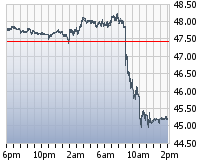

Oil started the day on a slight upswing, but following today’s Petroleum Weekly Status Report issued by the EIA, the price began to plummet, ending the day down 4.76%. Initial reports coming last night from the American Petroleum institute (API) showed a draw on inventories of 6.7 million barrels. However, the API was just setting up the EIA for disappointing news. The EIA reported Thursday morning that domestic crude oil supplies declined by 2.2 million barrels.

The draw on inventories was less than initially anticipated following the API report on Wednesday night, which usually translates to downward trading. The smaller than expected drop combined with concerns of a slowdown in demand for crude oil converged for some bad news for oil’s recent rally.

The drop in crude prices came even though the data also revealed a seventh-straight weekly fall for crude stockpiles and a sizable drop in daily domestic oil production. Another detrimental factor was the potential rise in Libyan and Nigerian output.

The EIA also reported a gasoline draw just about a third of market expectations, sending gasoline futures tumbling as well. U.S. gasoline inventories also fell less than expected in the government report, slipping 122,000 barrels versus forecasts of 353,000 barrels, adding to fears of a glut of the motor fuel despite the busiest season for driving.

Vessels carrying gasoline-making components could not unload at the New York Harbor delivery point for futures this week because of lack of space.

Following the Brexit decision, global markets have been on a wild ride. The assumption is that a global economic slowdown will result, and a glut in supplies of refined products will weigh on oil markets. An indicator of slowdown comes from the slowdown in Asian crude demand. While this could be a blip on the radar, it could represent permanent structural changes and an overall economic slowdown.