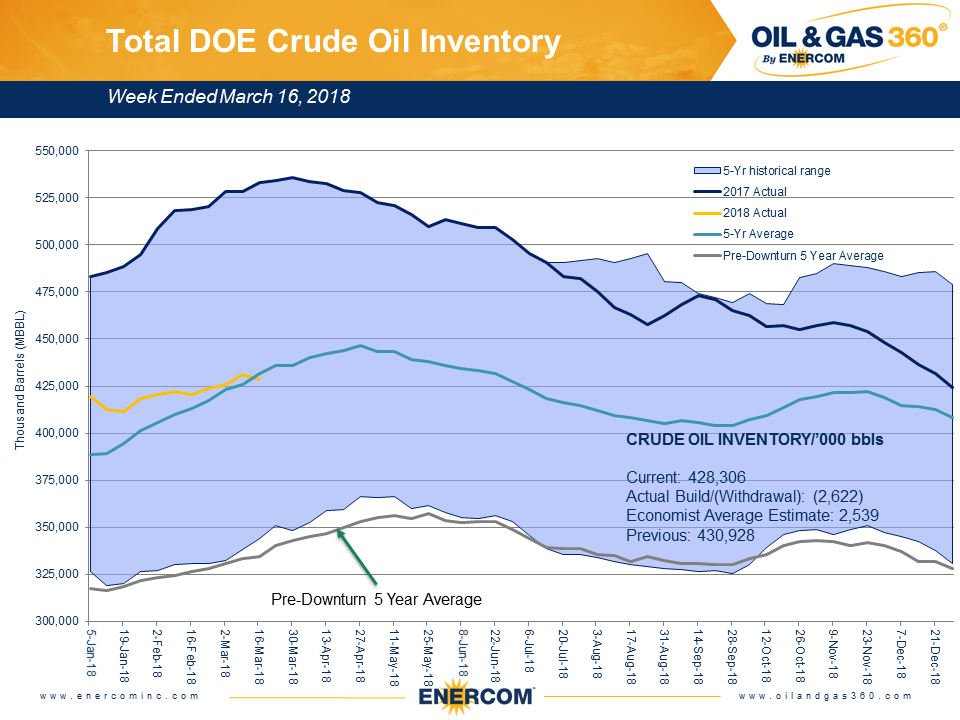

U.S. oil inventories have, at long last, fallen below the five-year average for this point in the year, according to data released by the EIA today.

Commercial crude inventories are currently at 428.3 MMBO, compared to a five-year average of 431.6 MMBO. This represents a major milestone in the recovery from the 2014 downturn, when stocks ballooned to levels never before seen. OPEC regularly cites the return to the five-year average in oil storage as its main goal for rebalancing the oil market.

However, the five-year average is not what it once was.

Inventories rose significantly from late 2014 to early 2017, meaning the current five-year average includes three years of unusually high inventories. These skew the average higher, making an inventory level that is still historically high seem normal. The current inventory of 428.3 MMBO is significantly above the highest inventory seen from 2010 to 2014.

If the pre-downturn average, from 2010 to 2014, is examined instead, the oil market appears much more unbalanced. Current stocks are still 28% above this five-year average. While this is much improved from early 2017 levels, when inventories were nearly 60% above the pre-downturn five-year average, it still represents significant oversupply.

OPEC has acknowledged this problem, and is now mentioning different goals and ways to evaluate global oil inventories. The cartel has considered the possibility of targeting the pre-downturn average, ideally returning the market to the time when $100 oil was common. Also considered is judging inventories based on demand, expressing inventories in terms of days of demand covered. This would take demand growth into account, as global oil consumption has risen since the downturn began.

Even though the five-year average is not quite as significant an inventory measure as it once was, it is still a major milestone in the “return to normalcy”. If inventories continue to decline, oil prices will certainly be buoyed by the inventory improvement, no matter what traders target for an inventory goal.