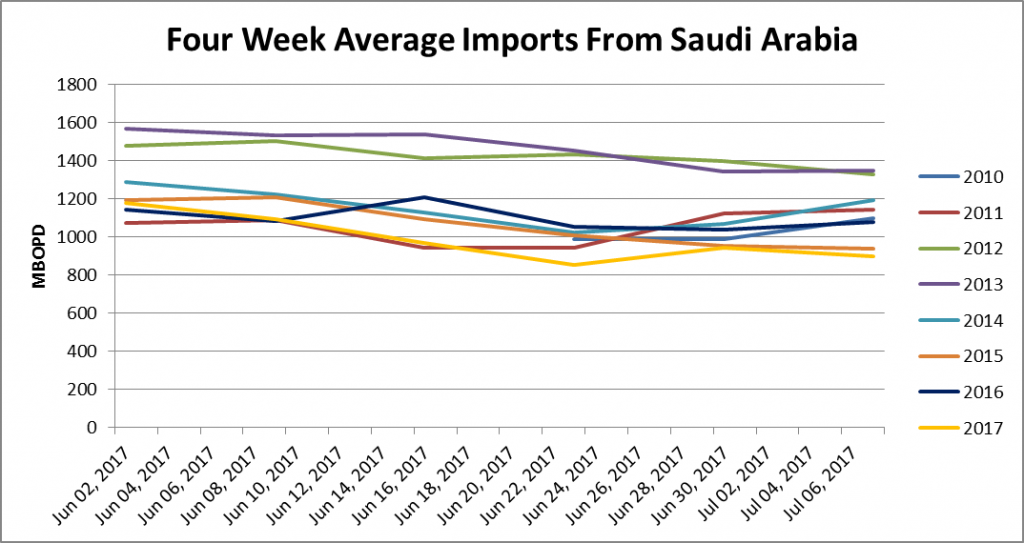

4-week average imports down 30% from May

U.S. imports of oil from Saudi Arabia are falling fast, as the kingdom seeks a new way to prop up disappointing oil prices.

One of the main stated goals of OPEC’s production cuts is to decrease global inventories, which are still well above historical averages. These large inventories weigh heavily on oil prices, and are part of the reason prices have not recovered like in other downcycles.

U.S. inventories have large effect on oil prices

U.S. inventories are especially important in this regard, more so than inventories in other nations. The U.S. accounts for more than 40% of the total amount of commercial crude and product stocks among OECD nations, meaning it has a great deal of influence on supply. But American inventories wield influence beyond their already large size. Unlike most countries, the EIA reports U.S. crude inventories weekly, giving investors more data on supply and demand.

According to Reuters, Saudi Arabia is looking to directly influence these numbers in a move to boost oil prices that have traded below $50/bbl WTI for more than a month.

Exports from the kingdom to the U.S. have fallen significantly in recent weeks, according to data from the EIA. The four-week average imports from Saudi Arabia are currently just below 900 MBOPD, down from 1,270 MBOPD in late May. Current imports from Saudi Arabia are the lowest since at least 2010, the first year EIA data is available.

So far, results are mixed. In the first week of June, when imports from Saudi Arabia first dropped sharply, U.S. oil inventories actually rose. Since then, though, EIA-reported crude inventories have dropped by nearly 18 million barrels, and have dropped sharply in the last two weeks.

With the yearly U.S. driving season well underway, a decrease in imports from Saudi Arabia is the perfect opportunity for inventories to at last fall below record levels. Next week’s inventory report must show a decrease of at least 4,187 MBBL for inventories to drop below 2016 levels.

According to Reuters, Saudi Arabia’s decreasing exports to the U.S. will continue, falling to less than 800 MBOPD in August.

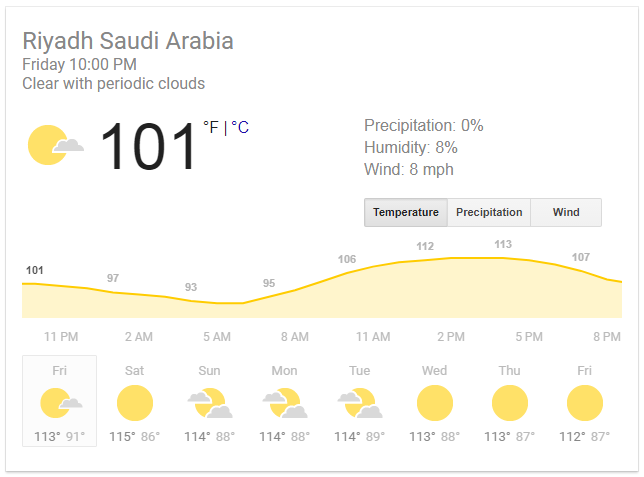

Saudi Arabia also needs to keep the AC on

However, this decrease in exports to the U.S. is not entirely due to Saudis attempting to influence data. The kingdom uses more oil in generating electricity than most countries. In the summer months, the country tends to hold onto its oil to power air conditioning and other domestic uses. At the time of writing, Saudi Arabia’s capital, Riyadh’s forecasted highs for the next seven days range from 112°F to 115°F, meaning power-intensive air conditioning is very necessary and very fuel intensive.