Low-Cost Vertical Drilling and Multiple Behind-Pipe Uphole Recompletions Coming in 2015

Chairman Comments in Audio Presentation

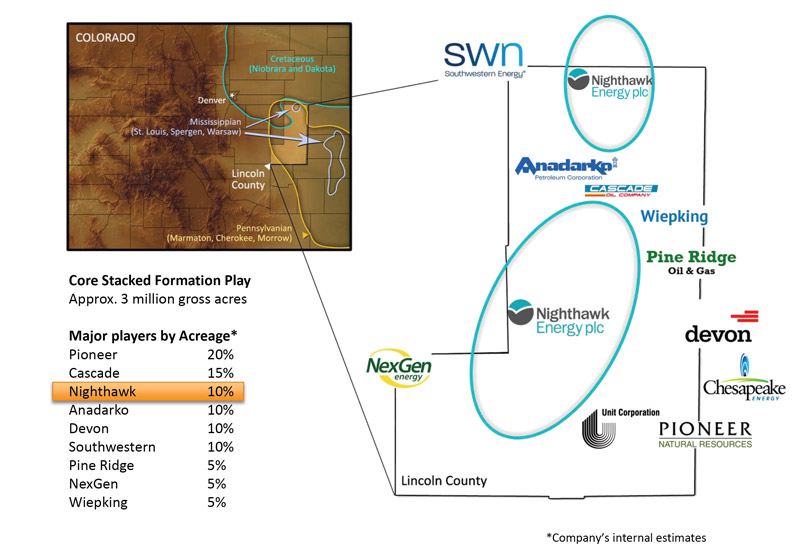

Nighthawk Energy (tickers – AIM: HAWK, OTCQX: NHEGY), which operates 100% of its Smoky Hill and Jolly Ranch projects in the eastern Denver-Julesburg Basin, has released projected economic potential for its multiple-zone drilling inventory in Lincoln County, Colorado, following a comprehensive 30-day internal review of its operations.

Nighthawk has established an initial economic drilling inventory of multizone opportunities in 97 locations—81 potential new well locations and 16 uphole recompletions across Mississippian and Pennsylvanian age formations in the Arikaree Creek field as well as the Snow King and Salen areas in Colorado’s eastern Niobrara basin.

The company released its analysis and its 2015 go-forward strategy today in a press release and an accompanying Webcast of its corporate investor presentation synchronized with audio commentary by Nighthawk Chairman Rick McCullough.

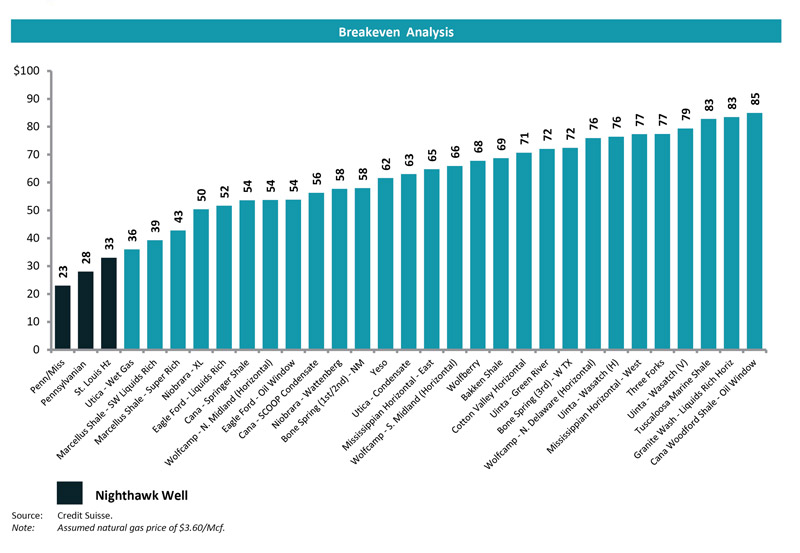

Of the more notable results from its economic analysis, Nighthawk has determined that its drilling inventory is capable of achieving a 25% breakeven rate of return at $40 per barrel West Texas Intermediate (WTI) crude.

$2 Million Well Costs Show Pre-Well Payback at 6-12 Months with IRRs of 100%+

“Go forward drill and completion well costs are estimated to remain around $2 million per well, which allows a rapid pre-well payback estimated at 6 to 12 months and estimated IRRs in most cases of at least 100 percent, even in a $70 per barrel WTI oil market,” the company said in the statement.

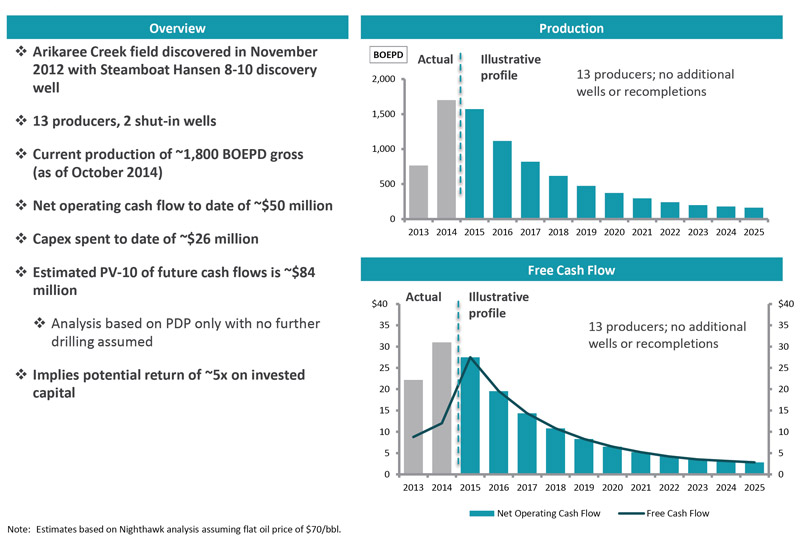

Nighthawk averaged gross oil production from all wells in the calendar month of October 2014 at 1,886 barrels of oil per day (BOPD), and production was in the 2,500-2,600 BOPD range in late November.

Five-Fold Return on Capital Invested in Arikaree Creek Field

Nighthawk believes it will continue to add to its uphole recompletion opportunities because of the multiple oil pay zones associated with its wells. The company said its past drilling success at the Arikaree Creek field “has already delivered a five-fold return on invested capital, thus exceeding the company’s internal return hurdle for its invested capital.”

Nighthawk believes it will continue to add to its uphole recompletion opportunities because of the multiple oil pay zones associated with its wells. The company said its past drilling success at the Arikaree Creek field “has already delivered a five-fold return on invested capital, thus exceeding the company’s internal return hurdle for its invested capital.”

In its Nov. 20 production and drilling update Nighthawk said it had three workover rigs in service pursuing behind pipe projects. “With our operating margins as high as 60% to 70%, we can earn a reasonable rate of return on our drilling capital at realized oil prices as low as $50 per barrel. While we may decide to slow our drilling somewhat because of these low prices, we continue to make sufficient returns on capital at oil prices much, much lower than most operators,” the statement said.

Updated Investor Presentation and Audio Commentary by Rick McCullough, Nighthawk Chairman and CEO

In today’s audio commentary (available below), Nighthawk’s Chairman and Chief Executive Officer Rick McCullough said he believes that Nighthawk is operating “in one of the finest emerging oil plays in the U.S.” McCullough also said the company’s breakeven drilling costs may be some of the lowest in the entire United States.

Nighthawk’s updated company presentation outlining the results of its internal economic and strategic review together with the synchronized audio presentation by Rick McCullough, Chairman of Nighthawk, are available on the Nighthawk Energy Web site.

Nighthawk’s updated company presentation outlining the results of its internal economic and strategic review together with the synchronized audio presentation by Rick McCullough, Chairman of Nighthawk, are available on the Nighthawk Energy Web site.

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.