Both regions have seen relief from 2018’s wide discounts

By Richard Rostad, analyst, Oil & Gas 360

Producers in the Permian and Canada are enjoying relief from the punishing differentials seen last year, as new developments in both regional supply and takeaway normalize markets. However, this relief may be short-lived.

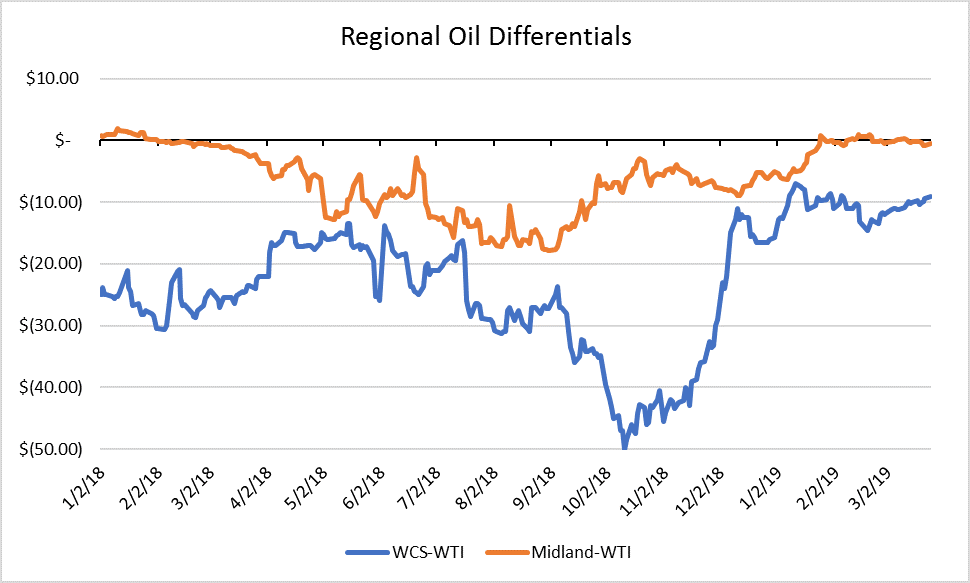

The Midland-WTI differential attracted significant attention last year, as booming Permian production overwhelmed takeaway capacity. While crude in Midland traded at a slight premium to WTI through all of January 2018, the regional benchmark fell to nearly $18 below WTI in August. This differential meant Permian producers were left behind by the mid-2018 oil price rally and instead saw prices fall.

The Midland-WTI differential exceeded $15 for three months straight, long enough that every firm active in the basin responded in one way or another. Several diversified companies chose to rethink their focus on the Permian, shifting capital allocations. Other firms moderated drilling plans, choosing not to grow into low prices.

While these moves improved the situation for Permian producers, the differential has been most impacted by the conversion of NGL pipelines to crude service. The most recent of these, Enterprise Products’ Seminole-Red, is expected to transport up to 200 MBOPD by April. Midland crude has traded in line with WTI since late January, trading at an average discount of only $0.07 over the period.

Despite the expansions in takeaway and slower drilling plans, the EIA expects growth in the Permian will once again face takeaway constraints in the coming months. Differentials are expected to expand once again in the next few months but are not likely to reach the levels seen in 2018.

There is a clear end point for the worst of the Permian’s oil takeaway struggles, as several major pipelines are scheduled to come online in late 2019. These will rapidly change the Permian, at least in the short term, from a basin with underbuilt oil takeaway into one with overbuilt oil capacity.

WCS-WTI differential has shrank from $50 to under $10

The Permian’s struggle with differentials has both similarities and differences with the situation in Canada. Expanding oil production combined with stubbornly constrained takeaway in Canada in 2018. The WCS-WTI differential blew out, reaching record highs late in the year. The spread reached $50 in October and only slightly contracted as WTI prices fell in the Q4 2018 downturn. WCS reached a low of a mere $14.38/bbl in mid-November, the lowest price in at least 10 years.

Unlike in the Permian, where companies have resolved the takeaway problem on their own, in Canada the regulators stepped in. Alberta has imposed OPEC-style production cuts on producers in the province, a nearly unprecedented move. These cuts, combined with intensified crude by rail, quickly deflated the WCS-WTI differential, which shrank to below $7 in January. WCS has traded at an average of $10.50 below WTI in 2019, near the historical average.

While both Canada and the Permian appear to have dealt with their oil takeaway problems, the visible futures of the basins diverge. Without a government-enforced production cut, Permian operators appear poised to recreate the problem seen last summer, bringing differentials back all over again at least temporarily. This will be short-lived, though, and the new pipeline projects scheduled for late 2019 will provide longer-term relief.

The WCS-WTI differential is not likely to blow out while the production cut is in place, but the country’s takeaway picture is much less rosy. Enbridge’s Line 3, the main hope for oil producers expecting new pipeline capacity, has been delayed and is not expected to come online until late 2020, instead of beginning operations in 2019. The interminably delayed Keystone XL line remains uncertain, and even the government-owned Trans Mountain line is being blocked by environmental review. The only major Canadian takeaway on the way before late 2020, then, is crude by rail.