Key European Oil and Gas Provider Doing More with Less

Norwegian oil and gas production has increased steadily since 2013 as ongoing cost efficiencies counteract declining exploration and production investments, according to a recent EIA analysis.

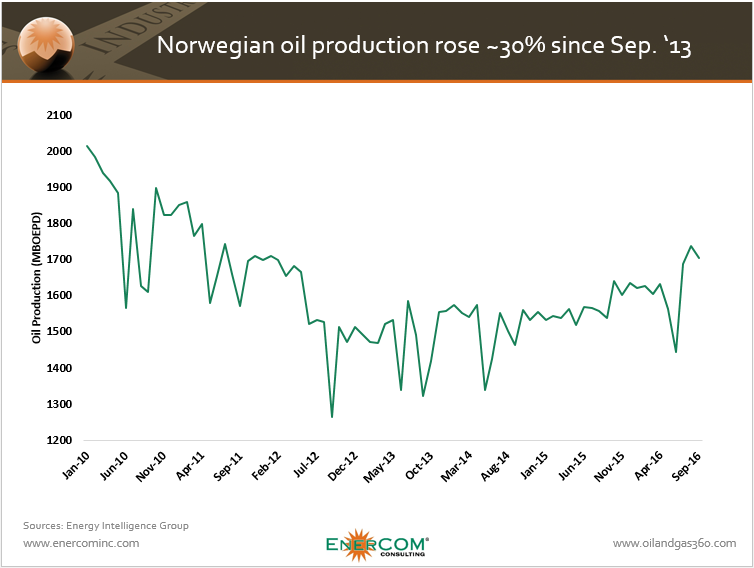

Production bottomed out early in 2013 and rose 29% to 1,704 BOEPD by September. Norway was the third-largest exporter of natural gas in the world after Russia and Qatar as of 2013 and currently contributes about 4% of all non-OPEC oil production, serving as an important gas and liquids exporter for European countries.

Production has grown since 2013 due to new fields coming online as well as an increases in output from existing fields. EIA expects new field production growth to balance declines from older fields.

North Sea development projects tend to have long lead times, with production from new fields occurring several years after development decisions. Lead times often increase for projects that are farther north or far from existing infrastructure. FIDs for Norwegian fields currently coming online were made around 2012, when Brent crude oil prices averaged more than $100 per barrel.

Exploration Drilling Cut, Production Drilling Continues

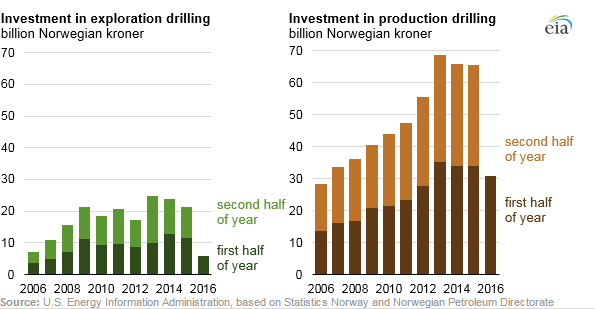

Total investment in oil and natural gas extraction was 21% lower in H1 2016 compared with H1 2015, a decline of about 20.9 billion Norwegian kroner (USD $3.5 billion). These investment cuts have affected some segments of the industry more than others.

Since 2009, exploration drilling accounted for about 12% of Norway’s total investment in oil and natural gas extraction while production drilling accounted for 31%. Other types of investment related to oil and natural gas extraction and pipeline transport include onshore activities, field services, and shutdown and removal. These declined 21% in H1 2016 compared with H1 2015.

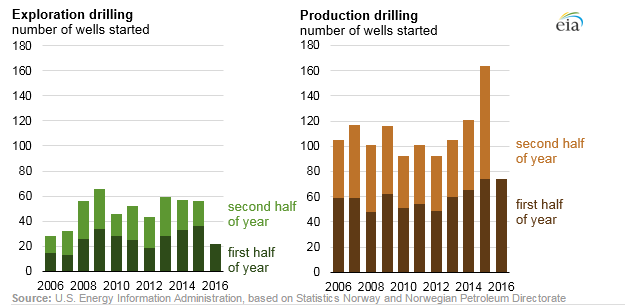

Exploration drilling investments have declined significantly in recent years, with H1 2016 spending lower by over 50% than the same period in 2015. Production drilling investment declined only 9% in the same period.

Changes in production drilling investment show the cost savings achieved by the industry. While production drilling investment has generally decreased since H2 2013, the number of new wells started has been flat or increasing. The number of new exploration wells started in H1 2016 was almost 40% lower than in H1 2015.

Cost Savings Coming through on Large Projects

The Norwegian Petroleum Directorate (NPD) estimates that the cost to develop a field on the Norwegian shelf has declined by more than 40% since 2014. NPD attributes much of these savings to more efficient drilling and to simplification and standardization of well designs. Development costs at Statoil’s recently activated Gullfaks Rimfaksdalen gas and condensate project and the Johan Sverdrup field have come in 20% lower than originally planned.

The Sverdrup field is scheduled to come online near the end of the decade with full production of up to 650,000 barrels per day, more than a quarter of Norway’s current total petroleum and liquids production. The field is expected to delay the onset of deep declines in the country’s production.

Low Exploration Spend will Bring Production Declines

With continued production drilling, EIA expects modest growth in Norwegian oil production for 2016, followed by gradual declines as fewer new fields come online. Lower levels of exploration drilling will further contribute to decreasing production.