OPEC will keep cuts for nine more months

The Organization of Petroleum Exporting Countries announced Thursday that it will extend production cuts for nine more months, through the end of Q1, 2018.

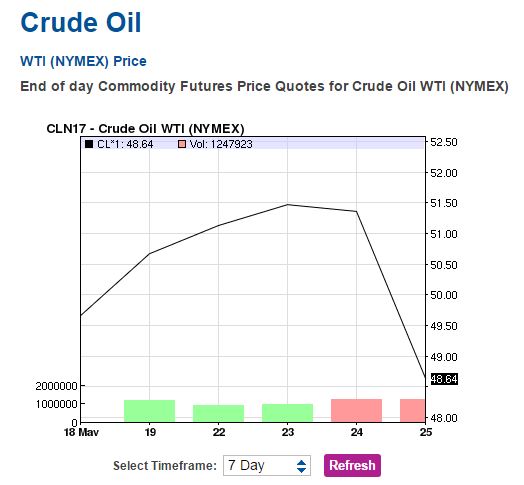

Oil prices dropped more than 5% on Thursday following the prior few days’ news that the deal would continue. That bit of positive news in the past couple of days succeeded in lifting WTI and Brent crude above $50 per barrel, an important psychological benchmark for shale drillers.

“It is a disappointment that OPEC hasn’t done more to balance the markets,” said Olivier Jakob, energy markets analyst at Petromatrix.

The nine-month extension was largely baked into oil prices ahead of the meeting, with the market selling out of crude after hopes that the deal might be extended for a full year, or cuts might be deepened, were not met.

The S&P 500 energy sector was also trading down 1.2% for its worst day since May 4, reported CNBC.

Saudi energy minister expects to reach inventory goals by Q4

OPEC’s decision will keep around 1.2 MMBOPD of oil from being produced, with another 0.6 MMBOPD of cuts expected to continue from non-OPEC members such as Russia. The group is trying to push stockpiles in developed nations down to the five-year average of 2.7 billion barrels from their current 3.0 billion barrels.

“We have seen a substantial drawdown in inventories that will be accelerated,” Saudi Energy Minister Khalid al-Falih said. “Then, the fourth quarter will get us to where we want.”

The group initially proposed extending cuts for an additional six months, but later decided to prolong for nine, as crude oil inventories remain stubbornly high. Russia, which makes up the majority of the non-OPEC production included in the deal, even suggested extending cuts for as long as 12 months.

“There have been suggestions (of deeper cuts), many member countries have indicated flexibility but … that won’t be necessary,” al-Falih said before the meeting. “Nine months with the same level of production that our member countries have been producing at is a very safe and almost certain option to do the trick.”

OPEC also discussed extending the cuts through June 2018 if the market deteriorates, sources told Dow Jones. That option would be decided near the end of the nine-month extension and could be triggered by high global stockpile levels and low oil prices, the sources said.

Thorn in OPEC’s side: U.S. shale companies continue to offset OPEC cuts

OPEC walks a fine line in trying to strengthen oil prices. Doing so allows a few hundred nimble U.S. shale producers—who have the ability to almost flip a switch to start new drilling and production—to drill more of their acreage and to complete wells that were drilled but not completed (DUCs), offsetting OPEC’s cuts and capping prices.

When the group initially agreed to production cuts, it hoped to keep oil below $60 per barrel, but U.S. operators have found the $50 range more than adequate to increase output. It’s a number many shale drillers, and their bankers can live with.

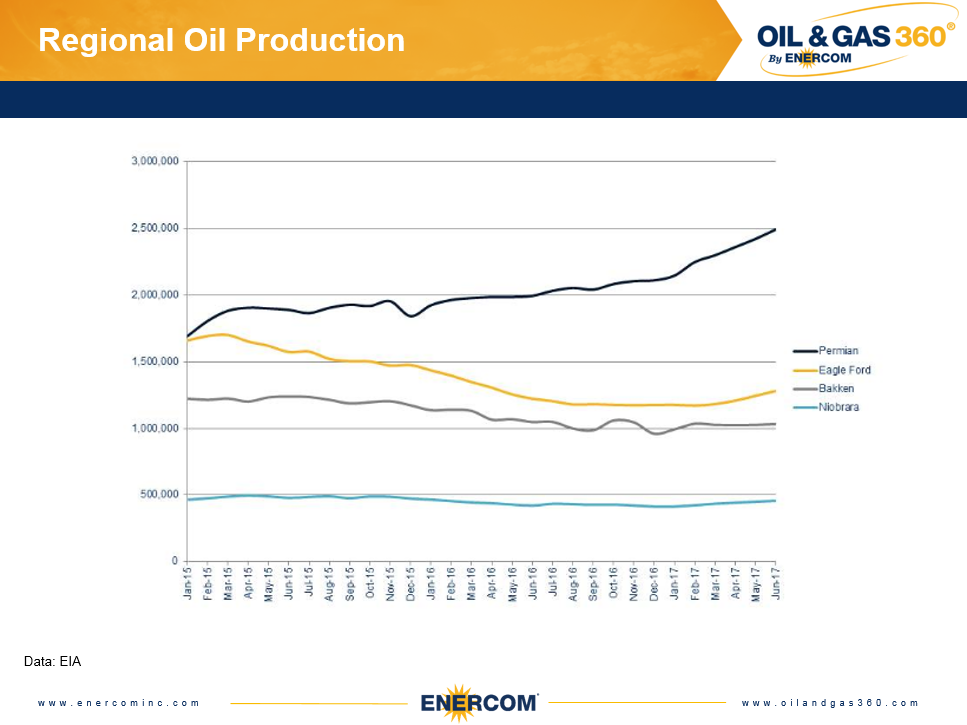

Activity in the Permian has skyrocketed, and most companies are predicting double-digit production growth this year. Oil traders are no longer worrying “Will OPEC cut production?,” but are now asking “Will cuts matter?”

According to the EIA, U.S. crude oil production was 8,780 MBOPD in December 2016, before the cuts took effect. Since then, U.S. production of crude oil has grown to about 9,160 MBOPD in April, an increase of 325 MBOPD. U.S. growth, therefore, has wiped out about 20% of OPEC’s efforts prior to Thursday’s extension. The agency expects U.S. oil production to increase in almost every month in the next two years as well.

By March 2018, the end of the proposed extension of cuts, the U.S. is projected to be producing 9,880 MBOPD, up 1,100 MBOPD from December 2016. If the agency’s U.S. production numbers hold, it means the U.S. shale companies would have wiped out and replaced almost all of OPEC’s cut production, leaving OPEC members with less market share and little to show for it.

Petrocurrencies likely to benefit from more stable markets

While oil prices are showing volatility following the announcement of OPEC’s production cuts, prices could remain more stable moving forward, now that markets know what to expect from the group—no Thanksgiving Day surprise.

“Petrocurrencies will benefit from the decision as prices will keep near current levels despite higher shale production,” Senior Currency Analyst at Market Pulse Alfonso Esparza told Oil & Gas 360®. “The Canadian dollar, Australian dollar, and the Norwegian krone will appreciate as long as crude prices are stable.”

Stronger petrocurrencies, particularly the dollar, create downward pressure on oil prices as the cost of purchasing crude for holders of other currencies increases. The dollar strengthened at the start of the year following the election of President Donald Trump but has since given back most of the gains.

U.S. – OPEC tug-of-war

“Oil prices will continue to be caught between the U.S. rising production and the efforts of the OPEC to reduce the glut,” added Esparza.

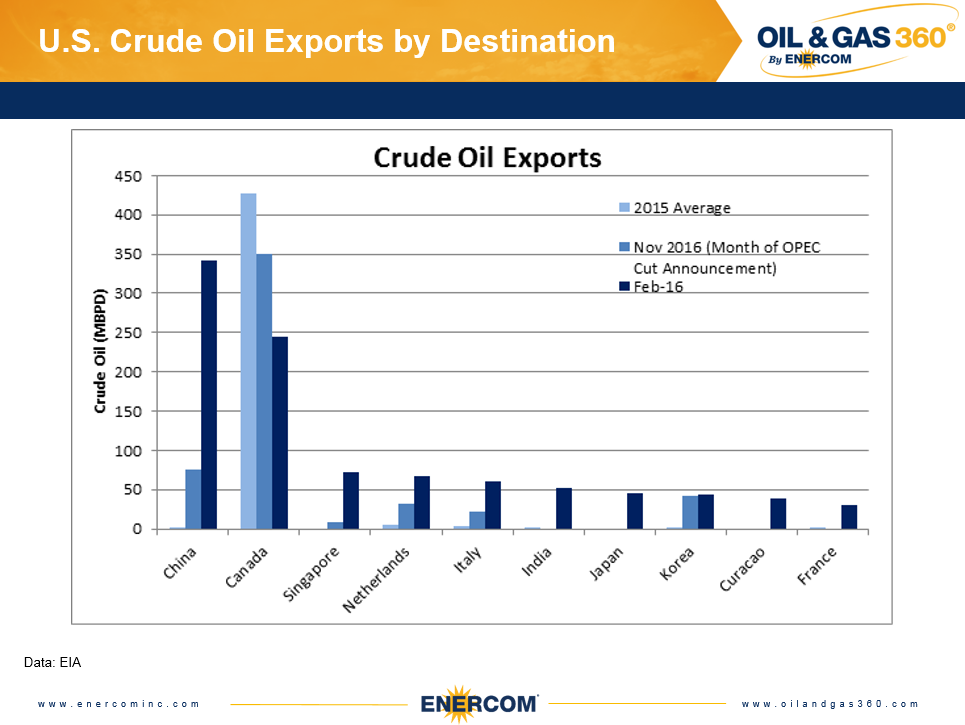

“Demand for energy continues to stagnate which makes the showdown even more intense as the U.S. exports have begun to move into markets usually dominated by OPEC members.”