Harvey’s effects continue to ripple

With the third quarter coming to a close, companies are beginning to prepare for reporting season. As part of these efforts, companies often update guidance for Q3 and full year production. This is especially pertinent this year, as Hurricane Harvey’s effects impacted operations throughout the country.

Noble Energy (ticker: NBL), Chesapeake Energy (ticker: CHK) and QEP Resources (ticker: QEP) each released updated guidance today.

Noble ups guidance on strong DJ wells

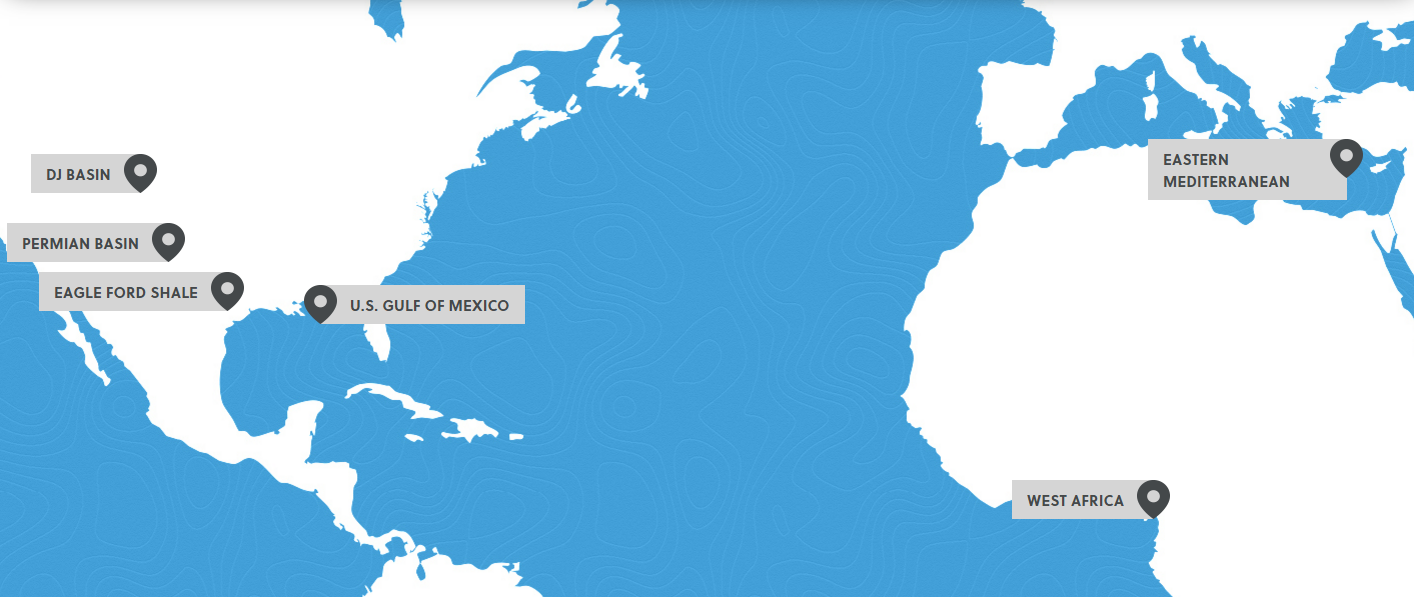

Noble Energy has updated its expected guidance for Q3 2017. Noble reports that expected sales volumes for Q3 have been raised to 352-358 MBOEPD, which represents an increase of 3% or 10 MBOEPD at the midpoint of expectations.

Expected oil volumes rose to a midpoint of 128 MBOPD, up more than 4% from previous guidance of 123 MBOPD. Natural gas volumes are now expected to be 977 MMcf/d, above the previous guidance high of 950 MMcf/d. Expected NGL production, on the other hand, has fallen from a midpoint of 67 MBPD to a midpoint of 64 MBPD.

Noble reports that it has accomplished this increase in expected production without spending above expectations, as third quarter CapEx remains within the original range of $625 to $725 million.

Multiple improvements have led to this guidance increase. The company reports that its DJ Basin production will be higher than expected, due to strong new well performance and a higher oil cut. Better than anticipated pipeline pressures throughout the DJ Basin are also benefitting overall production.

Noble reports that its volumes in Texas are consistent with expectations, despite the effects of Hurricane Harvey. The hurricane mostly impacted third-party downstream operations, which have been counterbalanced by strong well results.

One other major development in Noble’s operations comes from Israel. The company’s Tamar field, located off the coast of Israel, produced more than 1 Bcf/d in July and August. However, planned maintenance last week revealed “minor modifications necessary to the venting system,” reported by Reuters to consist of a crack in an exhaust pipe. This forced Noble to shut the field down to make repairs, which should be completed within the next few days. Noble does not expect this to have substantial impact on planned production volumes.

Israel will be pushing for a quick turnaround, as natural gas from Tamar supplies roughly half of all the country’s electricity needs. According to Reuters, power production has remained stable, but utilities have been forced to use imported LNG, diesel and fuel oil.

Hurricane Harvey forces Chesapeake to revise guidance down

Chesapeake Energy also announced an update to third quarter guidance today. Chesapeake reports that Hurricane Harvey and capital allocation changes mean the company will produce about 542 MBOEPD. While this is higher than the 527.6 MBOEPD the company produced in Q2 (after adjusting for asset sales) is falls short of the expected 550 MBOEPD.

However, Chesapeake reports that delays experienced during the third quarter have been largely mitigated and therefore Q4 production will display significant sequential growth. Overall 2017 guidance has been revised down, but Q4 levels will be in line with previous estimates.

Asset sales, Williston issues pull QEP production down

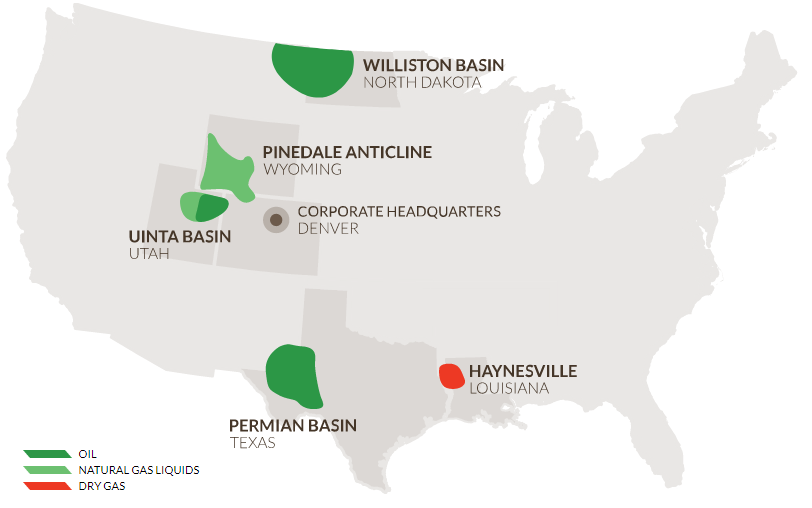

Finally, QEP updated guidance and announced the close of its Pinedale assets today. Current 2017 guidance calls for about 53.2 MMBOE of total production, down from previous estimates of 58.75 MMBOE. QEP reports that this change is due to multiple factors.

QEP removed about 3.3 MMBOE of production from its guidance due to the completed Pinedale sale. The pending Permian Basin acquisition is not expected to have a meaningful effect on 2017 production. In the Williston Basin, production has been affected by the results from a group of pilot wells. These wells were designed to test spacing and productivity of the deeper benches of the Three Forks formation, and have been experiencing higher than anticipated decline rates.

After examining the data available, QEP has determined that the wells are likely producing from overlying formations, rather than the targeted second and third Three Forks benches. In addition, issues in completing several wells led to offset wells being shut in while repairs were made. These wells have since been brought on production, but the delays have impacted guidance. Non-operated production volumes are also expected to drop.

QEP also reports that it will have a one month delay in bringing some Permian wells on production, due to shifts in completion timing related to the evolution of its tank-style completion methodology.

Analyst Commentary

From KLR Group:

CHK – Lowers 3Q/17 Production Guidance Due to Storm Impacts, 4Q/17 Oil Production Expectation In Line (Negligible Value Impact) – Chesapeake forecasts third quarter production volumes of ~542 Mboepd (~16% oil), below our ~550 Mboepd (~17% oil) expectation as a result of operational delays and curtailments associated with Hurricane Harvey, closed asset sales and capital allocation adjustments. Chesapeake anticipates substantial volume growth in the fourth quarter as the company’s current production rate has recovered from third quarter reductions. The company plans to place 120-130 new wells into production and projects oil volumes to average ~100 Mbpd in 4Q/17 (in line with our ~99 Mbpd expectation). Notably, the company has slightly increased its production expense guidance. This announcement should have a negligible value impact as fourth quarter oil production is in line with expectations.

QEP– Decreasing FY '17 Guide (Minor Negative Value Impact) -

Revising FY’17 Guide Downward - QEP revised down '17 guide to 52.3-54.1 MMboe (57.2-60.3 MMboe previously) to reflect the Pinedale Divestiture (removed ~0.2 MMbbl oil, ~0.3 MMbbl NGL, ~17 Bcf gas) and Williston issues/Permian production delays while capex remains unchanged at $1,050-$1,100 mm. Oil volume guide of 19.5-20 MMbo is down ~8% assuming the midpoint of guide. Currently we are modeling '17 volumes of ~53.3 MMboe relatively unchanged from prior expectation, though we reduced our ’17 oil forecast by ~3.5% to ~19.8 MMbo. Consensus was modeling ’17 production of ~55 MMboe and oil volumes of ~21 MMbo.

Preliminary ’18 Outlook - QEP provided a preliminary ’18 outlook. Assuming a $50 oil and $3 natural gas, the company expects '18 capex to more closely align with '18 cash flows while delivering mid teen oil production growth. Our 15% y/y oil volume growth is unchanged though the decrease in our 2H/17 forecast reduced our '18 oil forecast by ~5% to ~61.5 Mbopd. Consensus was modeling '18 oil volumes of ~68.2 Mbopd, which correlated to 22%+ growth y/y. Our '18 capex budget of ~$1,100 mm is unchanged.

Williston Issues - At South Antelope, the company is experienced higher than anticipated declines on a group of pilot wells testing spacing density and productivity of the 2nd/3rd Three Forks formation which reduced ’17 oil volumes by ~0.6 MMbbl. Additionally, the company recently returned online three South Antelope wells and their offsets which were shut in to deal with mechanical plug issues from 2Q/17 (~0.3 MMbbl reduction to '17). Lastly, QEP has seen a decrease in non-operated activity in '17 which negatively impacted production by an estimated ~0.3 MMbbl.

Williston Refrac - QEP has implemented a refrac program in the Williston Basin. The company expects to complete ~13 wells in '17 (four already completed) which is expected to contribute ~0.3 MMbbl of production to ’17.

Permian Ops Update - QEP announced a one month delay in completion timing related to the evolution of its tank style completions. The company’s '17 capital program in the Permian remains unchanged but the shift in timing is estimated to reduce '17 guide by ~0.6 MMbbl.

Takeaway - This announcement should have a minor negative value impact due to the reduction in our 2H/17 oil volumes. The company also provided updated expense guidance which is in line with our expectations. We anticipate the stock should underperform today, though we believe this announcement resets the markets expectations and anticipate several catalysts over the next 12 months.