Nighthawk Energy (ticker: HAWK.L), an exploration and production company focused on conventional operations in the Denver-Julesburg Basin, is preparing to ramp up its drilling program after finalizing a series of financing and joint development agreements.

Capital in Place to Begin Drilling in Sept. 2015

The company completed a convertible loan issue in August, raising $10 million to restart operations within the current month of September. Westhouse Securities Limited in the United Kingdom issued a research report on Nighthawk in which it forecasts volumes could increase to 3,626 BOPD by 2017, up from its estimated 2015 volumes of 1,959. In the same time frame, revenues are projected to reach $71.4 million and EBITDA to exceed $46.6 million. The forecasts are respective increases of 174% and 260% compared to 2015 estimates.

Joint Venture Partner

Nighthawk established two joint ventures with Cascade Petroleum to expedite its drilling programs.

Per terms of the agreement in the Monarch joint venture, the companies cross-assigned their interests within their acreage boundaries and Nighthawk was required to pay 100% of drilling costs for the first six wells. In turn, Nighthawk received a 50% working interest in 17,422 net mineral acres from Cascade, while Cascade received a 50% working interest in 6,197 net mineral acres owned by Nighthawk. At the time, all acreage was non-producing, but Nighthawk is focusing its near-term operations on ramping up activity in the JV.

In the El Dorado joint venture, Nighthawk will front the costs of a 3D seismic program and cross assign 85% of its working interest in 5,281 net mineral acres to Cascade. In return, Nighthawk will receive 15% working interest in 35,091 net mineral acres owned by Cascade.

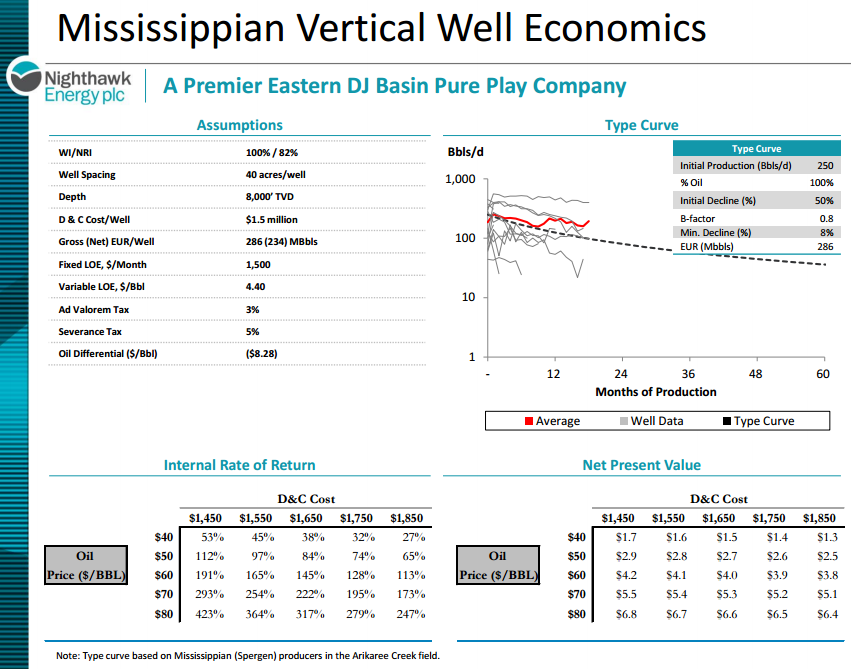

Eastern DJ: Prospects Backed by High Returns

Nighthawk’s low drilling costs (about $1.5 million per well) and established type curves of 286 MBOE yields high rates of return in a very difficult environment. According to the company’s investor presentation at EnerCom’s The Oil & Gas Conference® 20, a well drilled for $1.45 million in a $40/barrel environment generates a 53% internal rate of return. At $80/barrel, the internal rate of return exceeds 400%. An estimated 211 potential vertical Mississippian and Pennsylvanian wells are in Nighthawk’s portfolio, and five Mississippian wells are expected to be drilled before year-end.

In a note issued on September 3, Westhouse Securities says, “Having successfully maintained production at just under 2,000 bopd in the first half via production optimisation and improved well performance, we expect to see production grow into the year end with a significant ramp-up in production over the coming 18-24 months.”

Under-Explored Assets

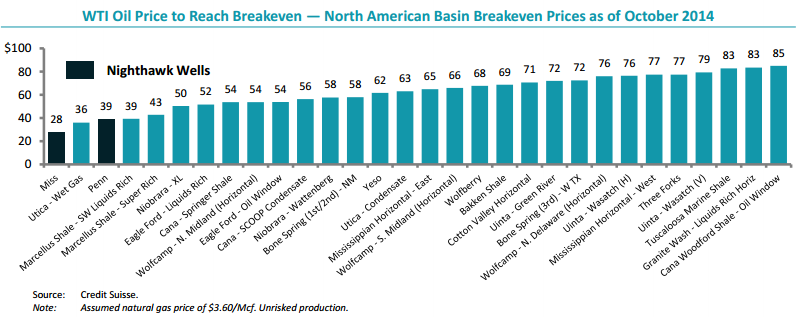

Westhouse notes that Nighthawk’s assets are “under-explored relative to many hydrocarbon provinces in the US,” as only 20% of its acreage has been tested or developed to date. The company has trimmed drilling costs by 30% compared to last year, further aiding the netbacks on its wells. The Mississippian and Pennsylvanian formations are among the lowest breakeven prices in North America, according to Credit Suisse. Breakevens in the Mississippian are below $30 for West Texas Intermediate.

The balance sheet is also free of near-term stress, as no debt principal payments are due until 2019. The company monitors its capital profile by using a net debt to equity ratio, which was below 70% by year-end 2014.