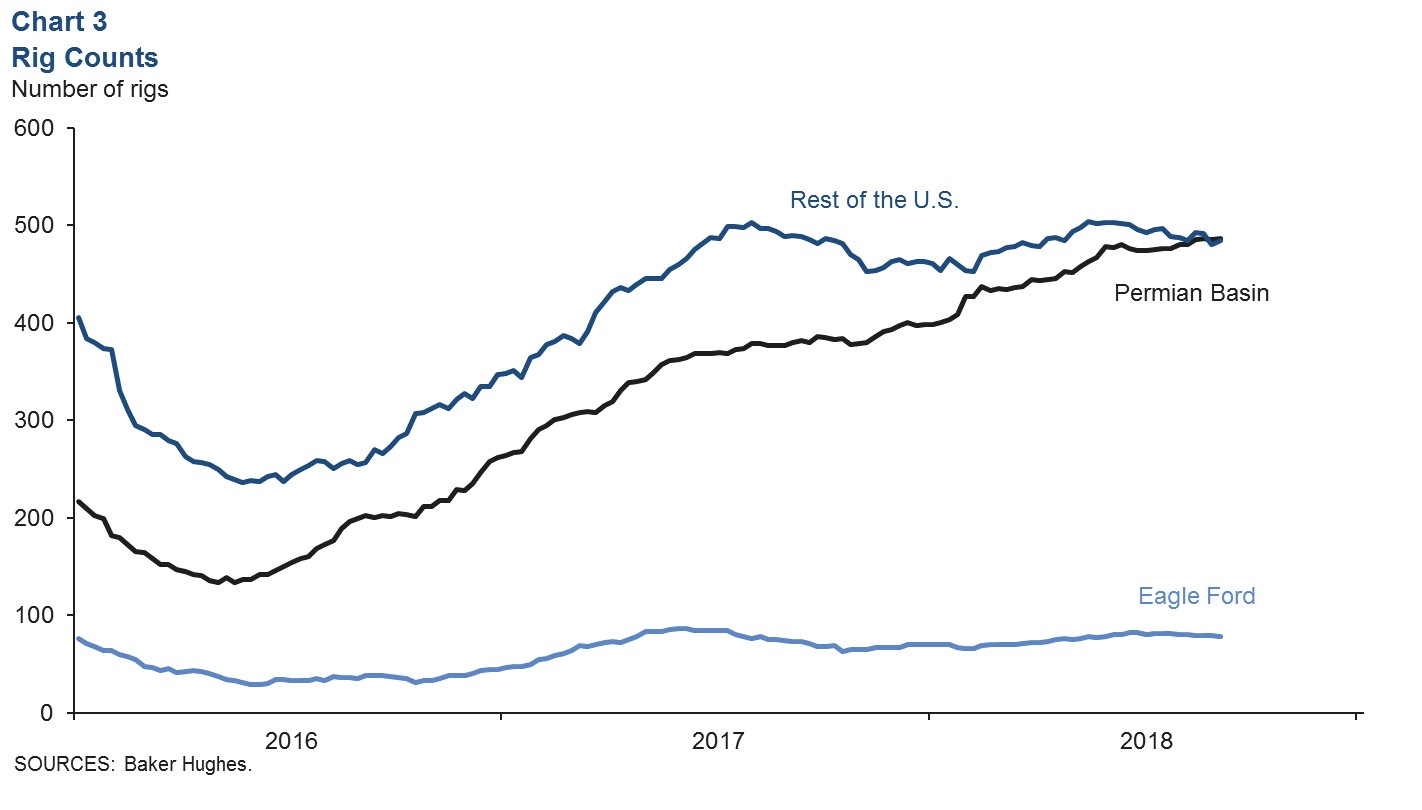

Oil at $52 per barrel in Midland is close to or below the breakeven price of new wells for some companies in the region, and it is near the price needed by some to cover operating expenses on existing wells, according to the Dallas Fed Energy Survey. While some companies may have shielded themselves against low wellhead prices, it is no surprise that drilling activity—and energy employment growth—slowed over the summer.

The weekly rig count in the Permian Basin inched up in late July, but was flat at around 485 over the month of August (Chart 3). The Eagle Ford has been essentially flat near 80 rigs over that time. Weekly drilling activity in the rest of the U.S. slipped from July to early August but was also essentially flat in August, oscillating by as many as 12 rigs from week to week.

Inventory of Uncompleted Wells Rises

Months of inventory, a measure of uncompleted wells (the number of drilled but uncompleted wells divided by the number of wells completed in a month) rose in the Permian to 8.0 months in July, and inventory in the Eagle Ford rose to 8.6 as the number of wells completed slipped (Chart 4). The trend has been different elsewhere in the country. As new well activity has focused increasingly on the Permian since the oil bust, completions have been drawing down well inventories in other regions. Inventories elsewhere in the nation fell to 3.4 months in July. Flattening rig counts in August and falling wellhead prices in West Texas suggest these trends are likely continuing.

Refinery Utilization

Refineries have been running full bore in the U.S. as low feedstock costs and refinery outages in Latin America (principally Venezuela) have helped keep demand for U.S. product healthy. Seasonally adjusted crude oil inputs to refineries dipped slightly to 16.8 million barrels per day (mb/d) in August after hitting an all-time record of 17.2 mb/d in July (Chart 5). The U.S. refinery utilization rate spent most of the summer at over 95 percent, and operating rates on the Gulf Coast reached as high as 99 percent in August.

Despite high refinery throughput and strong crude oil exports in the first half of the summer, seasonally adjusted commercial crude oil inventories have stabilized in recent months near 412 million barrels.

Petrochemicals

The price of ethylene—the key petrochemical input for many major plastic resins—fell on the Gulf Coast to 14.5 cents per pound in July, on par with the price of ethane, the principal feedstock used to produce it (Chart 6).

Booming production from U.S. shale has kept strong downward pressure on the domestic price of ethane for several years. Ethylene producers outside of the U.S. (Europe, Asia and Latin America) mostly rely on a refining byproduct called naphtha (which is tied to the price of oil) to produce ethylene. The wide and persistent spread between the cost of U.S. ethane and globally traded oil products drove an investment boom in U.S. chemical production. Over the past year, large new chemical plants have come online, increasing the supply of ethylene and putting downward pressure on its price.