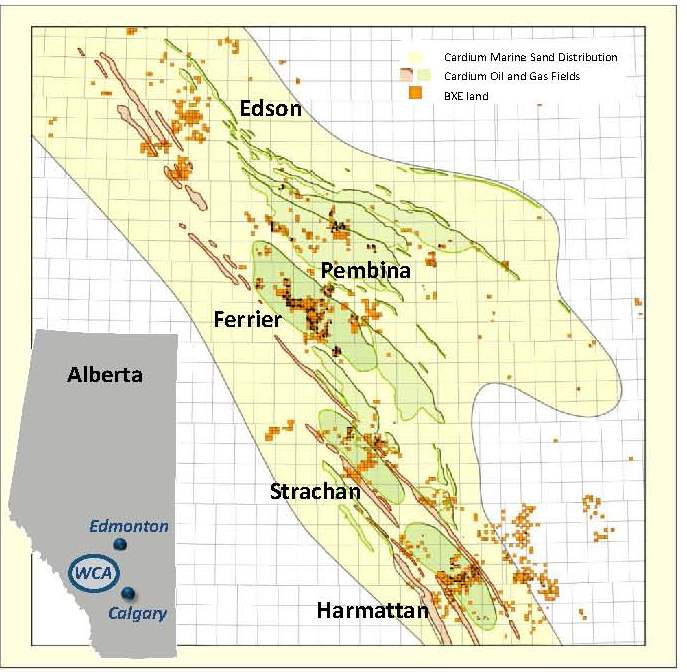

Bellatrix Exploration Ltd. (ticker: BXE) is a Calgary-based E&P operating in the Western Canada Sedimentary Basin. The majority of operations are focused on the Cardium tight oil play in Alberta – an area that has boosted production rates tenfold since 2008. Recoverable reserves from new drilling practices are estimated at 3.0 to 4.5 billion barrels of oil.

Bellatrix prepared for 2014 by more than doubling its 2013 reserve base and is now executing on its growth plan. In a press release on October 15, 2014, Bellatrix revised its 2014 guidance to average yearly production of 38,500 BOEPD with an exit rate of 46,000 BOEPD at its midpoint – increases of 67% and 111%, respectively, compared to 2013. Funds flow from fiscal 2014 is expected to reach $305 million ($1.66 per share), with a debt exit rate of $455 million (1.3x net debt to funds flow).

Bellatrix Exploration is currently scheduled to release its Q3’14 earnings on November 4, 2014, with a conference call occurring at 11:00 am EST.

Source: BXE October 2014 Presentation

Oil & Gas 360® spoke to Brent Eshleman, Chief Operating Officer of Bellatrix Exploration, to discuss the company’s progress in an exclusive interview.

OAG360: From your operational update on September 11, Bellatrix estimated it had approximately 5,000 boe/d of estimated production volumes behind pipe. Can you talk about how the volumes behind pipe relate to your current processing capacility and do you expect to bring on the majority of these constrained volumes by year end to reach your updated (October 15) exit rate guidance of 45,000 – 47,000 boe/d?

Eshleman: Given our current facility initiatives, we expect that by the end of the year our company will be in a position to process currently constrained volumes, and achieve our exit production guidance of 45,000 to 47,000 boe/d. In addition, we continue to run with a seven to eight drilling rig program through year end which provides us confidence in our projected year end guidance range. We remain on track to achieve our stated exit rate guidance given both our continued development activities and contribution from currently constrained or behind-pipe volumes.

Source: BXE October 2014 Presentation

OAG360: As of June 30, 2014, you had 395,000 undeveloped acres in Alberta, BC, and Saskatchewan and drilled 63 gross wells at a 100 % success rate. Could you speak to your ability to continue to drill this acreage with high success? Also, could you speak to the forecasted drilling plan and the ability to develop this acreage at a pace that will continue to hold the leases on this acreage?

Eshleman: The majority of our undeveloped acreage is concentrated in our core, low risk, resource based fairway in West Central Alberta. Thousands of historical legacy wellbore penetrations, a broad depositional environment, and our strong technical knowledge provide us a high level of confidence in the geology.

In our view our 100% drilling success rate in the Cardium (light oil) and the Notikewin/Falher (liquids rich natural gas) formations demonstrates this low geologic risk setting for our target productive zones. With our technical understanding of these plays types, we feel very confident in our ability to continue to develop this acreage with a high level of success. A large portion of our land is held by production and therefore material land expiries are currently not an issue. We remain cognizant of future land expiry and balance our ongoing development plans to optimize rate of return and tenure over our acreage.

OAG360: As you continue to drive efficiencies and enhance well performance, what techniques or procedures have you learned since your first well in the play? What advantages do you see from using ceramic sand and zipper fracks?

Eshleman: Technological innovations continue to advance at an ever increasing rate. We pride ourselves at Bellatrix on being a market leader in implementing and testing new innovative ideas. Zipper fracks and ceramic sands are two of the more recent completion technique enhancements we have begun testing this year. Although early, results from these enhancements are encouraging, however we would ideally like to see several data points and a longer history of results before reaching definitive conclusions. That being said we continue to look at all potential ways to enhance well productivity and reduce costs and ultimately improve returns for our shareholders.

OAG360: Can you clarify what the effects on your returns and capital allocation are as a result of the capacity issues and shutdowns of processing facilities and how your investment into infrastructure should alleviate some of the reliance on other parties and provide long-term returns for Bellatrix?

Eshleman: This year has proven to be extremely challenging from a reliability perspective, from third party operated facilities in our West Central core area. Given the success that Bellatrix and other industry players have achieved from formations such as the Cardium and also the Mannville (high impact liquids rich natural gas), capacity in the area’s gas gathering and processing system has filled rapidly. This has also increased operating pressure in the system, thereby resulting in reduced availability and ultimately production constraints for many operators including ourselves. Fortunately Bellatrix was very proactive and took measures to help alleviate these capacity issues including:

- Working with plant operators to install large diameter pipelines to access remaining available capacity in their plants,

- Recognizing the rapid pressure increases in the system and ordering additional compression, and

- The design and initial construction our own high efficiency liquid recovery gas plants at Alder Flats. We plan to have Phase 1 completed and on-stream in mid-2015; with plans to complete Phase 2 around April, 2016. Each phase is built with a raw gas capacity of approximately 125 MMcf/d; thus providing Bellatrix gross raw gas processing capacity of 250 MMcfd when both phases are completed.

In our view we have taken appropriate steps to mitigate the impact from future third party facilities downtime, improve overall operational reliability and build a long term strategic asset to facilitate our planned production growth.

OAG360: Looking forward over the next five years, what plans do you have to stay ahead of future capacity issues? How much drilling do you think you can accomplish before you would need to fund another project to expand capacity?

Eshleman: Our current initiatives including our planned gas plant phases provide the opportunity to continue to grow volumes over the next several years before additional processing capacity is required. We continually assess opportunities to achieve our ongoing growth initiatives. There are numerous potential longer term options to increase our net takeaway and processing capacity, and we prudently explore all potential options including new plant construction, plant expansions, third party processing, and other potential processing arrangements. Our goal is to ensure productive capacity exists for our future growth volumes and is an integral part of our long term corporate planning process.

OAG360: You have received some criticism surrounding the raising of equity capital in the amount of $172.6 million this year and the perceived reluctance to put this money to work. Could you explain the plans for the money and what issues may have kept you from committing the capital to projects thus far?

Eshleman: We understand the market’s concern that there was no defined use of proceeds announced at the time of the equity financing in late May. What we can say definitively, is that Bellatrix is committed to growing long term value for shareholders. Proceeds from the financing have improved our balance sheet and provide us with a strong financial position. We continue to assess a range of potential opportunities to effectively deploy capital; and acutely focus on opportunities that create value for shareholders and strengthen the organization over the long term.

Source: BXE October 2014 Presentation

OAG360: What is the current M&A market like for bolt-on prospects? What specifically does an asset need to have for you to consider an acquisition?

Eshleman: In our view, the M&A market within our area of the Basin have been very strong through 2014, and continue to remain robust. Our philosophy has been and continues to be focused on ‘Value Creation’ and our motto is, ‘Long Term Value Creation for the Company and our Shareholders’. With this in mind, we only pursue opportunities that achieve these objectives. We will not transact unless we see upside and/or a strategic fit. Discipline and patience are the keys to M&A success and we believe we have demonstrated prudence in our activities over the past several years.

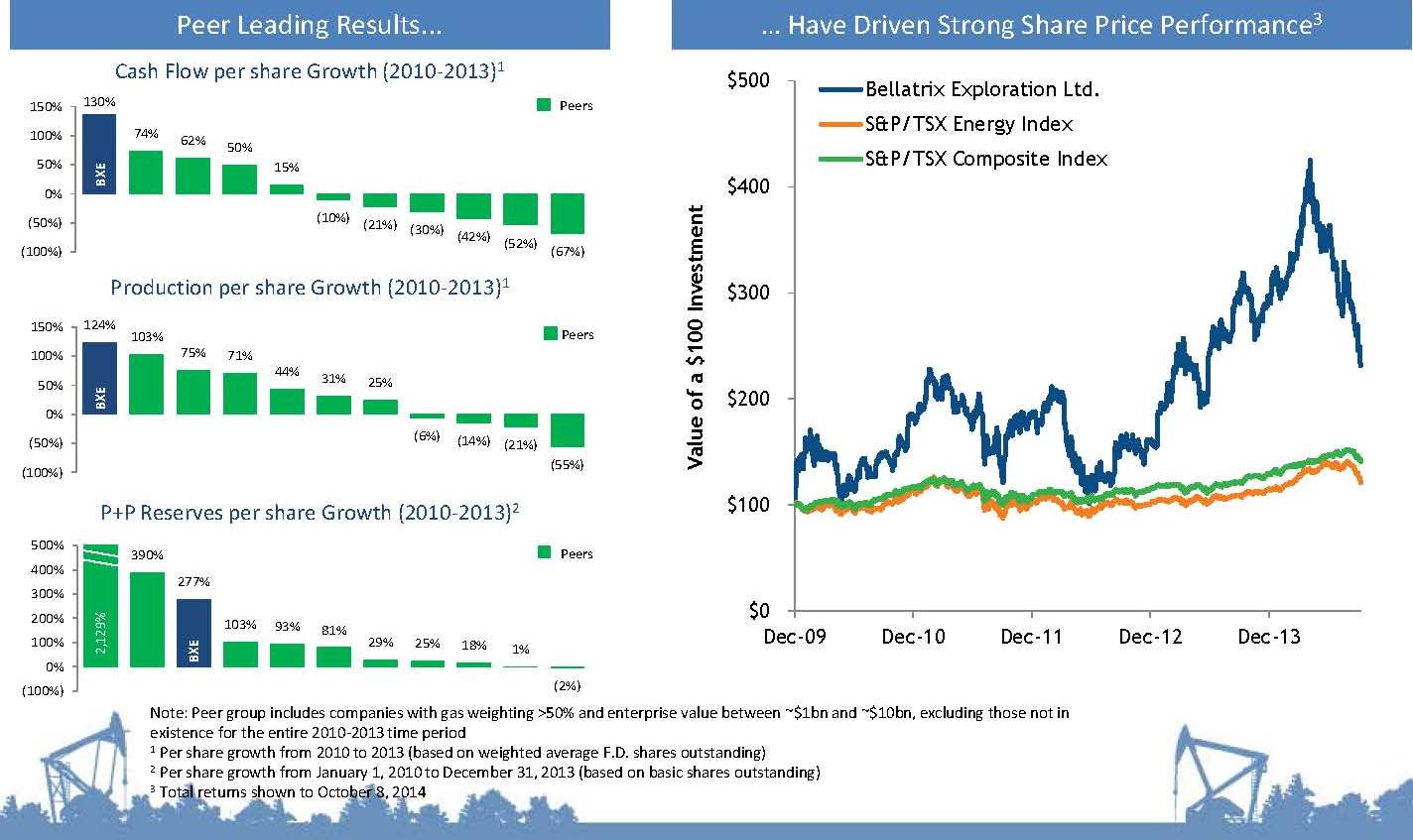

The company has had consecutive year-over-year growth in cash flow since inception, and the stock is up more than 12 times in the last five years despite the recent pull back. How do you manage the business and infrastructure going forward to ensure that BXE can continue on this growth path?

Eshleman: We continue to emphasize and build off of our four foundational pillars:

- People: Hiring and maintaining highly motivated employees that fit within our culture,

- Assets: Continuing to develop and increase our low risk, high rate of return resource assets,

- Capital: Utilizing capital efficiently and accessing promoted capital through joint ventures to accelerate inventory, and

- Capacity: Long term planning to ensure access to capacity to continue to grow.

OAG360: Thank you for your time.

[sam_ad id=”32″ codes=”true”]

Important disclosures: The information provided herein is believed to be reliable; however, EnerCom, Inc. makes no representation or warranty as to its completeness or accuracy. EnerCom’s conclusions are based upon information gathered from sources deemed to be reliable. This note is not intended as an offer or solicitation for the purchase or sale of any security or financial instrument of any company mentioned in this note. This note was prepared for general circulation and does not provide investment recommendations specific to individual investors. All readers of the note must make their own investment decisions based upon their specific investment objectives and financial situation utilizing their own financial advisors as they deem necessary. Investors should consider a company’s entire financial and operational structure in making any investment decisions. Past performance of any company discussed in this note should not be taken as an indication or guarantee of future results. EnerCom is a multi-disciplined management consulting services firm that regularly intends to seek business, or currently may be undertaking business, with companies covered on Oil & Gas 360®, and thereby seeks to receive compensation from these companies for its services. In addition, EnerCom, or its principals or employees, may have an economic interest in any of these companies. As a result, readers of EnerCom’s Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this note. The company or companies covered in this note did not review the note prior to publication. EnerCom, or its principals or employees, may have an economic interest in any of the companies covered in this report or on Oil & Gas 360®. As a result, readers of EnerCom’s reports or Oil & Gas 360® should be aware that the firm may have a conflict of interest that could affect the objectivity of this report.