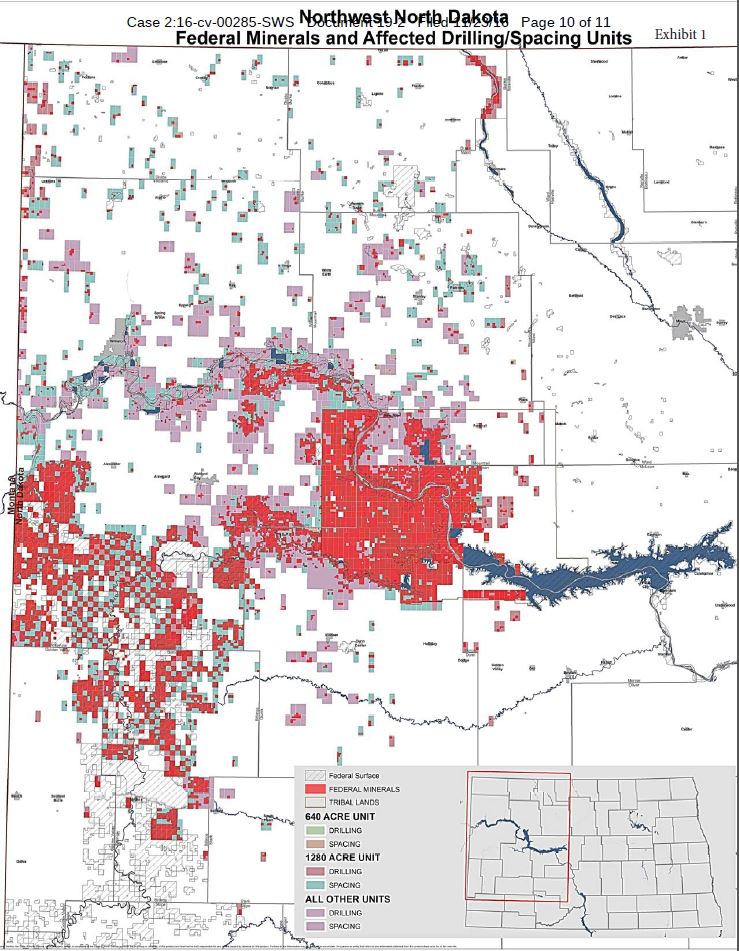

North Dakota has a unique split estate configuration that complicates oil and gas rule making

Last week, on the eve of the U.S. holiday, North Dakota joined Wyoming and Montana in a legal petition filed against the federal government’s final flaring and emissions rule. North Dakota filed a memorandum in support of the its unopposed motion to intervene as petitioner in case 2:16-cv-00285-SWS in the Federal District Court of Wyoming.

The petition references the Department of the Interior’s Bureau of Land Management’s (“BLM”) final rule published in the Federal Register on Nov. 18, 2016, entitled “Waste Prevention, Production Subject to Royalties, and Resources Conservation: Final Rule,” 81 Fed. Reg. 83,008.

“North Dakota seeks intervention in this matter because the Final Rule runs roughshod over North Dakota’s sovereign interests in administering its distinct regulatory programs governing oil and gas production and air quality within its borders.

Combination federal+ state+private ‘split estate’ land positions in a single oil and gas spacing unit

North Dakota argues that its oil and gas properties have “a unique land composition and split-estate configuration that results in a typical oil and gas spacing unit consisting of a combination of federal, State, and private mineral ownership,” according to the North Dakota petition.

“Virtually all federal management of North Dakota’s oil and gas producing region consists of some form of split estate,” the memorandum continues, “and even in such circumstances where the federal mineral ownership is small relative to other mineral ownership interests within the spacing unit, all the oil and gas operators within the unit will be subject to the Final Rule.

North Dakota has complicated ‘split estate’ reality to be considered when rule making for oil and gas.

“The Final Rule will significantly and adversely impact North Dakota, because the Final Rule displaces North Dakota’s sovereign authority, and it improperly asserts BLM regulatory authority over vast stretches of State- and privately-owned minerals—solely because they are interspersed with a small number of federal tracts.”

Second largest oil producing state

North Dakota makes the case that it is the second largest oil producing state in the country with an annual production of approximately 350 million barrels of oil. Measured as daily production, this equates to 959 MBOPD, which would put North Dakota between Oman and Colombia as the No. 21 largest global producer, according to statistics provided by the CIA World Fact Book.

North Dakota argues that one-sixth of the oil produced there is from Indian lands and another 5% of oil production within the state is from federal lands. However, at least 2,832 of the spacing units within North Dakota have well bores that contain federal minerals, all of which are now subject to the Final Rule, the state says. “Based on its unique land configuration, North Dakota has significant, legally-cognizable and protectable interests in enforcing its laws and regulations over oil and gas facilities within its state boundaries.

“The North Dakota Legislature declared it to be in the citizens of North Dakota’s interest ‘to foster, to encourage, and to promote the development, production, and utilization to provide for the operation and development of oil and gas properties in such a manner that a greater ultimate recovery of oil and gas be had and that the correlative rights of all owners be fully protected; and to encourage and to authorize cycling, recycling, pressure maintenance, and secondary recovery operations in order that the greatest possible economic recovery of oil and gas be obtained within the state to the end that the landowners, the royalty owners, the producers, and the general public realize and enjoy the greatest possible good from these vital natural resources’.”

Tax revenue will take a hit

According to the filing, North Dakota collected $6,048,792,082 in oil and gas taxes in the years 2013-2015, and $4,068,542,204 in the years 2011-2013. “The additional regulatory requirements imposed by the Final Rule threaten to substantially reduce the extent and amounts of royalties to be paid to mineral owners and the taxes paid to the State of North Dakota.”

A PDF of the Wyoming memorandum filed in Federal Court may be accessed here.