On August 3, 2016, Newfield Exploration (ticker: NFX) announced the signing of two separate purchase and sale agreements to divest all of its assets in the Maverick Basin of Texas for $390 million.

The transaction is expected to close in the third quarter of 2016 and covers 35,000 acres of unconventional and conventional assets in Dimmit and Atascosa counties.

EnCap-backed Protégé LLC signed the agreement to acquire a package of Eagle Ford assets while an undisclosed party signed the sales agreement for the South Texas conventional natural gas assets.

Current daily production for the combined Maverick assets is 12,700 BOEPD at 35% oil, with proved reserves of 20.36 MMBoe. Production peaked in 2015 and was set to decline in 2016 by 30-40%. After several years of active development, the company suspended its Eagle Ford drilling program in 2015 due to low oil prices.

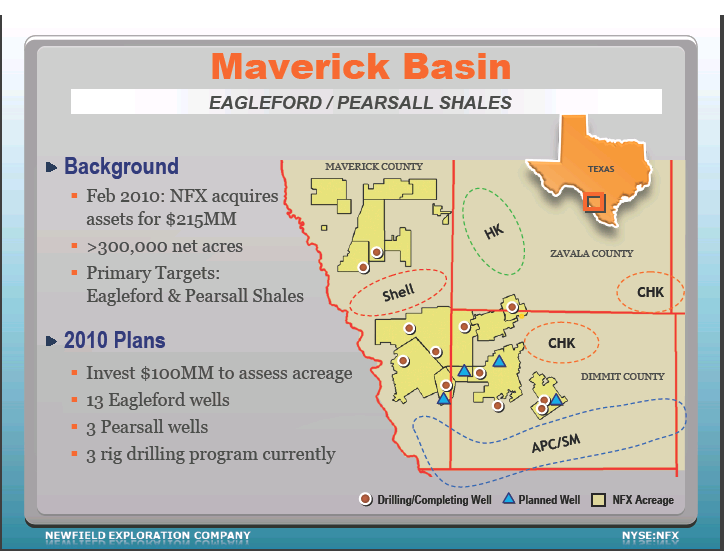

NFX first acquired its Maverick assets out of bankruptcy in February 2010 from TXCO Resource Inc. in a joint transaction with Anadarko Petroleum (ticker: APC). The $215 million transaction netted the company 300,000 acres of mostly undeveloped reserves, with net production of 1,500 BOEPD yielding 66% liquids.

Newfield’s Exit, Recent Transactions Highlight Eagle Ford Maturation, Declining Economics

While booming activity in the Eagle Ford drove a large part of the shale revolution in prior years, fields with more favorable economics in the Permian Basin and Mid-Continent region have drawn more acquisition interests recently.

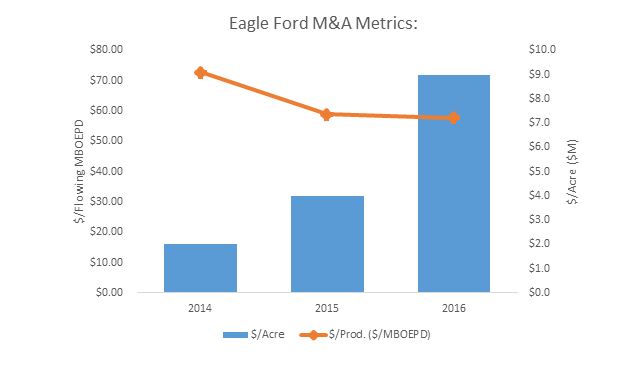

The chart below compares deal metrics for Newfield’s original acquisition and the recent divestiture of the Maverick Basin assets.

| Feb 2010 Acquisition | Aug 2016 Divestment | |

| $ / Flowing BOEPD | $143,333 | $30,708 |

| $ / Acre | $717 | $11,142 |

| $ / BOE Reserves | N/A | $19.16 |

At roughly $31,000 per flowing BOEPD, the realized price for the divestiture is lower than the average price paid for comparable assets in the Eagle Ford since the beginning of Q1 2015. The table below shows key data for Eagle Ford transactions greater than $150 million since 2015.

| Announce Date | Buyers | Sellers | Value ($MM) | Prod.

(MBOEPD) |

% Oil | Undev. Acreage | $/Prod.

($/MBOE) |

$/Acre ($M) | ||||

| 8/3/16 | Protégé; Undisclosed | Newfield | 390 | 12.70 | 51% | 35,000 | $30.71 | $11.14 | ||||

| 4/29/16 | EnerVest | GulfTex; BlackBrush | 1,175 | 13.74 | 85% | 11,254 | $85.52 | $104.41 | ||||

| 1/27/16 | Carrier | AWE | 199 | 4.14 | 71% | 1,240 | $48.07 | $160.48 | ||||

| 12/11/15 | Statoil | Repsol | 405 | 6.50 | 60% | 15,340 | $62.31 | $26.40 | ||||

| 5/11/15 | Noble | Rosetta | 3,847 | 65.70 | 62% | 91,200 | $58.55 | $42.18 | ||||

| 2016 Average | 588 | 10.19 | 69% | 6,247 | $57.71 | $94.13 | ||||||

| 2015 Average | 2126 | 36.1 | 61% | 53,270 | $58.89 | $39.91 | ||||||

Source: Company data, Bloomberg L.P., EnerCom analysis

For comparison, the following table shows similar Eagle Ford transactions that took place in 2014.

| Announce Date | Buyers | Sellers | Value ($MM) | Prod.

(MBOEPD) |

% Oil | Undev. Acreage | $/Prod.

($/MBOE) |

$/Acre

($M) |

||

| 12/5/14 | ReOil Eagle | Alta Mesa | 210 | 3.55 | 92% | N/A | $59.15 | N/A | ||

| 10/24/14 | Carrizo | Eagle Ford Minerals | 250 | 2.67 | 84.6% | 91,200 | $93.63 | $2.74 | ||

| 9/24/14 | Atlas | Cinco | 225 | 1.90 | 94% | N/A | $118.42 | N/A | ||

| 9/24/14 | Cabot | EF Energy | 210 | 1.60 | 92% | 30,000 | $131.25 | $7.30 | ||

| 6/17/14 | Ares | EIG; Tailwater | 819 | N/A | N/A | 160,000 | N/A | $5.12 | ||

| 5/21/14 | Sanchez | Shell | 639 | 20 | 60% | 43,000 | $31.95 | $14.86 | ||

| 5/7/14 | Encana | Freeport-McMoran | 3100 | 53.33 | 86% | 24,100 | $58.33 | $128.63 | ||

| 5/5/14 | Saka Energi | Swift Energy | 175 | 1.41 | 21% | 2,380 | $124.11 | $73.53 | ||

| 3/25/14 | Memorial | Alta Mesa | 173 | 1.65 | 90% | N/A | $104.85 | N/A | ||

| 2/6/14 | Baytex | Aurora | 2588 | 21.14 | 81% | 17,732 | $122.40 | $145.95 | ||

| 2014 Average | 866 | 11.9 | 75.6% | 52,630 | $72.76 | $16.45 | ||||

Source: Company data, Bloomberg L.P., EnerCom analysis

This transaction history shows that companies entering the Eagle Ford in 2014 were willing to pay greater prices per flowing barrel than they are currently. As undeveloped acreage has shrunk after extensive activity and delineation of the play in recent years, prices per undeveloped acre have risen.

The following chart summarizes the maturation of the Eagle Ford and its effect on key valuation metrics. Buyers are willing to pay more for undeveloped acreage, as knowledge of the play’s geology has improved from extensive prior drilling and uncertainty has been reduced. At the same time, operators are willing to pay less for daily production in the play due to lower commodity prices. Production levels are much lower due to lower drilling activity replacing legacy production.

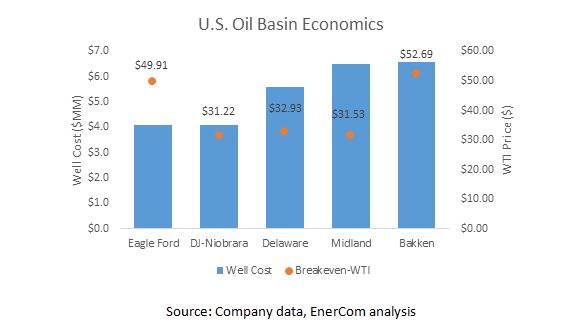

While the Eagle Ford features some of the lowest average D&C costs per well among U.S. oil basins, its PV10 breakeven WTI prices rank almost as high as the Bakken. The Delaware, Midland, and DJ-Niobrara Basins exhibit more favorable economics under the current oil price environment.

Of course, there are still highly economic production windows in the Eagle Ford. Sanchez Energy’s acreage in the South Central Catarina field boasts total estimated capital costs of $3.6 million, breakeven WTI prices of roughly $33, and a 16% IRR, assuming $40 WTI and $2.70 Henry Hub. Encana’s Karnes County acreage averaged D&C costs of $3.9 million in H1 2016, yielding breakeven at $28 and a 20% IRR at $40/$2.70.

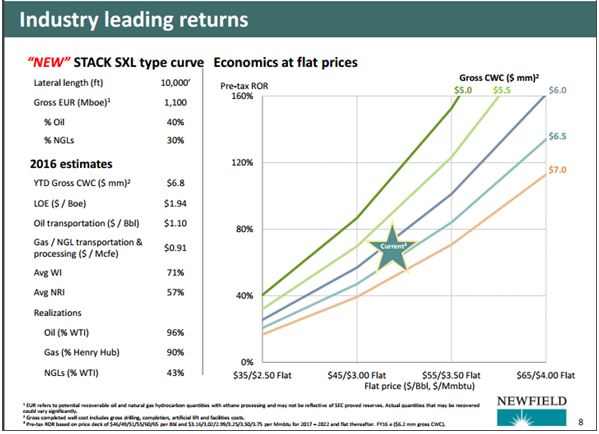

Out of the Eagle Ford, into the STACK

NFX intends to use the proceeds of the transactions to replenish its cash balance and ready itself to further increase its positions in the Anadarko Basin’s highly economic STACK play. The company announced capex increases in the STACK as well as improving type curves and successful downspacing pilots earlier this week.

Chairman Lee K. Boothy elaborated on the company’s success in the STACK in an earnings release.

“Today, we increased our average type curve in STACK by 15% to approximately 1.1 MMBOE gross. This increase is backed by the drilling of more than 100 wells to date – the largest sample set in the industry. Our well results continue to improve as we optimize our completions and look for innovative ways to enhance returns in our upcoming full-field development campaign.”

“We recently closed on our previously announced STACK acquisition and have allocated additional capital to these assets in the second half of this year,” continued Boothy. We remain excited about STACK and the play’s potential to drive our growth in production and reserves for years to come.”

The STACK, short for “Sooner Trend, Anadarko, Canadian, and Kingfisher counties,” in the Anadarko Basin of Oklahoma has drawn increasing attention from oil companies attracted to its strong RORs at low prices, strong initial production rates, and liquids potential. Newfield originally discovered and named the play in 2013.

One STACK transaction of note occurred in December 2015, when Devon Energy bought 80,000 net acres from privately held Felix Energy for $1.9 billion, subsequent to Felix’s presentation at EnerCom Inc.’s The Oil and Gas Conference® 2015. The company payed an estimated $20,000 per surface acre.

Given this recent move by NFX, time will tell if the STACK proves to be as strong, return-wise, as the DJ-Niobrara or Delaware Basins, or will it simply provide cash should asset redeployment and capital allocation decisions be made by other companies wishing to enter the next hot play.