Noble Energy purchases Clayton Williams Energy for $3.2 billion, inclusive of debt; NBL’s new full company production for 2020 is expected to reach 600 MBOEPD assuming $50 oil

Noble Energy (ticker: NBL) announced Monday that the company has purchased Clayton Williams Energy (ticker: CWEI) in a cash and stock deal valued at $2.7 billion, plus the assumption of approximately $500 million in CWEI’s debt. The boards of both companies have unanimously approved and the companies have executed a definitive agreement that is expected to close in Q2 of 2017, Noble said in a press release.

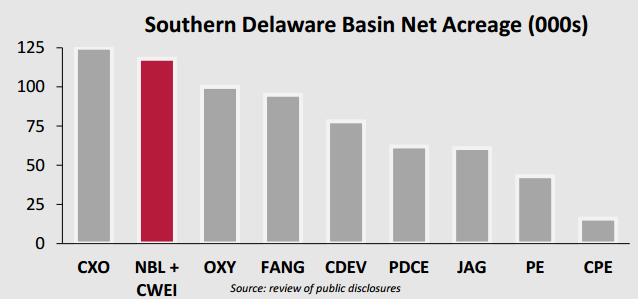

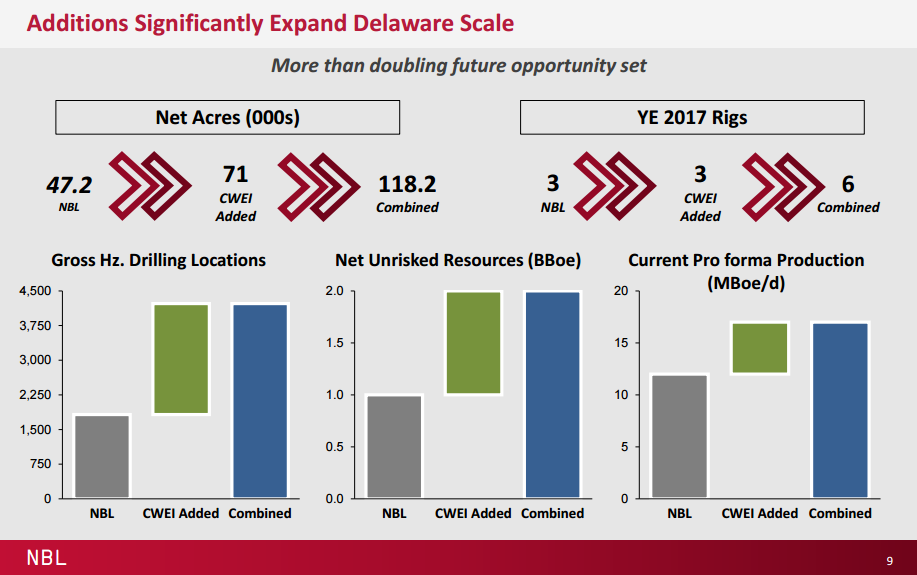

The combined company will have the second-largest Southern Delaware Basin acreage position in the industry, with more than 4,200 drilling locations on approximately 120,000 net acres, with over 2 billion barrels of oil equivalent in net unrisked resource, according to Noble Energy Chairman, President and CEO David Stover.

The deal also includes over 300 miles of existing midstream assets, which Noble believes represents substantial dropdown potential for Noble’s MLP, Noble Midstream Partners (ticker: NBLX).

Clayton Williams Energy shareholders will receive 2.7874 shares of NBL common stock and $34.75 in cash for each share of CWEI common stock held. In the aggregate, this represents 55 million shares of Noble Energy and $665 million in cash. The value of the transaction, based on Noble Energy’s closing stock price as of January 13, 2017, is approximately $139 per Clayton Williams Energy share, or $3.2 billion in the aggregate, including the assumption of approximately $500 million in net debt.

Noble intends to retire Clayton Williams’ outstanding debt as part of the transaction at, or following, the closing, it said in the press release.

The per share consideration represents a 21% premium to the average closing share price of Clayton Williams Energy over the past 30 days, and a 34% premium to the price on January 13, 2017, the last day of trading prior to the transaction.

Noble Energy intends to fund the cash portion of the acquisition through a draw on its revolving credit facility. As of the end of 2016, the Company’s $4 billion facility was completely undrawn.

Acquisition Highlights

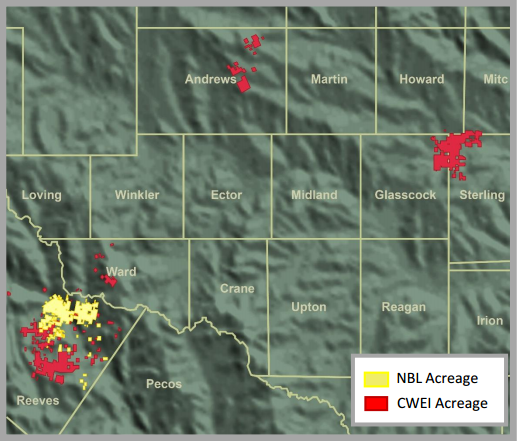

- 71,000 highly contiguous net acres in the core of the Southern Delaware Basin in Reeves and Ward counties in Texas (directly adjacent to Noble Energy’s existing 47,200 net acres). In addition, there are an additional 100,000 net acres in other areas of the Permian Basin.

- 80% average working interest in the Southern Delaware position, with more than 95% of the acreage operated.

- 2,400 Delaware Basin gross drilling locations identified, targeting the Upper and Lower Wolfcamp A zones, along with the Wolfcamp B and C. The average lateral length of the future locations is 8,000 feet.

- Total estimated net unrisked resource potential on the acreage of over 1 billion barrels of oil equivalent in the Wolfcamp zones, with significant upside potential in other zones.

- Noble Energy’s outlook is to increase production on the acquired assets from 10 MBOEPD currently (70% oil) to approximately 60 MBOEPD in 2020 in the Company’s base plan.

- Competitive economics, with Wolfcamp A wells (estimated ultimate recovery of 1.0 MMBOE for a 7,500 foot lateral) generating approximately 60% to 90% before-tax rate of return at base and upside plan pricing, respectively.

- The acquired Delaware Basin acreage is largely undedicated to third-party oil and gas gathering and water systems, and approximately 12,500 acres are dedicated from a third-party operator.

- Existing midstream Delaware Basin assets include over 300 miles of oil, natural gas, and produced water gathering pipelines (over 100 miles for each product).

- After adjusting for production and midstream opportunities, Noble estimates the purchase price represents approximately $32,000 per core Southern Delaware acre.

Expanded Delaware Basin position increases Noble’s compounded annual production growth by 11%

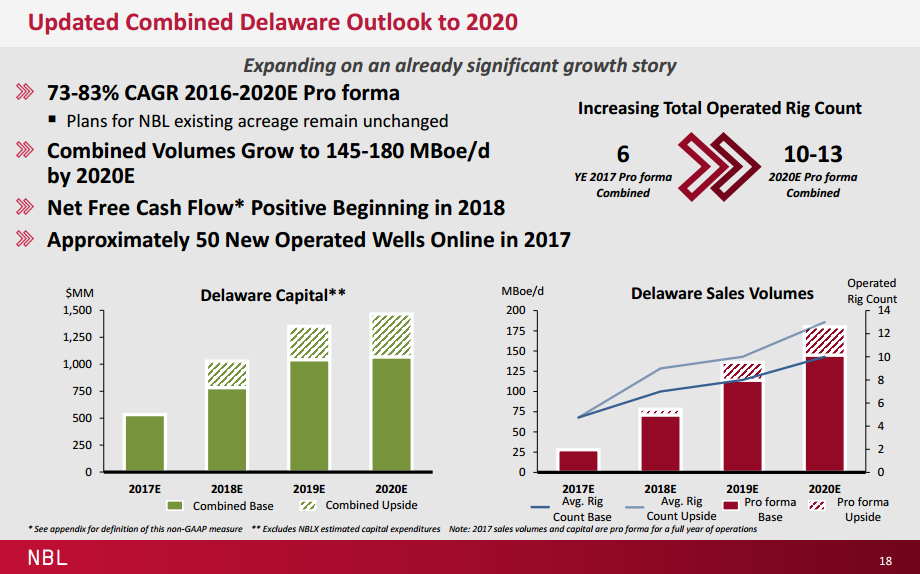

Along with news of today’s acquisition, Noble also released a new four-year plan that includes the assets purchased from Clayton Williams. The updated plan includes the development of the acquired acreage, which is estimated to result in production growth from approximately 10 MBOEPD currently to 60 MBOEPD in 2020 in the company’s base plan and to 70 MBOEPD in the upside plan. Rig activity on the new acreage is planned to accelerate from 1 rig currently to 3 rigs by year end 2017 and between 5 rigs (base plan) and 6 rigs (upside plan) in 2020, Noble said in its release.

Key outcomes of the updated plan through 2020 are:

- Total Delaware Basin net production grows to 145 MBOEPD in the base plan (73% CAGR) and 180 MBOEPD in the upside plan (83% CAGR), from a combined 10-13 drilling rigs in the Delaware in 2020.

- Noble Energy’s onshore U.S. oil volume CAGR has been raised 5%, now estimated to grow pro forma at a 28% CAGR in the base plan and 34% CAGR in the upside plan.

- Total company oil volumes now increase at a 16% CAGR in the base plan and 21% CAGR in the upside plan, up 5% versus the November 2016 plan.

- Full company production in 2020 is expected to reach 600 MBOEPD in the base plan and nearly 700 MBOEPD in the upside plan. This represents an 11% to 15% CAGR.

- Operating cash flow is now projected to increase at a CAGR of 33% in the base plan and 45% in the upside plan, up 7% from its previous projections.

Noble’s base plan utilizes $50 per barrel WTI and Brent and $3 per thousand cubic feet Henry Hub natural gas for 2017, with “modest oil price acceleration” through 2020. The upside plan adds $10 per barrel in commodity price to all periods.

With the anticipated closing of the transaction in the second quarter of 2017, Noble Energy now anticipates an incremental $150 million in reported 2017 capital to be allocated to the Delaware Basin, bringing total Delaware Basin reported capital in 2017 to approximately $500 million. Noble Energy’s total reported capital program for 2017, excluding Noble Midstream Partners’ capital, is now estimated to total $2.1-$2.5 billion. Total reported company sales volumes for 2017 are now estimated at 410-420 MBOEPD.

Analyst Commentary

Johnson Rice & Company

As the midstream valuation is a large variable in the per acre calculation and likely how most investors will determine whether the sale was justified, we will outline some of the details of how NBL got to its $600mm. The asset consists of >100 miles each of pipeline for oil, gas, and water with ~6 mbbl/d of the 10 mbbl/d oil capacity being used and ~7 mmcf/d of the 10 mmcf/d of gas capacity being used (see NBL deck); the water gathering system is at 100% capacity (15 mbbl/d). In addition, the ability to easily expand the midstream was a key selling point and as NBL ramps up activity the company also plans to add 3-5 central gathering facilities in the long-term, which will each increase the midstream capacity by 20-30 mbbl/d of oil, 50-60 mmcf/d of gas, and 30-50 mbbl/d of water.

Wunderlich

Noble Energy has plenty of dry powder. NBL will retire outstanding debt of Clayton Williams Energy assumed as part of the transaction at or following the closing ($500mm), resulting in total transaction cost $3.4 billion. This, along with G&A cost elimination, will result in annual cost savings of energy of ~$75 million to NBL. Because of the way the deal is structured, NBL’s debt ratio will remain mostly unchanged post deal.

Stephens

CWEI announced it is to be acquired by NBL for a total consideration of ~$3.2 billion (includes assumption of ~$500 million in net debt). CWEI shareholders will receive 2.7874 shares of NBL common stock and $34.75 in cash for each share of CWEI common stock held, which equates to a transaction value of ~$139 per share of CWEI (or a ~34% premium to its January 13 closing price). Using only CWEI's 71K net acres and ~10 Mboepd in current production in the Southern Delaware, we estimate CWEI received ~$38K per acre for its assets (assumes $50K per flowing Boe), which is on the higher end of recent transaction prices in the region. Shareholders of CWEI are expected to own ~11% of pro-forma NBL following the transaction's expected close in 2Q17.

Baird

Drop down runway just got bigger and better. Distribution growth upside possible. Before accounting for any changes to our model from the CWEI acquisition, we model 22-23% in 2017 and 2018 with ~1.7x and ~2.0x full-year coverage, respectively. We believe the transaction enhances NBLX's drop down inventory, potentially accelerating the drop down schedule.

SunTrust Robinson Humphrey

The deal highlights the appetite in the industry for more deals/acreage acquisitions within the Permian basin. In our view, this will remain a theme throughout 2017 as companies look to block up contiguous acres and take advantage of economies of scale to drive operational/financial efficiencies. Other names to potentially be impacted by today’s news include Diamondback (FANG, $101.36, Buy), Cimarex Energy (XEC, $139.65, Buy), Concho Resources (CXO, $134.76, Buy), Matador Resources (MTDR, $24.32, Buy), Parsley Energy (PE, $36.56, Buy), and WPX Energy (WPX, $13.72, Buy) among others.