Transaction represents 8% premium, not 75%: SandRidge letter

- November 15: SandRidge announces acquisition of Bonanza Creek Energy for $746 million

- November 27: SandRidge creates “poison pill” to fight Icahn

- November 30: Icahn responds to SandRidge

- December 11: SandRidge publishes new letter ‘dispelling myths’

SandRidge Energy, Inc. (ticker: SD) issued a letter today addressed to shareholders, highlighting the benefits of the Bonanza Creek Energy, Inc. (ticker: BCEI) acquisition. The company plans to file a registration statement on today, communicating the strategic rationale behind the proposed acquisition, other important details, and analysis regarding the transaction.

The company has also launched a dedicated website – www.sandridgeandbonanza.com – with information regarding the transaction.

The text of the letter follows:

Dear Fellow SandRidge Shareholders:

On November 15, 2017, the SandRidge Board of Directors and management team announced the acquisition of Bonanza Creek Energy. This strategic opportunity is immediately accretive and positions us to deliver additional long-term shareholder value by adding high-return and development-ready projects to our Niobrara position. After a detailed and thorough assessment of Bonanza Creek, we determined this acquisition to be in the best long-term interests of our shareholders.

BONANZA CREEK IS A HIGHLY STRATEGIC OPPORTUNITY

The acquisition of Bonanza Creek provides immediate cash flow and high-return development opportunities that allow us to continue generating strong risk-adjusted returns while we delineate our emerging assets.

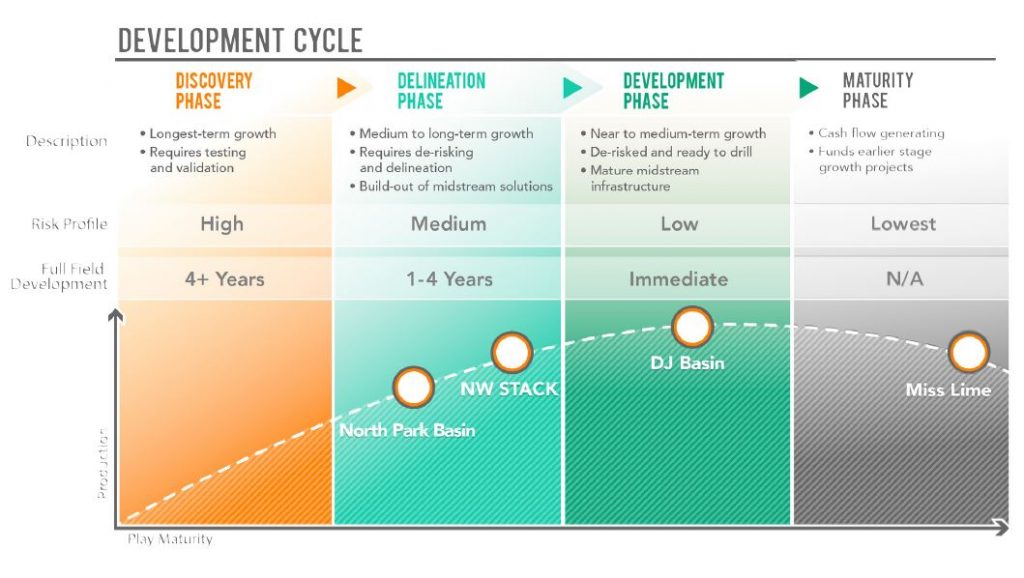

Our existing assets in the Mid-Continent and Niobrara are in different stages of the development cycle:

- Our mature Mississippi Lime assets in the Mid-continent generate significant production and material free cash flow, which help fund investment and value creation in our emerging assets. However, they are declining assets that do not offer meaningful opportunities for additional development and oil and cash flow growth.

- Our North Park Basin Niobrara assets are in the delineation phase of the development cycle and require significant investment over the next several years, including the construction of midstream and pipeline takeaway infrastructure, before full field development can be realized.

- Our NW STACK assets in the Mid-continent are also in the early phases of the development cycle and are being efficiently delineated under a development agreement that provides an initial $100 million of capital from our financial partner.

This current combination of mature Mississippi Lime assets and emerging North Park and NW STACK assets, in the absence of significant development-ready inventory, results in a higher risk profile. The expansion of our Niobrara position to include Bonanza Creek’s DJ Basin assets considerably improves our risk profile by:

- Adding 30-50% rate of return, development-ready inventory within a well-known, highly delineated area

- Adding an estimated 970 total drilling locations close to existing infrastructure in a well-delineated play

- Adding an estimated 230 proved locations, a 92% increase over SandRidge’s preliminary year end 2017 PUD inventory

- Increasing Niobrara production to 25% of total production, from 4%

- Reducing Mississippi Lime production to less than 60% of the Company’s total production, from 80%

These assets will allow us to accelerate returns and grow cash flow while our emerging assets progress to the development phase.

Significantly Strengthens Our Financial Profile

The acquisition results in meaningful benefits compared to the Company’s standalone plans:

- 15% accretion to cash flow per share in 2018

- 4% accretion to net asset value per share in 2018 while significantly reducing the Company’s risk profile

- 21% improvement in 2018 EBITDA margin per BOE

- At least $20 million in annual G&A savings

- An increase to 41% oil production in 2018, from 35%

- A strong balance sheet, which remains at or below 1.9x leverage over the next three years

- Proved reserves support a new $700 million borrowing base on more favorable terms

- Greater than $300 million of liquidity at closing

Strong Balance Sheet with Enhanced Liquidity from New $700 Million Credit Facility

To effect the transaction, we chose to use a measured balance of cash and equity and weighed increasing accretion from funding with cash against pro forma leverage and liquidity. The balance we chose of approximately 53% cash and 47% equity results in significant accretion while maintaining a prudent level of leverage which remains at or below 1.9x over the next three years.

Following the transaction, we expect greater than $300 million of liquidity at closing through a new reserve based loan with an initial borrowing base of $700 million on more favorable terms. To support the new credit facility, our current agent bank has delivered a highly confident letter to the Company supporting these terms. The increased borrowing base of $700 million versus the expected borrowing base of $618 million provides enhanced liquidity at closing and indicates the strength of the combined company’s proved reserves.

Operational, Technical and Financial Synergies

The acquisition is expected to generate meaningful operational, technical and financial synergies. Upon closing, we will immediately take the steps necessary to achieve at least $20 million in annual G&A savings and continue to focus on reducing our cost structure. We also expect to capture additional cost savings through operational efficiencies such as:

- Sharing drilling rig and stimulation crews

- Utilizing dedicated vendor services

- Achieving flexibility in scheduling drilling and completion activities

- Remotely monitoring and operating our assets using our centralized operations center

- Realizing efficiencies of scale in the procurement of materials

We also expect to benefit by leveraging the expertise of our combined operational teams to drive improvement in drill-site selection, drilling and completion techniques, well bore design and regulatory and stakeholder relationships across the Niobrara play.

Compelling Acquisition Value

In addition to delivering immediate accretion to cash flow per share and net asset value per share, the transaction is attractively valued. As highlighted in the table below, the $36.00 per share acquisition price is well within the per share valuation ranges implied by Bonanza Creek’s net asset value, historical trading range since emerging from bankruptcy and comparable company EBITDA and production multiples. These multiples compare favorably to recently announced acquisitions in the DJ Basin.

| Bonanza Creek Valuation Ranges |

Implied Value per Share Range for Bonanza Creek |

|

| Historical Trading Range Since Emergence from Bankruptcy | $497 million – $812 million | $24.00 – $39.20 |

| Aggregate Value to 2018 Consensus EBITDA Estimates | 4.7x – 6.0x | $31.10 – $39.70 |

| Aggregate Value to Current Production ($/Boepd) | $45,000 – $60,000 | $34.34 – $45.78 |

| Net Asset Value | $682 million – $804 million | $32.91 – $38.79 |

SETTING THE RECORD STRAIGHT

A vocal minority of shareholders have attempted to criticize the acquisition by distorting the facts and misleading the investing public. Their assertions are false and reckless and we believe it is imperative to set the record straight for our investors.

| Strategy | • Myth: The Bonanza Creek acquisition is not consistent with SandRidge’s stated strategy. |

| • Fact: The Bonanza Creek acquisition is highly strategic and fits within our stated strategy, which clearly includes opportunistic acquisitions. We articulated our key strategies, including “pursuing opportunistic acquisitions” in Item 1 of our 2017 Annual Report. | |

| Transaction Premium | • Myth: SandRidge is paying a 75% premium. |

| • Fact: The 75% premium calculation is misleading and based on a $421 million deeply discounted valuation in connection with a rights offering, which in no way reflects the public market valuation immediately prior to the transaction. | |

| • Fact: The transaction actually represents a 17.4% premium to Bonanza Creek’s closing price as of November 14, which is easily warranted given the strategic fit of the assets and the $20 million of annual G&A savings and operational synergies we have identified. | |

| • Fact: The transaction represents only an 8% premium to the equity valuation prepared in connection with Bonanza Creek’s restructuring in early 2017, which had a mid-point of $690 million and relied on lower commodity price and total production assumptions than used in our valuation of Bonanza Creek. | |

| Rights Plan | • Myth: This rights plan is designed to prevent large shareholders from campaigning against the Bonanza Creek transaction. |

| • Fact: The rights plan provides no such restriction. It is designed to protect the rights of all SandRidge shareholders, enabling them to fully review the merits of the proposed acquisition of Bonanza Creek and vote on the transaction. It also protects all of our shareholders from anyone gaining control of SandRidge without payment of a control premium. Importantly, the rights plan expires after one year unless terminated earlier by our shareholders at next year’s annual meeting. | |

| Board of Directors | • Myth: The Board is entrenched. |

| • Fact: Our independent directors have been in office for just over one year and were vetted and approved by the Company’s creditors in connection with its restructuring in 2016. | |

| • Fact: These same independent directors were reelected at our most recent annual meeting by SandRidge shareholders—most of whom were prior creditors—with greater than 97% of the shares voting in favor. All Board members are subject to election by the shareholders annually. | |

| • Fact: SandRidge Board members have a strong track record in the energy and private equity space, with professional experience ranging from 20-40 years per Board member. All directors have public company experience. |

COMMITTED TO SHAREHOLDER ENGAGEMENT

As shareholders, you have an important decision to make regarding the Bonanza Creek acquisition. We urge you to make this decision only after careful analysis of all of the facts. The preliminary proxy statement, investor presentation and other materials detailing the acquisition are being made available at www.sandridgeandbonanza.com, and we urge you to review these materials. After fully considering the rationale for the Bonanza Creek transaction and the detailed analysis that supports the Board’s decision to recommend it to shareholders, we are confident that you will agree that this transaction is immediately accretive and in the best long-term interests of SandRidge and all of its shareholders.

In closing, we look forward to continuing to engage in constructive dialogue with shareholders and to answering your questions, which you can submit to our Investor Relations team at Investors@SandRidgeEnergy.com or by calling 405-429-5515.