Pre-Salt rounds 2 and 3 offer more potential oil than Bakken-Three Forks

Brazil’s President Temer believes development of the blocks could bring $160 billion to the country

Major oil producers are currently looking to Brazil, where one of the last major plays in its infancy beckons.

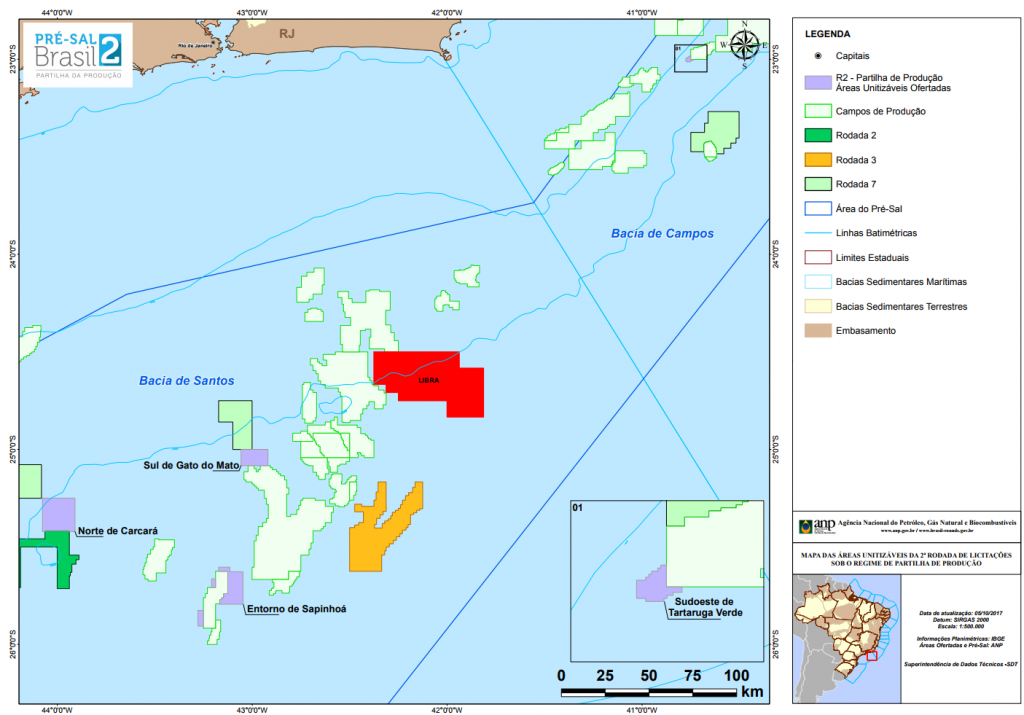

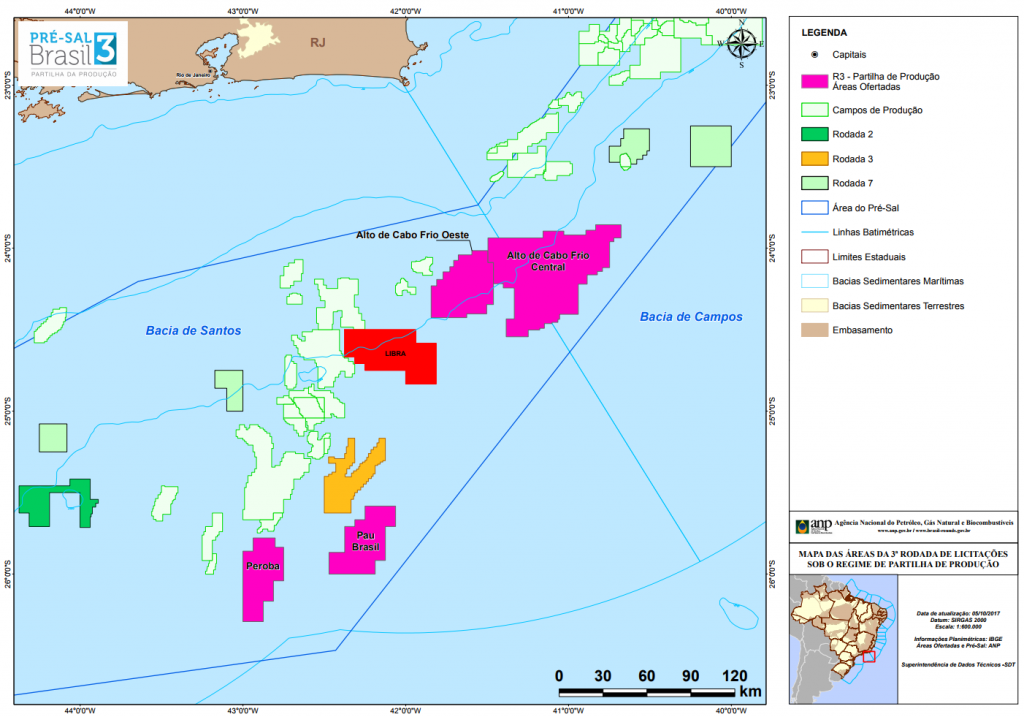

Brazil completed two offshore auctions on Friday, and a total of eight blocks were up for sale.

Six of these received bids, with the Brazilian government receiving a total of $1.8 billion in signing bonuses. According to a report by Reuters, the eight blocks offered hold an estimated 12 billion barrels of oil, or more oil than in the Bakken and Three Forks formations.

Many of the largest producers participated, with BP (ticker: BP), Shell (ticker: RDS.A), ExxonMobil (ticker: XOM), Total (ticker: TOT), Repsol (ticker: REP), Sinopec, CNOOC, and Petrobras all receiving shares of blocks. Consortiums of these companies received the blocks, and no block was awarded to a single company.

Shell wins three blocks; confident its costs will be sub-$40

The largest foreign operator in Brazil is Royal Dutch Shell, further cemented its position by acquiring portions of three blocks, a total of 656 square miles.

According to Reuters, Shell is confident it can pump oil from the fields at below $40 per barrel.

BP is ready to begin development of its two blocks

BP secured shares in two blocks, which it is eager to develop. BP Upstream Chief Executive Bernard Looney said “We will be anxious to move forward now at pace. We came for two blocks and we got them, so we’re very pleased. This is a significant step for us in the upstream in Brazil…These are potentially significant accumulations.”

Exxon concentrates on Carcara

ExxonMobil did not make the large move many expected, but did receive a share of one block in the auction. The company won ten blocks in the Brazilian auction last month, which seemed to imply that Exxon would add a similarly large portfolio in this round. Instead, the company focused on one location. A consortium of ExxonMobil (40%), Statoil (40%) and Petroleos de Portugal (20%) received the North Carcara block, which is adjacent to the previously-awarded Carcara block.

ExxonMobil purchased interest in the Carcara block on Friday, the same day as the auction. The company will purchase half of Statoil’s interest in the block, receiving a 33% share. Exxon paid Statoil $800 million upfront for this share, and will make an additional contingent cash payment for up to $500 million. After the close of the transaction, Exxon and Statoil will each own 33% of the Carcara block, while Brazilian companies will hold the remaining 34%.

According to Exxon, the Carcara oil field contains an estimated 2 billion barrels of recoverable resource.

Development could bring $160 billion to Brazil

Development of these fields could be a boon for Brazil, according to Brazilian President Michel Temer. Temer believes that the blocks sold will generate investments of more than $30 billion, with additional royalties as development proceeds.

In this auction, companies bid the share of production that the Brazilian government will receive, after operators recover costs. This pledge can vary widely, from 11% to 80% of production. Temer says that these shares and other revenues will bring in about $130 billion from development.