Newfield’s SCOOP/STACK operations pinned to future growth; Williston Basin infill projects look to deliver $100 million of free cash flow in 2018

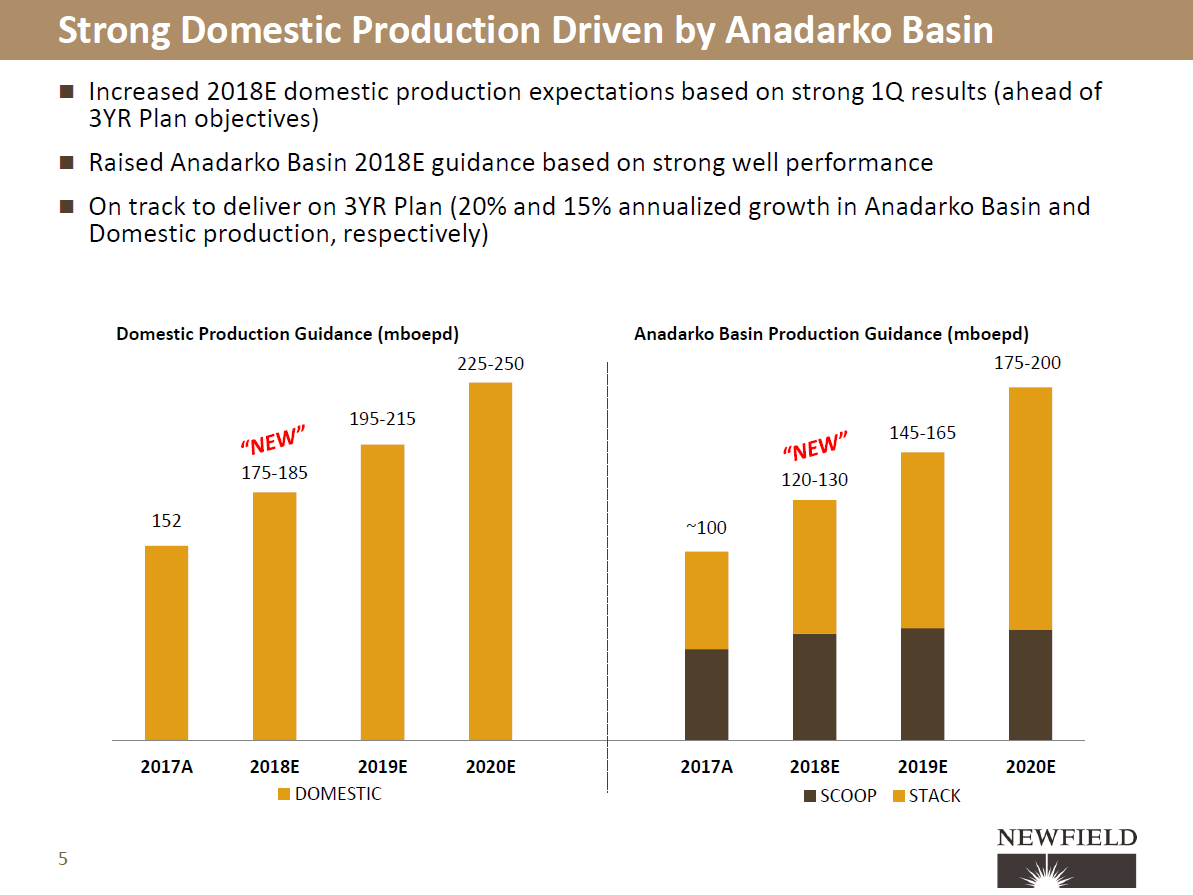

Newfield Exploration Company (ticker: NFX) had record net production during Q1 2018, with SCOOP/STACK net production averaging 117,500 BOEPD.

Newfield Chairman, President and CEO Lee Boothby said, “The Anadarko Basin is the asset that will fuel our growth and transition us to living within cash flow from operations. We expect our development of these assets will yield rapid growth from here.”

Boothby also said that net production estimates forecast as much as 200,000 BOEPD in 2020.

From a capital spending standpoint, Newfield invested $345 million in the quarter. Domestic production was up 27% year-over-year and our domestic oil production was up 29% year-over-year. Anadarko Basin production was up 34% year-over-year. During the quarter, the company turned 43 wells to sales in the Anadarko Basin and to-date, Newfield has 88 infill wells (both operated and non-operated pilots).

NFX’s Williston Basin operations

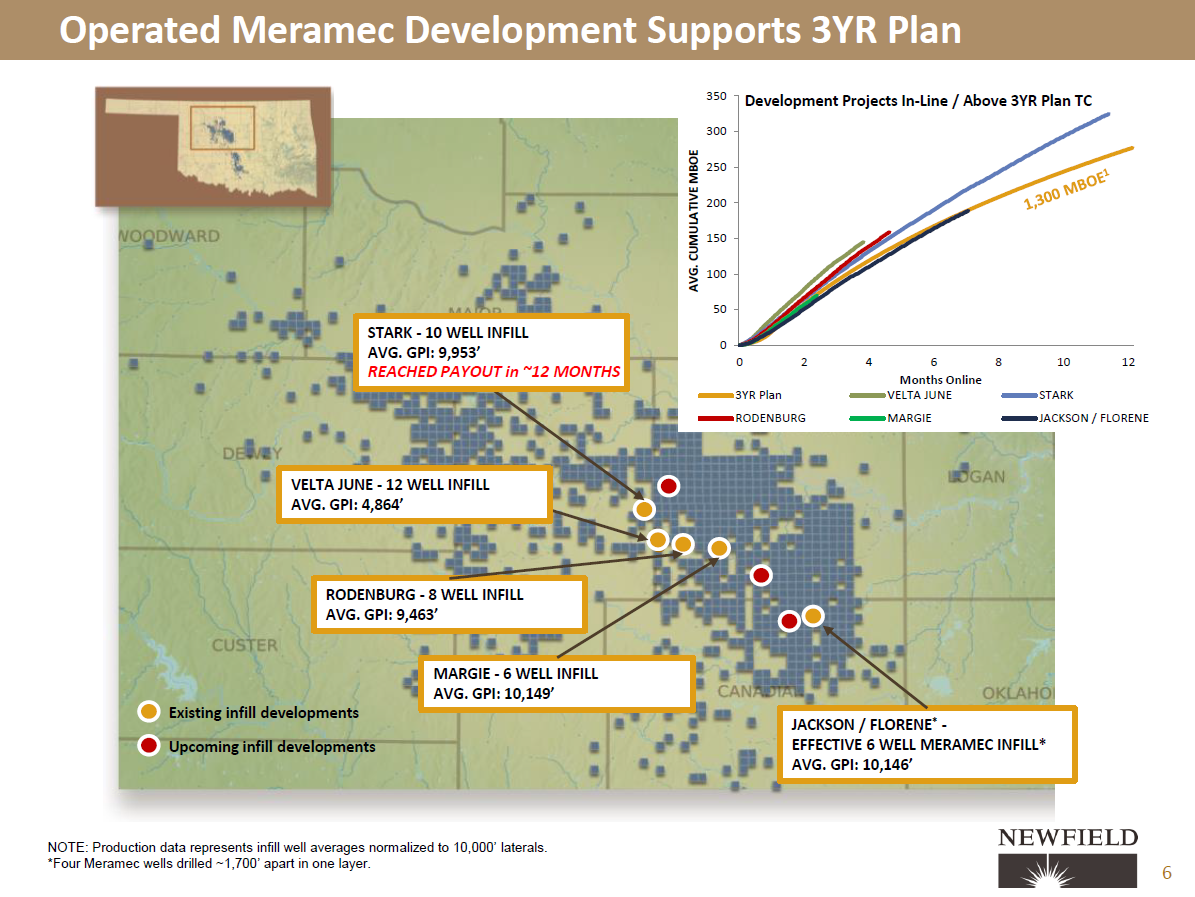

Newfield said that the Williston Basin continues to perform extremely well. The basin is up ~10% year-over-year and delivers some of the “most productive and cost-effective wells” in the play. One example Boothby noted was the Stark DSU, a 10-well development that achieved payout in 12 months.

The infill projects are expected to deliver more than $100 million of free cash flow in 2018 at current oil prices.

NFX conference call Q&A excerpts

Q: About the Bakken… can you tell us about well performance and consistency? What about gas processing and takeaway?

EVP and COO Gary Packer: Results in the Bakken continue to impress, both on the Nesson Anticline and off the Anticline.

Everything has responded very, very well to the increased proppant densities and fluid densities, and I really like the results that we continue to achieve there and a lot of them are being achieved not only in the drilling within the Bakken itself, but the team has done a great job in threading additional Three Forks wells in both the first and second benches.

There are constraints developing in the basin. I think they’ve been widely reported. It looks like we may have some relief on the flaring the side. These are all things that we’ve got baked into our plans. Many of these things have already been anticipated, but the fact of the matter remains, the Bakken remains some of the best returns most productive wells that we have in just about anybody’s portfolio, and a one-million-barrel EURs, and these wells are being drilled in oftentimes less than $6 million.

It has a great place in our portfolio and it continues to find greater confidence that we have in our plan coming out of the basin.

Chairman, President and CEO Lee Boothby: I referenced the earlier focus on generating free cash flow composite, the $100 million plus in the current price environment for the Williston Basin this year, one rig program. We’ve used this asset to kind of lead the way on some of the innovations that we’re applying today in SCOOP and STACK, I think that’s been a positive attribute as well.

And clearly, were the bottleneck to develop, we can shift capital out of the Williston Basin into the SCOOP and STACK plays that would be the response if it were to affect Newfield in terms of production.

Q: With flat CapEx and higher production, capital efficiency should be improving. Am I missing something?

Boothby: No, I don’t think you’re missing anything.

I think the DSUs that I referenced earlier, where we have substantial performance to-date, are all performing extraordinarily well. The fact that you’re running on those slightly above the 1.3 million-barrel average that we embedded in the three-year plan, that should be encouraging to everybody, but I will remind everyone that it’s still early innings.

You can see that in the @NFX publication, we’ve got additional pilots, as we continue to spread out across the primary STACK footprint. My expectation is, we’ll continue to deliver strong results there and further de-risk the planned forecast.

Looking forward, I think all of that’s positive. The fact that we’re on track with regard to our efficiency gains coming into this year I think is positive as well and the fact that we’re not seeing the type of inflationary pressures that we suffered through last year is also positive.

At the end of the day, a lot of work went into that three-year plan. I think our team has been consistently right in terms of how it’s forecasted and how it’s predicted the play was going to evolve. We did take a position in terms of not driving the type curve up, we’re in an HBP mode and counseling people that when you get into development mode and the wells have neighbors, you need to be thinking about that. I think these results demonstrate that our team is embedding that all the way along.

And I think most importantly Dave, at the end of the day, it comes out to this. Good plays tend to get better over time. Great teams tend to make great plays even better and that’s what our team has done, that’s what we’re going to do. I think I’ll reference the Bakken as most recent example, but I think in each play, I think we’ve deployed capital and talent. Our team has managed to exceed expectations.

Continental kicks off Springer Row and SpringBoard – a 400 MMBoe multilayered area of SCOOP

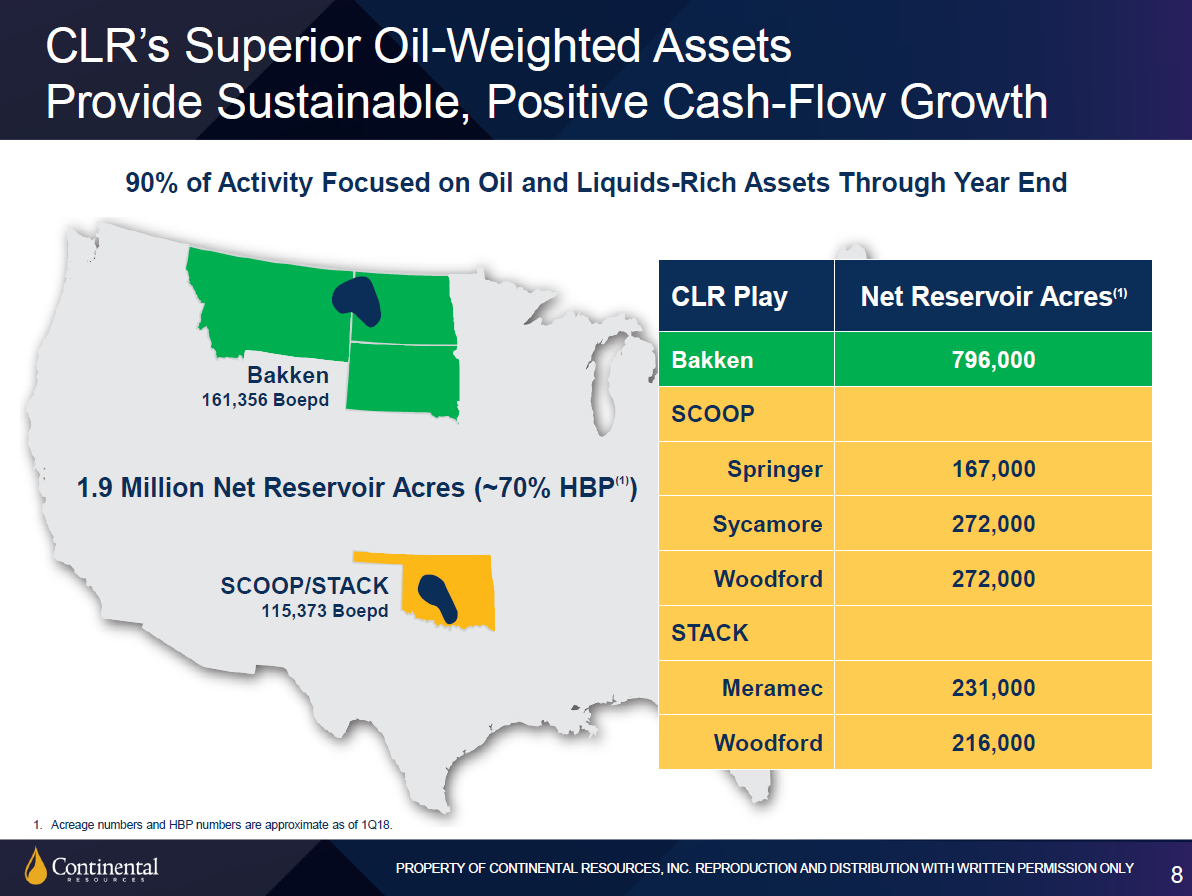

Continental Resources, Inc. (ticker: CLR) Chairman and CEO Harold Hamm announced that the company has “kicked off” its SCOOP Springer Row development and project SpringBoard. Continental owns approximately 75% of this project and 85% of Springer production.

According to Continental, project SpringBoard is a multi-layered portion of the SCOOP and it is sourced and produced from the Woodford Shale and numerous rock layers, including the Garvin Springer, Mississippi and Sycamore and other layers. Full-scale unit development is underway with five rigs.

The SCOOP Woodford has seen improvements to well design, lowering drilling costs by $1 million to $11.7 million per well. As for the STACK Meramec, Continental listed approximately 10 planned STACK infills for 2018, with estimated first production dates ranging from Q3 2018 to Q3 2019.

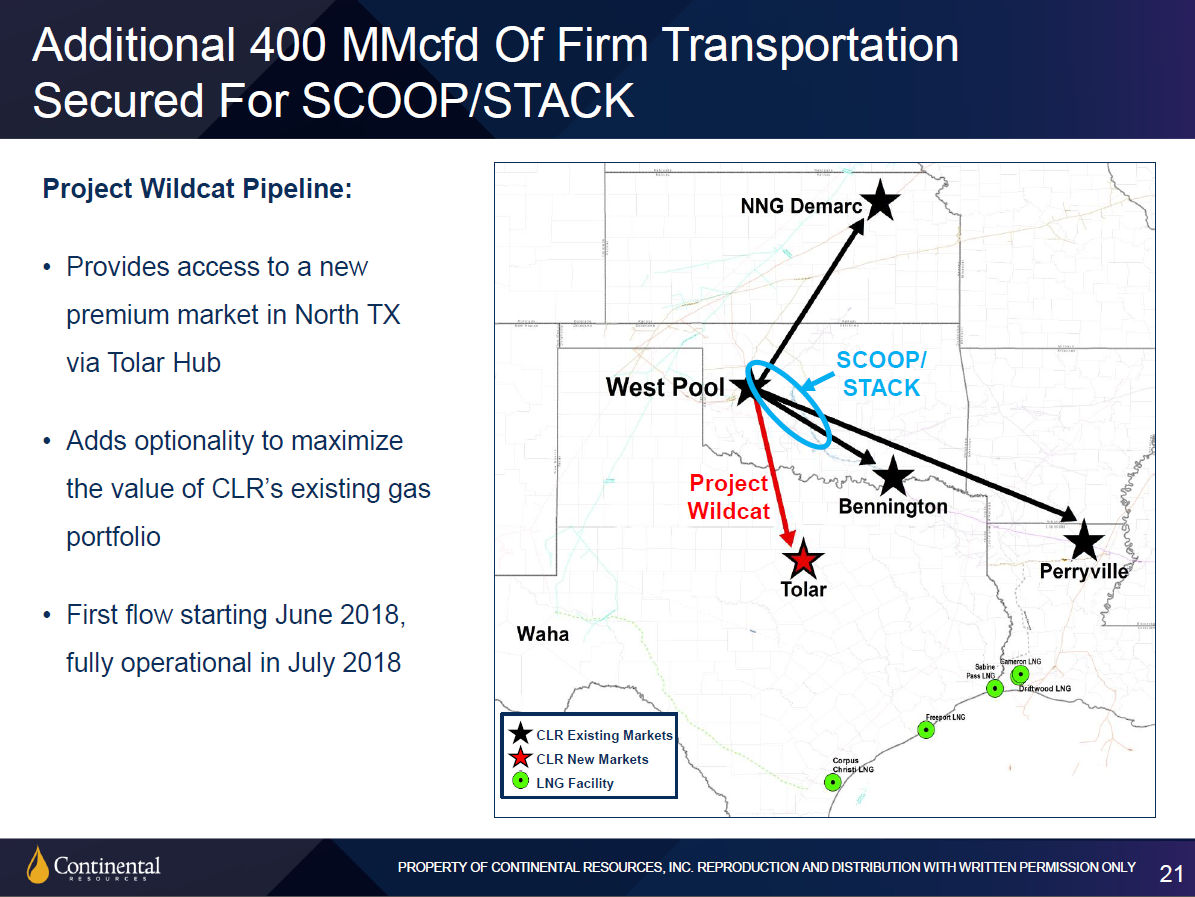

In Q1 2018 the company completed 30 gross operated wells, produced 115,373 BOEPD and increased SCOOP/STACK daily oil production up 21% over Q1 2017. Continental also announced a new project, Wildcat, which will provide additional takeaway capacity needed for projected growth in SCOOP and STACK.

The Bakken is back: wells across the field are producing at unprecedented levels: Stark

Continental President Jack Stark said, “I suspect many of you have seen recent articles that say the Bakken is back where the Bakken is booming again. Well, I couldn’t agree more. Bakken wells across the field are producing at unprecedented levels, uplifting the economics of the entire field.”

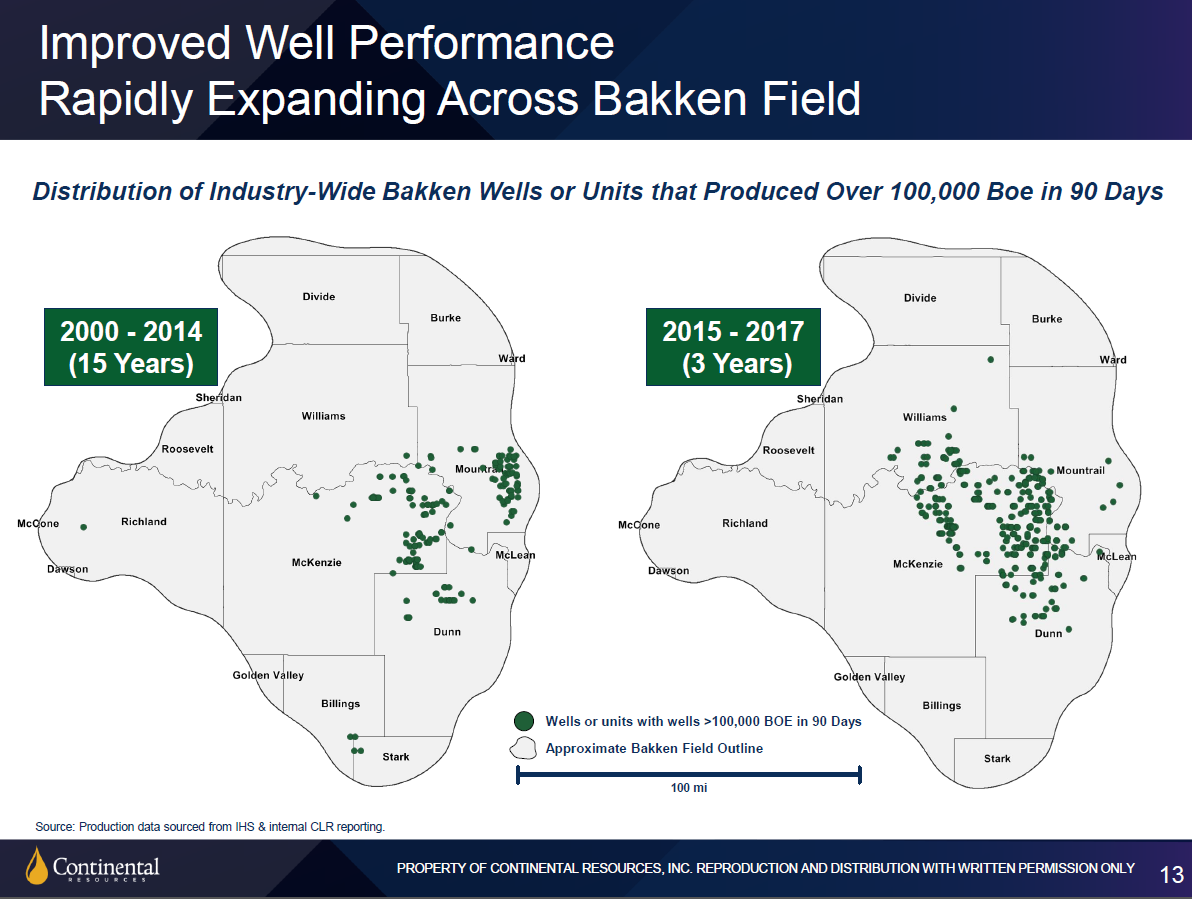

CLR Bakken Well Performance, May 2018 – This image compares the distribution of all Bakken wells that have produced more than 100,000 BOE during the first 90 days on two separate timeframes: the last three years and the prior 15 years.

“As you can see, there has been a drastic increase in both the number and distribution of wells that meet this criteria of the last three years and the footprint is expanding rapidly,” Stark said. “This is truly a step change in performance for the Bakken made possible thanks to the breakthroughs and completion technologies.”

Continental said it stands as the number one producer in the North Dakota Bakken, representing approximately 15% of the total production from the field on a gross basis. Bakken production in first quarter was up 48% from the first quarter of 2017.

Three of the 31 Bakken wells completed in the first quarter produced a record 30-day rates for Continental operated Bakken wells, averaging 2,300 BOEPD (80% of the production was crude oil).

CLR conference call Q&A excerpts

Q: I wanted to start on the Bakken if we could and maybe you guys can just talk about on how completion designs are evolving and what you’re doing to drive those much stronger results?

SVP of Production and Resource Development Gary Gould: We continue to test most of our designs with 60 stages.

Right now, if you look at the 164 wells that we have out in our — fit for our type curve in the investor update. We’re about 50% of those are 40 stage, 50% of 60 stage. We like what we’re seeing with 60 stage, where teams continue to look at how we can maximize the rate of return from that project. And so we will continue to look at various design mechanisms in order to maximize that rate return both looking at how we can increase the type curve as well as how we can reduce cost.

Q (continued): A lot of your peers around you are also modifying their completion designs or their development style – what are your peers doing differently, that seem to be working for them and different from what you’re doing?

Gould: We get a lot information since we’re the largest lease owner up in Bakken. And note that we get their information as well as ours, our teams evaluate outside operated activity levels our own, as we make our decisions on how we maximize our rates of return and we believe we’re a leader in this category testing not only stage linked, but also cluster spacing or entry points along the lateral. We’re also doing limited entry perforating. We looked at a number of different design parameters and we believe we are the leader in this category.

Q: You’ve got 4,000 locations declared in the Bakken… just trying to get an idea what the running room is on the quality of these enhanced completions?

CFO John Hart: Sure. It’s 4,000 gross operated locations. Okay. You need to know that. As far as running room is concerned … if we were to put eight to 10 rigs active in the Bakken… it would take us 10 years to drill up half our inventory. And the quality of that inventory, as far as rate of return on that blended average that we’d have for that period of time is in that 60% to 80% rate of return range.

So it’s a great inventory and it continues to impress.