Return on invested capital breaks from historic patterns as companies reap the benefits of efficiencies

Oil and gas companies are beginning to take a more measured approach to growing even as oil prices hover above $55 per barrel, a move that many investors have been asking to see for months. A report published by EnerCom Analytics this month found that North American E&P companies plan to heed that call in 2018 with many pulling back the throttle on increasing CapEx budgets, but that does not mean that does not mean they plan to stop driving efficiencies.

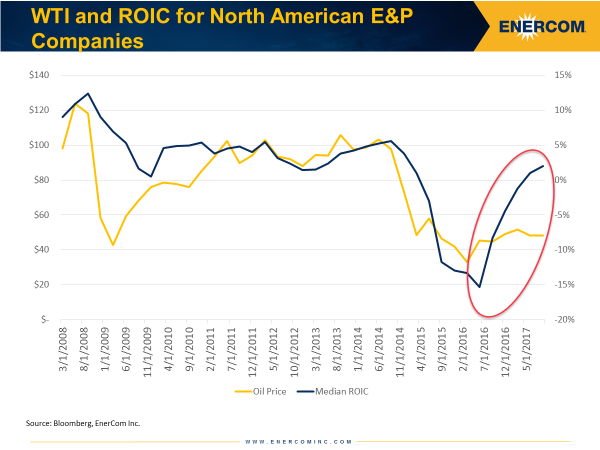

Low oil prices are having a lasting effect on the industry, and the proof is in returns on capital invested (ROIC). ROIC has traditionally be tied very strongly to the price of oil with dips in the commodity price translating into similar drops in the size of the return companies realized on their production. ROIC for public E&P companies held near 5% following the Global Financial Crisis until oil prices dropped following OPEC’s November 2014 decision not to defend price taking ROIC metrics to a low of -15% in H2 of 2016.

While oil prices have improved to a point at which companies are now discussing ways to return capital to investors, ROIC has separated from WTI price as companies realize gains from the efficiencies which have been implemented over the last three years.

ROIC jumped from -15% to 2% from July of 2016 to September 2017 even as WTI made more modest gains. The last time return metrics were that high was in the fourth quarter of 2014 shortly after OPEC’s decision sent markets into a tailspin. The ensuing three years forced companies to improve their operations to such an extent that returns are disconnecting from the associated oil price.

For more insight into 2018 CapEx spending, production and what it means for markets, click here to read EnerCom Analytics’ November report “Oil & Gas Steadies CapEx Hand.”