Noble Midstream Partners receives more than anticipated for IPO

Noble Energy (ticker: NBL) announced a public offering for its MLP subsidiary Noble Midstream Partners (ticker: NBLX) last week with the hope of garnering an offer price between $19.00 and $21.00 roughly 10 months after the company postponed an IPO of the same assets. Today, Noble announced that it received $22.50 per share for a total offering of $281 million, and Noble’s strong results could signal more capital for more MLPs in the future.

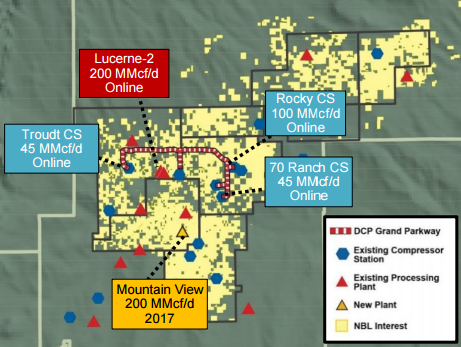

The assets consist of the company’s DJ Basin crude oil, natural gas and water-related midstream services. The 12.5 million units the company offered represent a 39.3% interest in the partnership.

Between 2010 and 2014, investors poured a net $44 billion into energy pipeline and storage funds, according to Morningstar Inc. But MLPs lost some of their luster along with the wider energy market following the crash in oil prices in 2014. Noble originally postponed the IPO of NBLX in November, 2015, due to “unfavorable equity market conditions,” but its second attempt at an IPO may prove investors are looking at the energy equities in a new light.

“If the deal goes well, it certainly will show that the healing has begun and investors are looking at this asset class from a different lens than they were six months ago,” Chris Eades, portfolio manager for several MLP strategies at ClearBridge Investments, told The Wall Street Journal.

While he said he doesn’t expect the floodgates to open for new MLP offerings, a successful stock-market debut should signal to MLP management teams that if they need to raise equity they can, something that “is in striking contrast to the beginning of the year.”

A slow IPO market has made it difficult for companies to raise money while oil prices remain below $50 per barrel. Roughly a dozen natural resource drillers and producers are considering an IPO, according to reports from Reuters, and may have been waiting to see how NBLX faired before proceeding.

Tuesday, Vantage Energy (ticker: VEI) announced publically that it hopes to raise up to $100 million in an IPO. Still, there is a strong possibility that some of these firms will be bought by larger energy companies, who have collectively fortified themselves with $30 billion through secondary stock offerings since early 2015.