Algonquin Incremental Market Project Brings Relief to Gas-Constrained New England

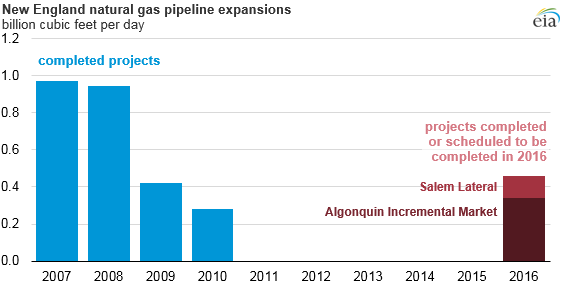

Spectra Energy Corporation (ticker: SE) is nearing completion of the first two natural gas pipeline projects completed in New England since 2010. Ten natural gas pipeline projects have been completed or are expected to be completed before the end of 2016, adding an additional 5.9 Bcf/d of capacity according to EIA.

On November 1, Spectra placed part of the Algonquin Incremental Market (AIM) project into service, following its approval in late October by the Federal Energy Regulatory Commission (FERC). The remainder of the project is expected to be completed this month.

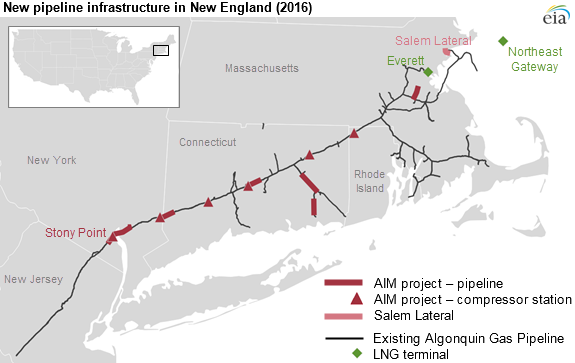

The $972 million project will bring natural gas from the Appalachia into New England and is the largest project since 2007 to supply New England with natural gas from outside the region. The pipeline will provide an additional 342 MMcf/d of pipeline capacity to the New England market.

AIM entered commercial service in November 2016, adding capacity to the constrained New England pipeline infrastructure system ahead of upcoming winter demand and ahead of the anticipated increase in demand from the Salem Harbor Power Plant, a 674 megawatt converted coal-to-gas electric power plant due to enter service in June 2017.

The Salem Harbor plant will be served by another new pipeline project, the Salem Lateral, which was placed into service on November 1 but it is not expected to be used the plant begins operations. The plant will use up to 115 MMcf/d of natural gas.

Cold Winters Mean Big Trouble for Region

New England’s natural gas infrastructure was not designed to serve demand for natural gas for both heating and power generation, so on cold winter days, New England’s network of pipelines is near or at capacity for commercial and residential heating.

Higher pipeline capacity from these projects is expected to continue offsetting decreasing natural gas imports into the region. Regional demand has typically been met through LNG imports, which have declined due to increased demand in other markets and the expiration of long-term contracts.

LNG shipments to the Algonquin Northeast Gateway Lateral project and shipments to ENGIE’s LNG import terminal in Everett, MA have decreased over the past several years. LNG shipments can be held up by severe winter weather.

Numerous points along the natural gas pipelines in the region have reached full capacity utilization rates during the winter months. The Algonquin Gas Transmission pipeline shown above is the major pipeline currently transporting Appalachian gas to New England.

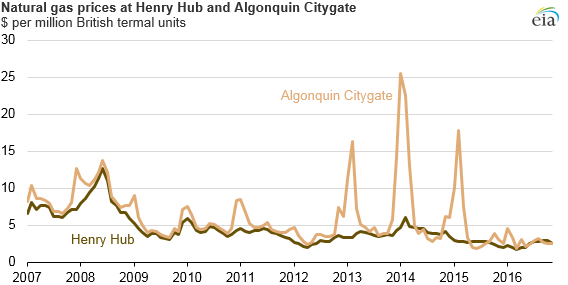

Deliveries through the Algonquin pipeline have been growing since 2010, as the pipeline has been operating at capacity for a longer portion of the winter and at higher levels during summer use. As a result, natural gas spot prices for New England are highly volatile, shown in the chart below.

Average monthly natural gas prices at the Algonquin Citygate trading hub, the point of entry for the Boston market, reached $15 per MMBtu during the winters of 2013 and 2015 and $25 per MMBtu during the winter of 2014.

Regional Utility Planners Increasingly Worried

On December 1, ISO New England implemented a Winter Reliability Program to incentivize oil and LNG procurement in the event of natural gas capacity shortages. The organization listed a total of 3,450 MW of natural gas-fired generating capacity as at risk of not being able to get fuel when needed this winter.

“This winter, the situation will grow even more uncertain because non-gas power plants are retiring and being replaced primarily with new, gas-fired generation. We are currently evaluating how the ISO will maintain reliability in the future under these conditions,” said ISO New England Inc.’s executive vice president and chief operating officer, Vamsi Chadalavada.

The next regional power plant slated for retirement is the 1,500 MW, coal-fired Brayton Point Power Station in Somerset, MA, which will cease operations in May 2017. Although the lost electricity will be partially offset by new gas-fired generation from the Salem Harbor Plant, no new natural gas infrastructure or additional plant capacity is currently being developed.

Stay warm, New England.