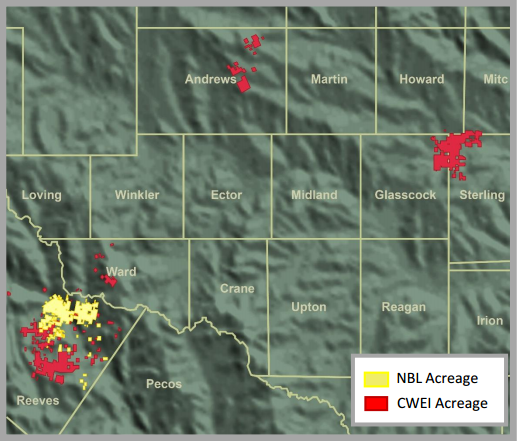

Noble becomes 2nd largest Southern Delaware acreage holder

Noble Energy, Inc. (ticker: NBL) has completed its acquisition of Clayton Williams Energy as of market close on April 24, 2017. In conjunction with the closing, Clayton Williams Energy became a wholly owned subsidiary of Noble Energy under the name NBL Permian LLC.

71,000 ‘highly contiguous’ acres in the Southern Delaware

The acquired assets include 71,000 highly contiguous net acres in the core of the Southern Delaware Basin adjacent to Noble Energy’s original Reeves county holdings in Texas, the company said in a statement.

Noble also gets an additional 100,000 net acres in other areas of the Permian Basin, and more than 300 miles of oil, natural gas, and produced water gathering pipelines. Production on the assets totals approximately 10 thousand barrels of oil equivalent per day (MBoe/d).

Highlights of what Clayton Williams deal brings Noble

- Combined 118,000 net acres, giving Noble the second largest Southern Delaware position in the industry,

- Doubles Delaware Basin net unrisked resources to 2 billion barrels of oil equivalent,

- Total volumes in 2020 from combined Delaware assets are expected to be approximately 145 MBoe/d assuming current commodity strip pricing,

- An average lateral length on the acquired acreage of over 8,000 feet, and

- Midstream ownership, with the majority of acreage previously undedicated to third parties for midstream services.

Recent well results for Clayton Williams Energy

Noble said it plans to boost activity on the acquired acreage from one rig currently to two rigs by the end of the second quarter 2017 and three rigs by year-end 2017. This will bring Noble’s total Delaware rigs to six entering 2018.

Two recent Clayton Williams Energy Wolfcamp A Lower completions, the Lowe 26 2H and the South Williams 10-51 1H, both located on the northern part of the acreage, commenced production in 2017. The Lowe 26 2H, with a lateral length of 4,897 feet, was completed with approximately 2,900 pounds of proppant per lateral foot. Drilled to a lateral length of 4,477 feet, the South Williams 10-51 1H was completed with 3,100 pounds of proppant per lateral foot. When normalized to a 7,500 foot lateral, cumulative production for each of the wells is performing approximately 10 percent higher than the 1.0 million barrel of oil equivalent (MMBoe) EUR Wolfcamp A type curve utilized in Noble Energy’s acquisition assessment. Oil comprises 80 percent of the production stream.

In addition to these two wells, Clayton Williams Energy recently commenced production on two new Delaware Basin wells on its acreage which are in the initial ramp up period. One well represents Clayton William Energy’s first Wolfcamp C completion with a slickwater design.

Outperformance versus the Wolfcamp A type curve on the previously announced Collier 34-51 1H (6,284 ft lateral) and the Geltemeyer 297 1H (4,737 ft lateral) on the southern part of the new acreage continues. At three months of cumulative production, the wells were performing between 20 and 30 percent above type curve. After seven months, the outperformance has increased to 30 to 40 percent, continuing to show flatter decline versus expectation. The Collier 34-51 1H and the Geltemeyer 297 1H produced over 250 and 170 thousand barrels of oil equivalent over the first seven months, respectively, with an average oil mix for the two wells of 80 percent, the company reported.

Midstream update

Noble said that the vast majority of the Delaware Basin acres acquired has been dedicated for infield crude oil, natural gas and produced water gathering to the Blanco River development company, which is owned 75 percent by Noble Energy and 25 percent by Noble Midstream Partners LP (ticker: NBLX).

Infield gas gathering has been added to the existing crude oil and produced water dedication to the Blanco River development company on Noble Energy’s original 47,000 Delaware Basin acres. Noble Energy’s first central gathering facility within the Delaware Basin, operated by NBLX, is progressing to a mid-year start-up.