EnerCom, Inc. arranged meetings with institutional investors and analysts for PetroQuest Energy (ticker: PQ) during a non-deal roadshow in Denver on October 13 and 14, 2014.

Click here for the company’s latest presentation.

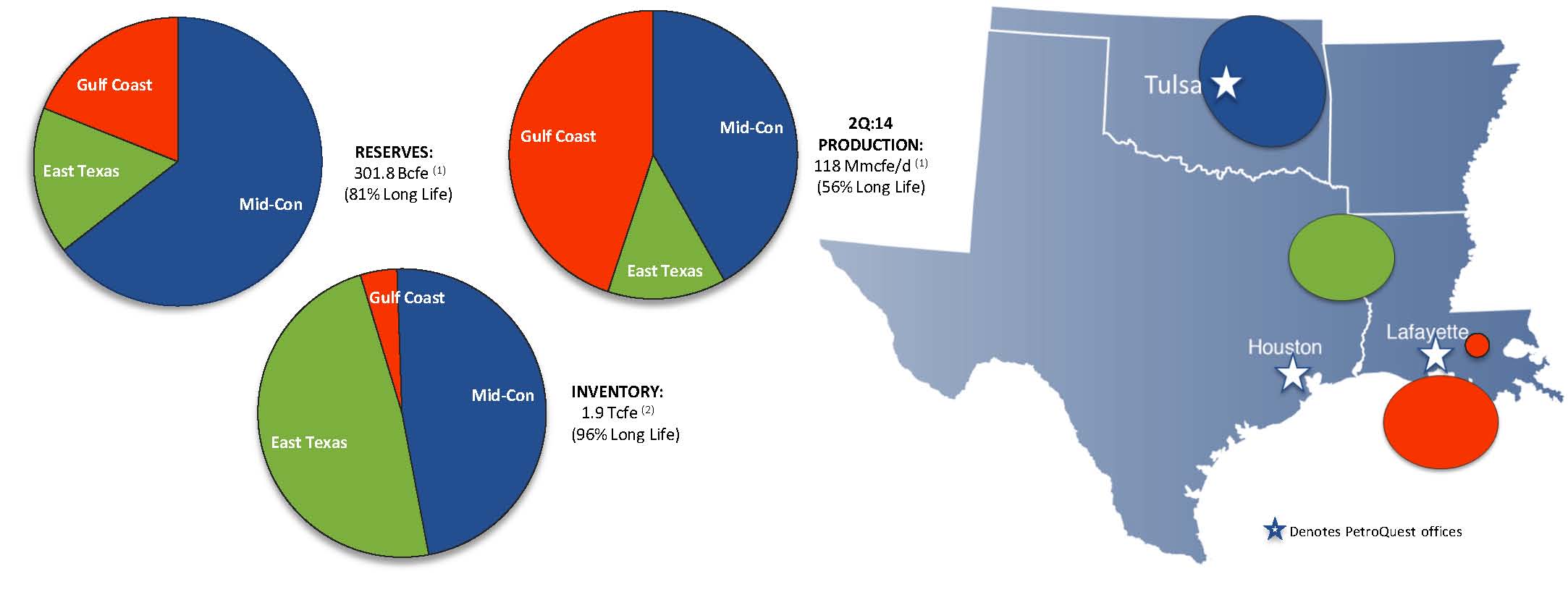

PetroQuest Energy, Inc. is an independent energy company focused on growing reserves and production from three core plays: East Texas Cotton Valley, Mid-Con Woodford Shale and Gulf Coast.

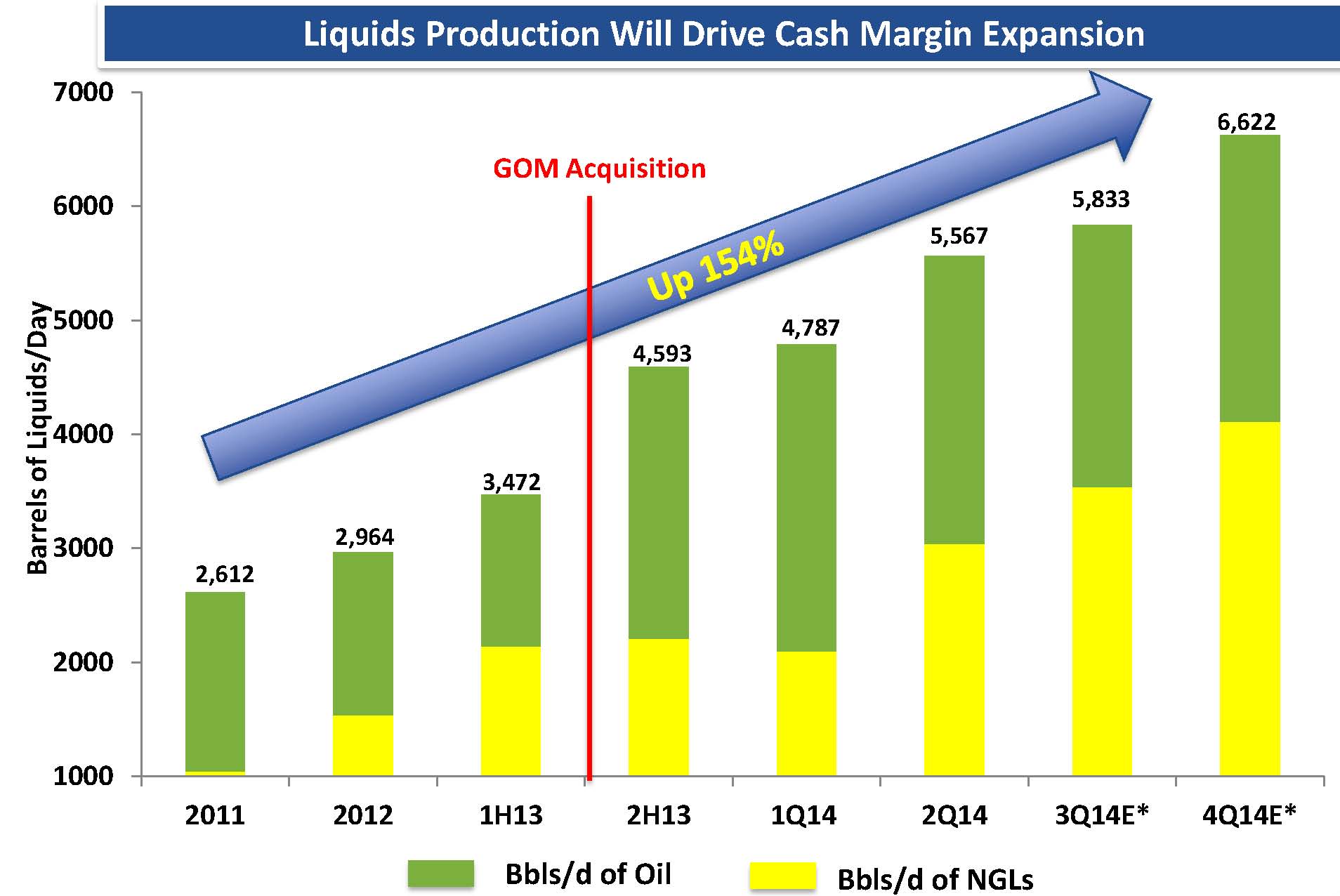

During the second quarter of 2014, the company continued its successful drilling programs across its core plays to drive year-over-year increases in oil production (up 99%), NGL production (up 32%), net income (up 162%), and reported its fourth consecutive quarter of discretionary cash flow growth.

Source: PQ October 2014 Presentation

On the Road

Below are data points that were highlighted during our meetings:

- PQ has demonstrated the ability to grow during a tough price environment for gas

- PQ is focused on basins that can add the most value based upon location and geology, and has exited positions where creating the required scale was cost prohibitive

- East Texas Cotton Valley – horizontal liquids-rich gas play; sandstone has 10 times more porosity, is easier to frac (using white sand) and displays lower decline rates than the Eagle Ford shale (40% compared to 50%); current acreage position provides plenty of runway to grow and options exist to expand into adjacent acreage; located close to key infrastructure for gas takeaway; good pricing (premium to Henry Hub); most recent wells have displayed strong IP and original reserve booking; rich NGL mixture (30% liquids, mostly C4 / C5); CV formation is approximately 800 feet thick, and while not all of the zone will be productive, PQ believes the siltstones above and below the tight sandstone are contributing to the production profile; PQ continues to de-risk its 55,000 net acreage position; average IP rates for PQ’s Cotton Valley horizontal wells are up 34% in 2014 versus 2013, and up 94% from 2011

- Mid-Con Woodford Shale – strong JV partner (NextEra Energy Resources) with high demand for natural gas and desire to source additional supply; adding a second rig and increasing well count in 2H14; Bravo Natural Resources LLC recently paid $250 million to Canaan Natural Gas PE Funds (a private company headquartered in Oklahoma City) for 56,000 net acres ($4,464/acre) in and around PQ’s Woodford Shale acreage; this implies a value of $151.8 million just for PQ’s West Relay 34,000 net acreage position. Applying the same per acre metric to PetroQuest’s total 60,000 net acre Woodford position implies an acreage-only value of $267.8 million.

- Gulf Coast – PQ’s historical drilling success rate is 73%; PQ-operated onshore Fleetwood JV (with MidStates Petroleum) starts drilling in second half of 2014; high oil-focused horizontal play, with rock characteristics similar to East Texas; the Gulf Coast assets generate net-cash for investment in other core assets; PQ estimates the Thunder Bayou prospect could contain 162 Bcfe of unrisked reserves (the Thunder Bayou prospect is testing the Cris R horizon where PQ made a significant discovery in 2011 at La Cantera – since that discovery, PQ has successfully drilled and completed three wells on its La Cantera complex); more than $400 million of free cash flow has been generated from the Gulf Coast assets since 2007 (1H’14 FCF is almost in line with 2013 year’s full year number)

-

Source: PQ October 2014 Presentation

As market dynamics change, PQ has flexibility to move assets from gas production to oil production; liquids production is up 154% since 2011

- Location of their assets allow them to benefit from proximity to established takeaway infrastructure (e.g., East Texas gas better positioned than Marcellus)

- Long-term demand for US-generated natural gas should improve in 2016 as infrastructure build-out will facilitate ability to export

- PQ’s discretionary six-month 2014 cash flow is up 81% from 2013’s corresponding period

- Using the company’s low-case production projection of 134 MMcfe/d average in Q4’14, equates to an increase of 28.8% compared to full-year 2013 production average of 104 MMcfe/d

- Company remains focused on spending its cash flow to grow

- Expect to end 2014 with record production and reserves for the company

Below are a series of questions management fielded from investors during the trip:

- How can you grow in each region in which you currently have a presence?

- What are the next steps with your JVs?

- As oil prices decline, are there financial liquidity concerns?

- What is different with your Cotton Valley acreage compared to your peers in the play, for example Memorial?

- How have you determined the horizontal inventory across your Cotton Valley position?

- How does your experience in the Woodford prepare you to move up the learning curve in the Cotton Valley?

- Is there more acreage to be acquired in the Woodford and the Cotton Valley?

- What is your target debt level?

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.