Noble Energy Eyes Growing Gas Market

Eastern Asia is generating plenty of interest for its future natural gas needs, but Noble Energy (ticker: NBL) believes its own substantial opportunity lies below the sea floor of the Eastern Mediterranean.

Noble has received its fair share of government and media interest in Israel’s Leviathan Field; the project has been called a “monopoly,” been subject to anti-trust reviews and was originally opposed by the country’s economy minister. Prime Minister Benjamin Netanyahu has since taken command of the discussions, offering what many consider to be favorable terms for Noble and Delek – the partner in the project.

“One of the things we need for the next decades is utilization of our gas resources,” Netanyahu said in a cabinet meeting over the summer. “This is not solely for the purpose of supplying our current needs; it is also aimed at supplying our needs later.”

Noble’s Macro Views

Noble believes the future needs, as implied by Netanyahu, will only continue to grow. In a conference call on November 2, 2015, David Stover, Chairman and Chief Executive Officer of Noble Energy, said the region’s natural gas shortfall will reach 9 Bcf/d by 2025 – more than double the current shortfall of 4 Bcf/d.

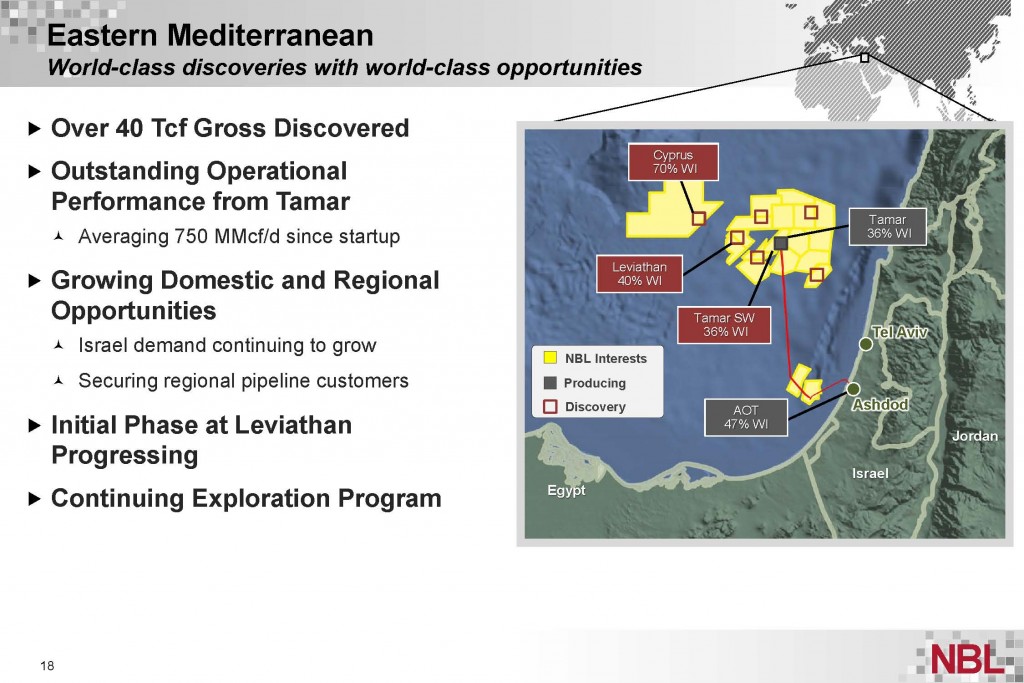

Israel’s economy minister recently resigned, seemingly setting the path for Leviathan Field development. Stover called the move an indication of Israel’s commitment to the project, which the company believes is still about three to four years away from first production. Noble believes more than 40 Tcf lies off the coast of Israel, and natural gas sales in the region averaged 305 MMcf/d in Q3’15. Eni S.p.A. (ticker: E), a nearby operator located in Madrid, announced a 30 Tcf discovery in August.

Reuters is reporting that Israeli Prime Minister Benjamin Netanyahu will personally take control of the Economy Ministry to fast-track a plan to develop the huge offshore natural gas deposits after the minister who had been holding up the plan stepped down, according to the Reuters story.

Final investment decisions have not been announced, but the company plans on a minimal capital spend in 2016 as more contracts and marketing arrangements are secured. Shipping the gas to neighboring nations like Egypt and Jordan are also possibilities, but NBL management says the turnaround speed relies largely on mutual government agreements. Egypt’s natural gas export market fell by roughly 30% per year from 2010 to 2013 as its slowly declining production is losing ground to rising demand.