Activity at record, still accelerating

Energy executives are becoming steadily more optimistic about the industry, according to the Federal Reserve Bank of Dallas’ most recent Energy Survey.

The Fed’s business activity index, which examines the overall activity level in oil and gas, reached 44.5 this quarter, the highest result seen by the Dallas Fed, which began its Energy Survey in Q1 2016. An index of 44.5 means that activity is both increasing and accelerating, as the value is positive and greater than the index last quarter.

This growth is concentrated in service firms, where increases in business activity were extensive. Only 10% of service executives reported activity falling this quarter. The increases in activity level have translated through all facets of oil and gas operations, and capital expenditures, employment and prices are all up.

WTI price expectations up, natural gas more cautious

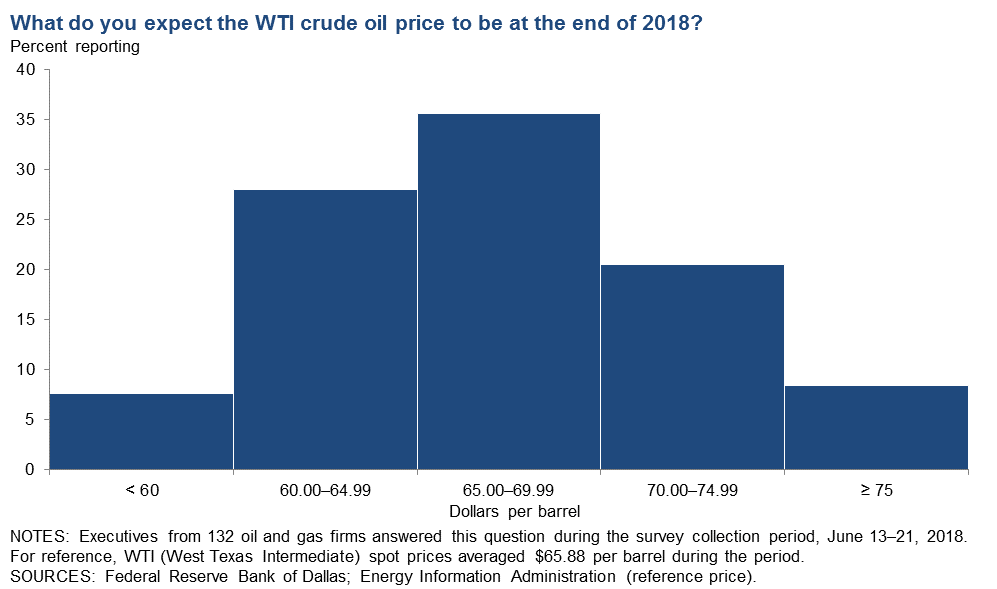

One of the standard questions in the Fed’s energy survey involved commodity prices, and executives give their expected prices for WTI and Henry Hub at the end of 2018. Respondents have become slightly more optimistic regarding WTI prices, and the average expected price was $65.68/bbl, up from $63.07 last quarter. A higher proportion are expecting significant increases in price, with about 10% predicting WTI will be at least $75/bbl by the end of the year. Last quarter the highest prediction given was only $77/bbl, so executive sentiment has significantly improved.

Respondents are much more conservative about natural gas. The vast majority of executives surveyed predict Henry Hub will be between $2.80 and $3.19/MMBTU, with an average estimate of $2.91/MMBTU. This is exactly the same average as was seen in the previous survey, though gas prices have risen by $0.31/MMBTU in between surveys. Fewer respondents are predicting a large drop in price also, as the lowest price given was $2/MMBTU this survey, compared to $1.30/MMBTU last time.

Pipelines, labor constrains activities

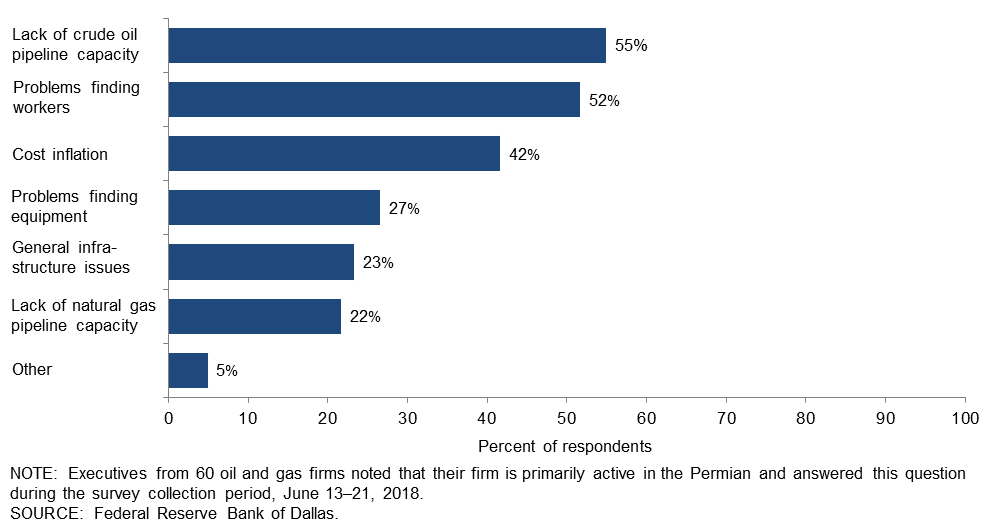

Executives also discussed potential constraints in the Permian and throughout the industry, identifying what might impede activity growth. Unsurprisingly, Permian operators singled out a lack of capacity on crude oil pipelines as the key problem impeding activity in the basin. Pipeline problems in the Permian are well documented, and have caused the differential between Midland and Cushing WTI to reach $16 last week.

Other major problems for producers and service companies in the Permian are much more universal, finding workers, cost inflation and finding equipment are identified as the next most important impediments to activity growth. These are the top problems for non-Permian companies as well, though cost inflation is identified as the most important possible impediment to activity.

Overall, 31% of executives have reported difficulty hiring new employees, but this is primarily a service company problem, as less than 20% of E&Ps have hiring problems. The main trouble for firms seeking workers is simple and difficult to resolve. There aren’t enough people in many of the major oil and gas basins to fill the available jobs. Unemployment in the Midland region is at rock bottom, and 83% of companies that are having problems finding workers report the simple lack of applicants is a major cause.

Companies are willing to pay more to recruit and retain employees, as 45$ of executives reported increasing wages and benefits and 30% are increasing bonuses. Firms are not willing to lower their requirements, however, and only 2% of respondents have lowered education and other requirements for new hires.

Executive comments show significant optimism, tempered with realism

Executives also provided anecdotal comments on the state of the industry, showing generally positive outlooks. Some of the comments follow:

LABOR

- The labor shortage is getting critical. Overall unemployment is at record lows in most of the basins we work, especially the Permian.

- Hiring and retaining the bottom 20 percent of labor is a significant challenge in busy oil fields like the Permian Basin. Employees will jump to a new job for as little as $1 more per hour. The more-tenured employees—those who have been through multiple down-cycles—understand loyalty and the benefits of working for companies with staying power and a good culture. However, younger workers have shorter memories and get caught up in the euphoria.

CRUDE PRICES/DIFFERENTIALS

- The negative crude price differential in the Permian Basin to West Texas Intermediate in Cushing is completely unexpected. In fact, it’s really a double hit since predictions were for a new pipeline to bring higher prices in the Permian as it would bypass Cushing. Several new pipelines were scheduled to come online, so the expectation was there would be surplus capacity from the Permian for the foreseeable future. In the Delaware Basin, water disposal is creating a new issue. In addition to injection availability, issues are developing in the zones where injection is taking place. Depleted zones drilled in the early 1900s are becoming recharged, and old wellbores generally cannot handle the pressure, primarily due to age.

- I think we are getting comfortable that the floor for oil prices is moving up. Although it is tough to call where the ceiling is, confidence in a higher floor than anticipated will help assets move and help create slightly more aggressive capital plans. However, this is with the backdrop of a more skeptical equity market and the reasonable expectations that we are running the business inside cash flow.

INDUSTRY OUTLOOK

- The outlook has definitely improved. We are positive on our forecast for energy prices going forward, at least in the near term, which is six months to a year out. We are looking to buy production where possible and are still investing in drilling and development deals.

COSTS

- My vendor and supplier costs continue to increase. Even in areas outside of the shale plays, drilling, completion and vendor prices are at very high levels. There are no longer any low-cost operations in my area of activity.

- We are a conventional driller/explorer who is finding it difficult to attract capital and services because unconventional (shale) drillers are consuming most of the “oxygen.”